Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

All collectibles gain is subject to a potential alternative tax rate of 28%.

(True/False)

4.8/5  (31)

(31)

Copper Corporation sold machinery for $27,000 on December 31,2010.The machinery had been purchased on January 2,2007,for $30,000 and had an adjusted basis of $21,000 at the date of the sale.For 2010,what should Copper Corporation report?

(Multiple Choice)

4.9/5  (37)

(37)

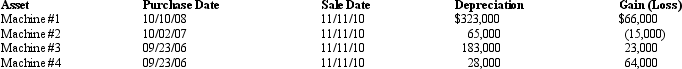

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction. )

(Essay)

4.8/5  (48)

(48)

In early 2009,Wilma paid $56,000 for an option on a parcel of land she intended to hold as an investment.After a survey of the land (paid for by the grantor)determined that the parcel was much smaller than the grantor said it was,she let the option lapse when it expired in 2010 after 14 months.How should Wilma treat these events in 2009? 2010?

(Essay)

4.9/5  (39)

(39)

In 2010,Mark has $18,000 short-term capital loss,$7,000 28% gain,and $6,000 0%/15% gain.Which of the statements below is correct?

(Multiple Choice)

4.8/5  (41)

(41)

Section 1237 allows certain professional real estate developers capital gain treatment if they engage only in limited development activities.

(True/False)

4.8/5  (30)

(30)

A business taxpayer sells depreciable business property with an adjusted basis of $40,000 for $32,000.The taxpayer held the property for more than a year.The taxpayer has an $8,000 long-term capital loss.

(True/False)

4.7/5  (37)

(37)

When an individual taxpayer has a net long-term capital gain that includes both 25% gain and 0%/15% gain,which of these gains will be taxed first when the alternative tax on net long-term capital gain method is used and what difference does it make?

(Essay)

4.8/5  (36)

(36)

Ramon is in the business of buying and selling securities.Which of the following is a capital asset for Ramon?

(Multiple Choice)

4.9/5  (35)

(35)

Mike is a self-employed TV technician.He is usually paid as soon as he completes repairs,but occasionally bills a customer with payment expected within 30 days.At the end of the year he has $2,500 of receivables outstanding.He expects to collect $1,200 of this and write off the remainder.Mike is a cash basis taxpayer and had net earnings from his business (not including the effect of the items above)of $55,000.He also had $3,500 interest income,$200 gambling winnings,and sold corporate stock for $7,000.The stock had been purchased in 1998 for $8,200.Mike is single,has no dependents,and claims the standard deduction.What is his 2010 taxable income? (Ignore the self-employment tax deduction. )

(Essay)

4.8/5  (43)

(43)

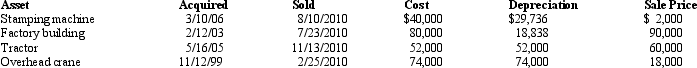

The chart below describes the § 1231 assets sold by the Bronze Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

(Essay)

4.8/5  (46)

(46)

Personal use property casualty gains and losses are not subject to the § 1231 rules.

(True/False)

4.7/5  (36)

(36)

Depreciation recapture under § 1245 and § 1250 is reported on Form 4797.

(True/False)

4.8/5  (36)

(36)

An individual taxpayer with 2009 net short-term capital loss of $5,000 generally can deduct up to $3,000 for AGI and carry the balance forward to 2010.

(True/False)

4.7/5  (31)

(31)

The maximum amount of the unrecaptured § 1250 gain (25% gain)is the depreciation taken on real property sold at a recognized gain.

(True/False)

4.8/5  (39)

(39)

The Code contains two major depreciation recapture provisions-§§ 1245 and 1250.

(True/False)

4.8/5  (39)

(39)

Section 1231 lookback losses may convert some or all of § 1250 gain into ordinary income.

(True/False)

4.7/5  (37)

(37)

Property sold to a related party purchaser that is depreciable by the purchaser may cause the seller to have ordinary gain.

(True/False)

4.7/5  (45)

(45)

Showing 21 - 40 of 144

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)