Exam 10: Deductions and Losses: Certain Itemized Deductions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Several years ago,Ross,who is single,purchased a personal residence for $200,000 and took out a mortgage of $130,000 on the property.In May of the current year,when the residence had a fair market value of $270,000 and Ross owed $80,000 on the mortgage,he took out a home equity loan for $110,000.He used the funds to purchase a BMW for himself and a Lexus SUV for his wife.For both vehicles,100% of the use is for personal use.What is the maximum amount on which Ross can deduct home equity interest?

(Essay)

4.9/5  (36)

(36)

Shannon traveled to San Francisco during the year to do volunteer work for one week for the Salvation Army.She normally receives $1,050 salary per week at her job and is planning to deduct the $1,050 as a charitable contribution.In addition,Shannon incurred the following costs in connection with the trip: $450 for transportation,$1,950 for lodging,and $375 for meals.What is Shannon's deduction associated with this charitable activity?

(Essay)

4.9/5  (42)

(42)

Erica,Carol's daughter,has a mild form of autism.Dr.Malone recommends that Carol send Erica to a special school for autistic children when she enters first grade.Erica may include the cost of tuition,meals,and lodging for the special school when computing her medical expense deduction.

(True/False)

4.8/5  (44)

(44)

Pat died this year.Before she died,Pat gave 5,000 shares of stock in Coyote Corporation (a publicly traded corporation)to her church (a qualified charitable organization).The stock was worth $180,000 and she had acquired it as an investment four years ago at a cost of $150,000.In the year of her death,Pat had AGI of $300,000.In completing her final income tax return,how much of the charitable contribution should Pat's executor deduct?

(Multiple Choice)

4.8/5  (36)

(36)

Grace's sole source of income is from a restaurant that she owns and operates as a proprietorship.Any state income tax Grace pays on the business net income must be deducted as a business expense rather than as an itemized deduction.

(True/False)

4.9/5  (32)

(32)

Medical expenses must relate to a particular ailment in order to be deductible.The cost of a periodic physical exam is not deductible because it relates to the taxpayer's general state of health.

(True/False)

4.9/5  (40)

(40)

Betty owned stock in General Corporation that she donated to a church (a qualified charitable organization)on July 28,2010.What is the amount of Betty's charitable contribution deduction assuming that she had purchased the stock for $13,400 on October 17,2009,and the stock had a value of $18,800 when she made the donation?

(Multiple Choice)

4.8/5  (37)

(37)

In April 2010,Hiram,a calendar year cash basis taxpayer,paid the state of Nebraska additional income tax for 2009.Since it relates to 2009,for Federal income tax purposes the payment qualifies as a tax deduction for tax year 2009.

(True/False)

4.8/5  (32)

(32)

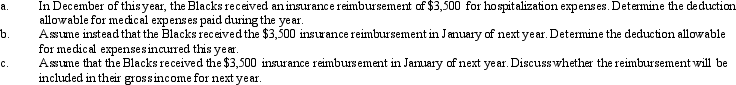

Paul and Patty Black are married and together have current AGI of $140,000.They have two dependents and file a joint return.During the year,they paid $8,000 for medical insurance,$15,000 in doctor bills and hospital expenses,and $1,000 for prescribed medicine and drugs.

(Essay)

4.8/5  (39)

(39)

Georgia contributed $2,000 to a qualifying Health Savings Account in 2010.The entire amount qualifies as a medical expense and is potentially deductible as an itemized deduction.

(True/False)

4.8/5  (37)

(37)

Betty,who is an accounting firm partner,paid $4,800 for medical insurance coverage for herself.She can include the $4,800 when calculating her itemized medical expense deduction.

(True/False)

4.9/5  (47)

(47)

Joseph and Sandra,married taxpayers,took out a mortgage on their home for $350,000 in 1989.In May of this year,when the home had a fair market value of $450,000 and they owed $250,000 on the mortgage,they took out a home equity loan for $220,000.They used the funds to purchase a single engine airplane to be used for recreational travel purposes.What is the maximum amount of debt on which they can deduct home equity interest?

(Multiple Choice)

4.8/5  (33)

(33)

Dwayne contributed stock worth $17,000 to a qualified charity.He acquired the stock fourteen months ago for $8,000.He may deduct $17,000 as a charitable contribution deduction (subject to percentage limitations).

(True/False)

4.9/5  (45)

(45)

Antonio,who is single and lives alone,is physically handicapped as a result of a skiing accident.In order to live independently,he modifies his personal residence at a cost of $10,000.The modifications included widening halls and doorways for a wheelchair,installing support bars in the bathroom and kitchen,installing a stairway lift,and rewiring so he could reach electrical outlets and appliances.His neighbor,who is in the real estate business,charges Antonio $100 for an appraisal that places the value of the residence at $106,000 before the improvements and $108,000 after.As a result of the operation of the stairway lift,Antonio noticed an increase of $225 in his utility bills for the current year.Disregarding percentage limitations,how much of the above expenditures qualify as medical expense deductions?

(Multiple Choice)

4.8/5  (33)

(33)

Chad pays the medical expenses of his son,James.James would qualify as Chad's dependent except that he earns $7,500 during the year.Chad may not claim James' medical expenses because he is not a dependent.

(True/False)

4.8/5  (31)

(31)

Bert resides in a nursing home primarily for medical reasons rather than personal reasons.Costs for meals and lodging can be included in determining his deductible medical expenses.

(True/False)

4.8/5  (34)

(34)

Brian,a self-employed individual,pays state income tax payments of:

$900 on January 15,2010 (4th estimated tax payment for 2009)

$1,000 on April 15,2010 (1st estimated tax payment in 2010)

$1,000 on June 15,2010 (2nd estimated tax payment in 2010)

$1,000 on September 15,2010 (3rd estimated tax payment in 2010)

$800 on January 18,2011 (4th estimated tax payment of 2010)

Brian had a tax overpayment of $500 on his 2009 state income tax return and applied this to his 2010 state income taxes.What is the amount of Brian's state income tax itemized deduction for his 2010 Federal income tax return?

(Essay)

4.7/5  (37)

(37)

The reduced deduction election enables a taxpayer to move from the 30% of AGI limitation to the 50% of AGI limitation.

(True/False)

4.9/5  (38)

(38)

Interest paid or accrued during the tax year on aggregate acquisition indebtedness of $2 million or less ($1 million or less for married persons filing separate returns)is deductible as qualified residence interest.

(True/False)

4.9/5  (40)

(40)

Stewart,a calendar year taxpayer,pays $6,000 in medical expenses in 2010.Even if he expects $3,000 of these expenses to be reimbursed by an insurance company in 2011,Stewart can include all $6,000 of the expenses in determining his medical expense deduction for 2010.

(True/False)

4.9/5  (32)

(32)

Showing 41 - 60 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)