Exam 4: Activity-Based Costing

Exam 1: Introduction to Cost Management157 Questions

Exam 2: Basic Cost Management Concepts201 Questions

Exam 3: Cost Behavior200 Questions

Exam 4: Activity-Based Costing201 Questions

Exam 5: Product and Service Costing: Job-Order System150 Questions

Exam 6: Process Costing188 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products173 Questions

Exam 8: Budgeting for Planning and Control Key200 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach123 Questions

Exam 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing139 Questions

Exam 11: Strategic Cost Management151 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management202 Questions

Exam 15: Lean Accounting and Productivity Measurement172 Questions

Exam 16: Cost-Volume-Profit Analysis138 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making128 Questions

Exam 18: Pricing and Profitability Analysis164 Questions

Exam 19: Capital Investment126 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

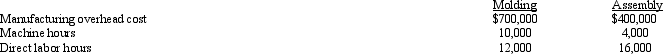

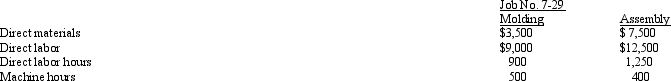

Bear Claw Industries uses a job-order costing system. The Molding Department applies overhead based on machine hours, while the Assembly Department applies overhead based on direct labor hours. The company made the following estimates at the beginning of the current year:  The following information was available for Job No. 7-29, which was started and completed during August:

The following information was available for Job No. 7-29, which was started and completed during August:

The predetermined overhead rate for the molding department is

The predetermined overhead rate for the molding department is

(Multiple Choice)

4.9/5  (36)

(36)

The formula Budgeted annual overhead/Budgeted annual driver level is used to calculate a __________ rate.

(Short Answer)

4.9/5  (32)

(32)

Maintenance of the production equipment would be classified as a

(Multiple Choice)

4.8/5  (46)

(46)

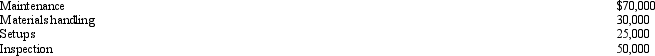

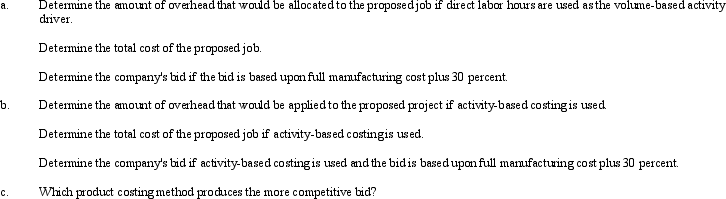

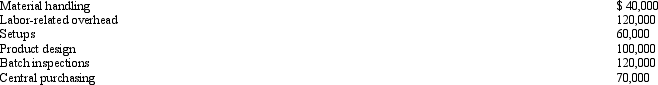

Forest Queen Manufacturing has four categories of overhead. The four categories and expected overhead costs for each category for next year are as follows:

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labor hours. 50,000 direct labor hours are budgeted for next year.

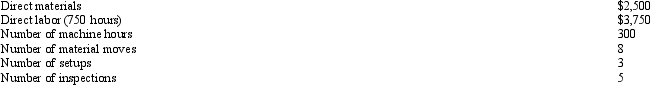

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually, bids are based upon full manufacturing cost plus 30 percent.

Estimates for the proposed job are as follows:

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labor hours. 50,000 direct labor hours are budgeted for next year.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually, bids are based upon full manufacturing cost plus 30 percent.

Estimates for the proposed job are as follows:

In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based activity driver, direct labor hours. The plant manager has heard of a new way of applying overhead that uses cost pools and activity drivers.

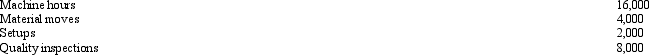

Expected activity for the four activity drivers that would be used are:

In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based activity driver, direct labor hours. The plant manager has heard of a new way of applying overhead that uses cost pools and activity drivers.

Expected activity for the four activity drivers that would be used are:

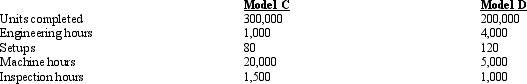

Required:

Required:

(Essay)

4.8/5  (35)

(35)

After-the-fact simplification includes two approaches: the approximately relevant reduced ABC system and the equally accurate enhanced ABC system.

