Exam 21: Costing Systems Process Costing

Exam 1: Uses of Accounting Information and the Financial Statements167 Questions

Exam 2: Analyzing Business Transactions189 Questions

Exam 3: Measuring Business Income171 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Financial Reporting and Analysis177 Questions

Exam 6: The Operating Cycle and Merchandising Operations145 Questions

Exam 7: Internal Control117 Questions

Exam 8: Inventories154 Questions

Exam 9: Cash and Receivables177 Questions

Exam 10: Current Liabilities and Fair Value Accounting180 Questions

Exam 11: Long Term Assets241 Questions

Exam 12: Contributed Capital189 Questions

Exam 13: Long Term Liabilities194 Questions

Exam 14: The Corporate Income Statement and the Statement of Stockholders Equity176 Questions

Exam 15: The Statement of Cash Flows149 Questions

Exam 16: Financial Performance Measurement163 Questions

Exam 17: Partnerships129 Questions

Exam 18: The Changing Business Environment-A Managers Pers130 Questions

Exam 19: Cost Concepts and Cost Allocation188 Questions

Exam 20: Costing Systems: Job Order Costing88 Questions

Exam 21: Costing Systems Process Costing136 Questions

Exam 22: Activity-Based Systems-Abm and Lean152 Questions

Exam 23: Cost Behavior Analysis166 Questions

Exam 24: The Budgeting Process116 Questions

Exam 25: Performance Management and Evaluation117 Questions

Exam 26: Standard Costing and Variance Analysis120 Questions

Exam 27: Short Run Decision Analysis90 Questions

Exam 28: Capital Investment Analysis123 Questions

Select questions type

In many instances, direct materials are added at the beginning of the process.

(True/False)

4.9/5  (34)

(34)

In order to be classified as a process costing system, the product flow must represent a series of processes in which only one process has input into the next process.

(True/False)

4.8/5  (30)

(30)

The Bakersfield Company has the following information available:  At the beginning of the period, there were 800 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 5,800 units were started and completed. Ending inventory contained 400 units that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO process costing method.)

The equivalent units of production for direct materials and conversion costs, respectively, were

At the beginning of the period, there were 800 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 5,800 units were started and completed. Ending inventory contained 400 units that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO process costing method.)

The equivalent units of production for direct materials and conversion costs, respectively, were

(Multiple Choice)

4.8/5  (34)

(34)

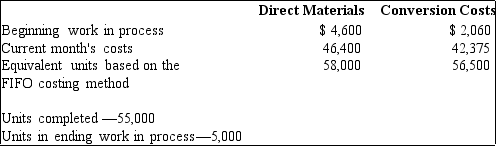

Use the following information to perform the calculations requested below, assuming that the FIFO costing approach to a process costing system is being used.

Beginning work in process inventory: 16,000 units, 100 percent complete as to direct materials, 85 percent complete as to conversion costs

Ending work in process inventory: 36,000 units, 100 percent complete as to direct materials, 70 percent complete as to conversion costs

Units started during the month: 59,000

a. Calculate units to be accounted for during the month.

b. Calculate units started and completed during the month.

c. Calculate equivalent units for direct materials.

d. Calculate equivalent units for conversion costs.

(Essay)

4.9/5  (30)

(30)

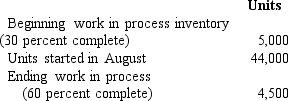

The following unit data were assembled for the heating process of Morgan Processing, Inc., for the month of August. Direct materials are added at the beginning of the process. Conversion costs are added uniformly over the production process. The company uses the FIFO process costing method.  The number of equivalent units produced with respect to direct materials costs is

The number of equivalent units produced with respect to direct materials costs is

(Multiple Choice)

4.7/5  (38)

(38)

In a process cost report, accounting for physical units excludes the physical units in beginning inventory to arrive at "units to be accounted for."

(True/False)

4.8/5  (43)

(43)

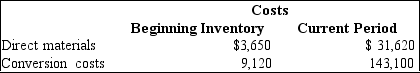

Information for the current month for Process 5 is shown below.  Direct materials are added at the beginning of the process. Beginning work in process is 40 percent complete as to conversion costs; ending work in process inventory is 60 percent complete. The cost of ending work in process inventory totaled

Direct materials are added at the beginning of the process. Beginning work in process is 40 percent complete as to conversion costs; ending work in process inventory is 60 percent complete. The cost of ending work in process inventory totaled

(Multiple Choice)

4.9/5  (39)

(39)

In a process costing system, each product is assigned the same amount of costs.

(True/False)

4.8/5  (40)

(40)

Measures of equivalent production are necessary in process costing because

(Multiple Choice)

4.9/5  (39)

(39)

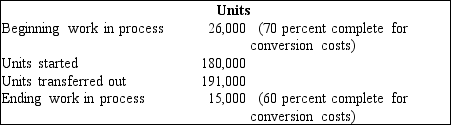

The Taylor Company uses a process costing system. Assume that direct materials are added at the beginning of the period and that direct labor and overhead are added continuously throughout the process. The company uses the average costing method. The following data are available for one of its accounting periods:  Equivalent units for conversion costs are

Equivalent units for conversion costs are

(Multiple Choice)

4.8/5  (40)

(40)

Regardless of beginning inventory levels, the unit costs are determined by dividing the equivalent units by the total costs of the period.

(True/False)

4.7/5  (30)

(30)

In a process costing system, products flow in a LIFO manner, from department to department.

(True/False)

4.8/5  (35)

(35)

Lopez Company uses the FIFO process costing method to determine the product unit cost. The company began the period with 1,800 units in beginning inventory. During the period, 32,000 units were started and completed. There were 4,000 units in ending inventory at the end of the period. If all direct materials are added at the beginning of the process, the number of equivalent units for direct materials for the period is

(Multiple Choice)

4.8/5  (41)

(41)

A process costing system first accumulates the costs of direct materials, direct labor, and overhead for each process, department, or work cell and then assigns those costs to the products produced during a particular period.

(True/False)

4.8/5  (39)

(39)

A company that manufactures potato chips would probably use a process costing system.

(True/False)

4.8/5  (32)

(32)

Equivalent production is a measure of productive output of units for a period of time, expressed in terms of fully completed or equivalent whole units produced.

(True/False)

4.9/5  (38)

(38)

During March, Department A started 300,000 units of product in a particular production process. The beginning work in process inventory was 50,000 units, and the ending inventory was 40,000 units. Direct materials are introduced at the start of processing, and beginning and ending inventories are considered to be 40 percent complete with respect to conversion costs. Department A uses the FIFO costing method. Units transferred out during March were

(Multiple Choice)

4.9/5  (37)

(37)

Bakersfield Company manufactures a variety of chips and utilizes a process costing system. The following information was provided by the accounting department as of May 31, 20xx:

a. Units started during the month of May totaled 35,000.

b. Units partially complete as of May 31 equaled 8,400.

c. Ending work in process inventory as of May 31, 20xx, was 75 percent complete.

d. Direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process.

e. No units were in process on May 1, 20xx.

Using the information provided, compute the equivalent units of production for direct materials and conversion costs for the month ended May 31, 20xx, assuming a FIFO costing flow.

(Essay)

4.9/5  (33)

(33)

Showing 41 - 60 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)