Exam 21: Costing Systems Process Costing

Exam 1: Uses of Accounting Information and the Financial Statements167 Questions

Exam 2: Analyzing Business Transactions189 Questions

Exam 3: Measuring Business Income171 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Financial Reporting and Analysis177 Questions

Exam 6: The Operating Cycle and Merchandising Operations145 Questions

Exam 7: Internal Control117 Questions

Exam 8: Inventories154 Questions

Exam 9: Cash and Receivables177 Questions

Exam 10: Current Liabilities and Fair Value Accounting180 Questions

Exam 11: Long Term Assets241 Questions

Exam 12: Contributed Capital189 Questions

Exam 13: Long Term Liabilities194 Questions

Exam 14: The Corporate Income Statement and the Statement of Stockholders Equity176 Questions

Exam 15: The Statement of Cash Flows149 Questions

Exam 16: Financial Performance Measurement163 Questions

Exam 17: Partnerships129 Questions

Exam 18: The Changing Business Environment-A Managers Pers130 Questions

Exam 19: Cost Concepts and Cost Allocation188 Questions

Exam 20: Costing Systems: Job Order Costing88 Questions

Exam 21: Costing Systems Process Costing136 Questions

Exam 22: Activity-Based Systems-Abm and Lean152 Questions

Exam 23: Cost Behavior Analysis166 Questions

Exam 24: The Budgeting Process116 Questions

Exam 25: Performance Management and Evaluation117 Questions

Exam 26: Standard Costing and Variance Analysis120 Questions

Exam 27: Short Run Decision Analysis90 Questions

Exam 28: Capital Investment Analysis123 Questions

Select questions type

Unit costs are determined by dividing the total costs of the period by the equivalent units.

(True/False)

4.8/5  (38)

(38)

In a process costing system, the cost of ending work in process inventory for a period can be verified by reference to supporting analysis in

(Multiple Choice)

4.8/5  (41)

(41)

In process costing system, the average costing method assumes that cost flows do follow the logical physical flow of production.

(True/False)

5.0/5  (25)

(25)

In a process costing system, the amount of total costs to be accounted for is made up of direct materials and conversion costs incurred during the current period plus those costs included in the beginning Work in Process Inventory account.

(True/False)

4.9/5  (38)

(38)

Conversion costs are defined as the combined total of direct materials costs and direct labor costs incurred by a production department.

(True/False)

4.9/5  (36)

(36)

During October, Department A started 320,000 units of product in a particular manufacturing process. The beginning work in process inventory was 50,000 units, and the ending inventory was 30,000 units. Direct materials are introduced at the start of processing, and beginning and ending inventories are considered to be 50 percent complete with respect to conversion costs. Department A uses the FIFO costing method. Units transferred out during October were

(Multiple Choice)

4.9/5  (43)

(43)

In process costing, all costs incurred by a department or production process are divided by the equivalent units produced during the period to determine the average cost per unit produced.

(True/False)

4.8/5  (43)

(43)

Process costing information can inform managers about the amounts and types of products ordered by specific customers.

(True/False)

4.8/5  (33)

(33)

It is not necessary to ascertain the portion of ending Work in Process Inventory applicable to direct materials costs versus conversion costs.

(True/False)

4.8/5  (43)

(43)

A measure of productive output of units for a period of time, expressed in terms of completed whole units, is the definition of

(Multiple Choice)

4.8/5  (41)

(41)

Nader, Inc., has the following information available:  At the beginning of the period, there were 500 units in process that were 40 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 4,300 units were started and completed. Ending inventory contained 320 units that were 80 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO costing method.)

The equivalent units of production for direct materials and conversion costs, respectively, were

At the beginning of the period, there were 500 units in process that were 40 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 4,300 units were started and completed. Ending inventory contained 320 units that were 80 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO costing method.)

The equivalent units of production for direct materials and conversion costs, respectively, were

(Multiple Choice)

4.9/5  (42)

(42)

Surf's Up manufactures surfboards. Production has just been completed for May 20xx. The beginning balances in Work in Process Inventory were direct materials costs, $31,400, and conversion costs, $16,400. Cost of direct materials used in March was $394,800, and March's conversion costs were $598,400. A schedule of equivalent production for March has already been prepared. It shows a total of 9,400 equivalent units as to direct materials and 8,800 equivalent units as to conversion costs.

From this information, compute the cost per equivalent unit for May. Use the FIFO costing method.

(Essay)

4.8/5  (45)

(45)

Regardless of the cost accounting system used, when the products are completed, they are transferred from work in process inventory to finished goods inventory.

(True/False)

4.9/5  (39)

(39)

During March, Department A started 300,000 units of product in a particular production process. The beginning work in process inventory was 50,000 units, and the ending inventory was 40,000 units. Direct materials are introduced at the start of processing, and beginning and ending inventories are considered to be 40 percent complete with respect to conversion costs. Department A uses the FIFO costing method. The number of equivalent units produced with respect to conversion costs was

(Multiple Choice)

4.8/5  (34)

(34)

In a process costing system, each department's production costs are transferred to the next department and ultimately to the Finished Goods Inventory account.

(True/False)

5.0/5  (41)

(41)

Equivalent units are defined as the number of units completed and transferred out of work in process inventory during the current period.

(True/False)

4.8/5  (41)

(41)

Use the following information to perform the calculations requested below, assuming that the FIFO costing approach to a process costing system is being used.

Beginning work in process inventory: 6,000 units, 100 percent complete as to direct materials, 75 percent complete as to conversion costs

Ending work in process inventory: 18,000 units, 100 percent complete as to direct materials, 65 percent complete as to conversion costs

Units started during the month: 44,000

a. Calculate units started and completed during the month.

b. Calculate units to be accounted for during the month.

c. Calculate equivalent units for conversion costs.

d. Calculate equivalent units for direct materials.

(Essay)

4.8/5  (34)

(34)

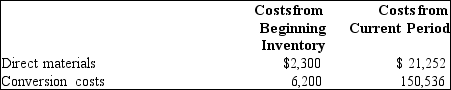

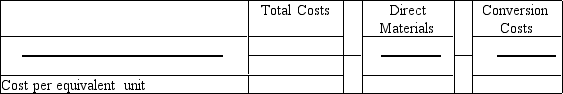

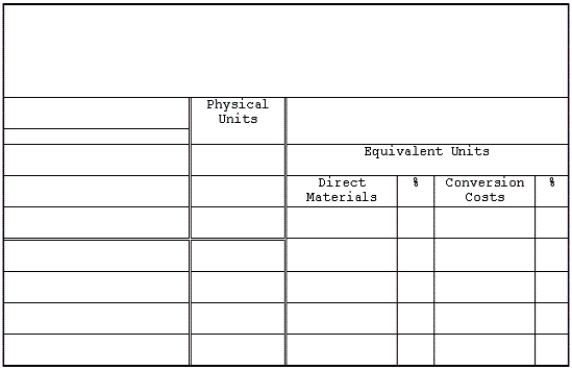

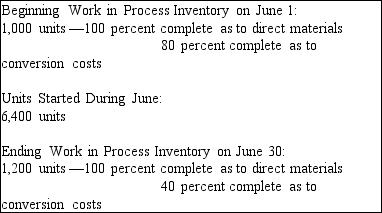

Use the following data from a company using a process costing system to answer the question(s) below.  The FIFO process costing method is used by the company.

Equivalent units for direct materials during the month totaled

The FIFO process costing method is used by the company.

Equivalent units for direct materials during the month totaled

(Multiple Choice)

4.8/5  (32)

(32)

Showing 81 - 100 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)