(True/False)

4.9/5  (35)

(35)

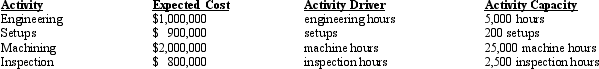

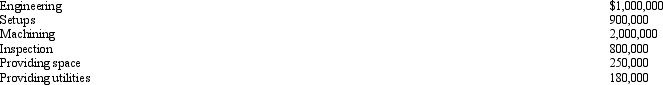

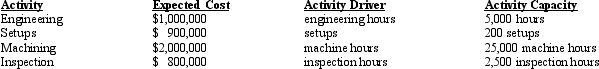

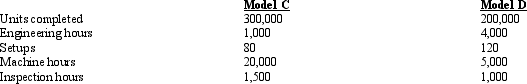

Figure 4-20 Quasi-Tech Corporation produces specially machined parts. The parts are produced in batches in one continuous manufacturing process. Each part is custom produced and requires special engineering design activity (based on customer specifications). Once the design is completed, the equipment can be set up for batch production. Once the batch is completed, a sample is taken and inspected to see if the parts are within the tolerances allowed. Thus, the manufacturing process has four activities: engineering, setups, machining, and inspecting. Costs have been assigned to each activity using direct tracing and resource drivers:

Owens produces two models: Model X and Model Y. The following table shows how the two products consume activity.

Owens produces two models: Model X and Model Y. The following table shows how the two products consume activity.

Refer to Figure 4-20. How much overhead is assigned to Model C using the 4 activity drivers?

Refer to Figure 4-20. How much overhead is assigned to Model C using the 4 activity drivers?

(Multiple Choice)

4.9/5  (34)

(34)

The activity __________ is a simple list of activities identified in an ABC system.

(Short Answer)

4.9/5  (46)

(46)

An activity-based costing system uses which of the following procedures?

(Multiple Choice)

4.8/5  (31)

(31)

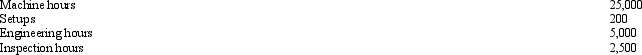

Figure 4-19 Attraction Corporation produces specially machined parts. The parts are produced in batches in one continuous manufacturing process. Each part is custom produced and requires special engineering design activity (based on customer specifications). Once the design is completed, the equipment can be set up for batch production. Once the batch is completed, a sample is taken and inspected to see if the parts are within the tolerances allowed. Thus, the manufacturing process has four activities: engineering, setups, machining, and inspecting. In addition, there is a sustaining process with two activities: providing utilities (plantwide) and providing space. Costs have been assigned to each activity using direct tracing and resource drivers:

Activity drivers for each activity have been identified and their practical capacities listed:

Activity drivers for each activity have been identified and their practical capacities listed:

The costs of facility-level activities are assigned using machine hours.

Refer to 4-19. What is (are) the facility-level activity(ies)?

The costs of facility-level activities are assigned using machine hours.

Refer to 4-19. What is (are) the facility-level activity(ies)?

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following is NOT a limitation of a plantwide overhead rate?

(Multiple Choice)

4.9/5  (36)

(36)

The Magnanimous Company uses a predetermined overhead rate of $12 per direct labor hour to apply overhead. During the year, 30,000 direct labor hours were worked. Actual overhead costs for the year were $320,000. The overhead variance is

(Multiple Choice)

4.9/5  (40)

(40)

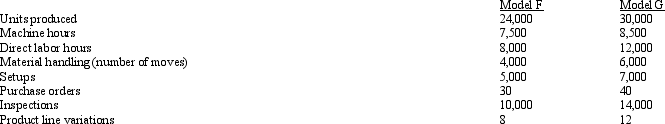

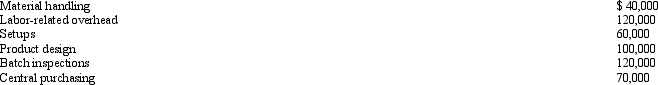

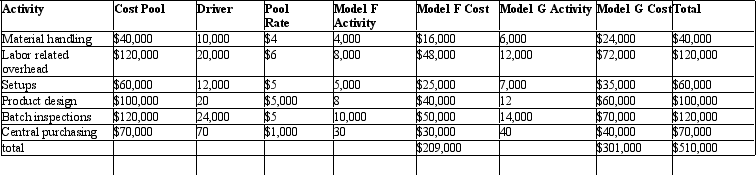

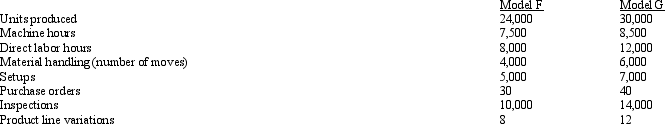

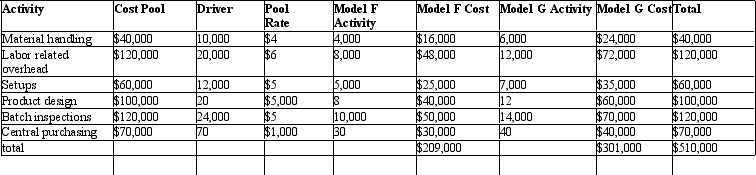

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under the equally accurate reduced ABC system, using consumption ratios for labor related and batch inspections, what allocation rate would be used to assign labor related costs? (round to 5 decimal places)

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under the equally accurate reduced ABC system, using consumption ratios for labor related and batch inspections, what allocation rate would be used to assign labor related costs? (round to 5 decimal places)

(Multiple Choice)

4.8/5  (35)

(35)

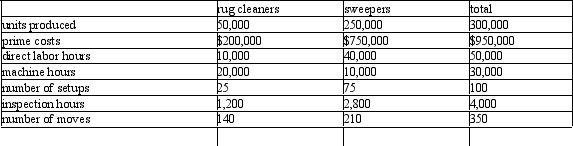

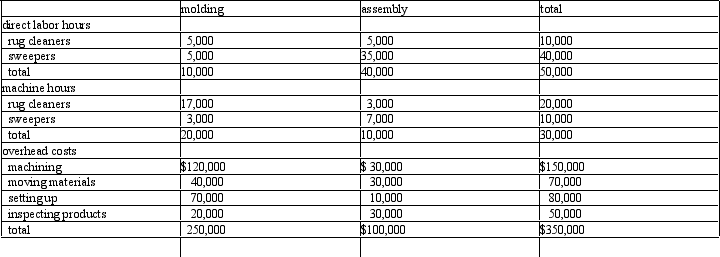

Figure 4-10 The Manoli Company has collected the following data for use in calculating product costs:

Activity Data: (expected and actual)

Departmental Data: (expected and actual)

Departmental Data: (expected and actual)

Refer to Figure 4-10. Manoli Company uses departmental overhead rates: Molding uses machine hours and Assembly uses labor hours. What is the unit product cost for sweepers if departmental overhead rates are used?

Refer to Figure 4-10. Manoli Company uses departmental overhead rates: Molding uses machine hours and Assembly uses labor hours. What is the unit product cost for sweepers if departmental overhead rates are used?

(Multiple Choice)

4.9/5  (38)

(38)

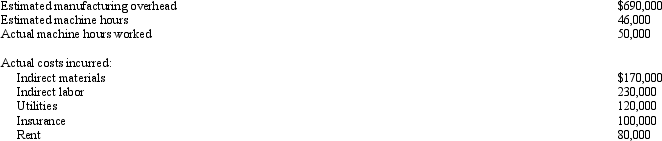

Figure 4 - 3 The records of Family Manufacturing show the following information:

Refer to Figure 4-3. The amount of overapplied or underapplied overhead is

Refer to Figure 4-3. The amount of overapplied or underapplied overhead is

(Multiple Choice)

4.9/5  (46)

(46)

A list of the activities identified in the design of an activity-based system is called an activity inventory.

(True/False)

4.8/5  (37)

(37)

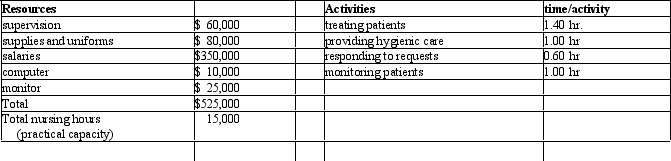

Figure 4-22 The Wellness Clinic is considering a time-driven activity based costing system. Given the following data:

Refer to Figure 4-22. What is the capacity cost rate?

Refer to Figure 4-22. What is the capacity cost rate?

(Multiple Choice)

4.9/5  (31)

(31)

The activity-based cost assignment is the most accurate method of costing because it follows a cause-and-effect pattern of overhead consumption.

(True/False)

4.9/5  (45)

(45)

Figure 4-20 Quasi-Tech Corporation produces specially machined parts. The parts are produced in batches in one continuous manufacturing process. Each part is custom produced and requires special engineering design activity (based on customer specifications). Once the design is completed, the equipment can be set up for batch production. Once the batch is completed, a sample is taken and inspected to see if the parts are within the tolerances allowed. Thus, the manufacturing process has four activities: engineering, setups, machining, and inspecting. Costs have been assigned to each activity using direct tracing and resource drivers:

Owens produces two models: Model X and Model Y. The following table shows how the two products consume activity.

Owens produces two models: Model X and Model Y. The following table shows how the two products consume activity.

Refer to Figure 4-20. First determine the overhead costs assigned to model D using the two most expensive activities for cost pools. The costs of the two relatively inexpensive activities are allocated to the two most expensive activities in proportion to their costs. (Round to two decimal places.)The engineering cost assigned to model D would be

Refer to Figure 4-20. First determine the overhead costs assigned to model D using the two most expensive activities for cost pools. The costs of the two relatively inexpensive activities are allocated to the two most expensive activities in proportion to their costs. (Round to two decimal places.)The engineering cost assigned to model D would be

(Multiple Choice)

4.9/5  (33)

(33)

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, what is the new pool rate for labor related costs?

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, what is the new pool rate for labor related costs?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 81 - 100 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)