Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Cocoa Corporation is acquiring Milk Corporation in a "Type A" reorganization by exchanging 40% of its voting stock and $50,000 for all of Milk's assets (value of $850,000 and basis of $600,000)and liabilities ($200,000).The shareholders of Milk are Elsie (650 shares)and Ferdinand (350 shares).They bought their stock for $500 per share.What is the amount of gains or losses that Elsie and Ferdinand will recognize due to the reorganization? What is the value of the stock they received from Cocoa and what is their basis in the Cocoa stock?

(Essay)

5.0/5  (38)

(38)

After a plan of complete liquidation has been adopted,Condor Corporation sells its only asset,land (basis of $170,000),to Eduardo (an unrelated party)for $400,000.Under the terms of the sale,Condor Corporation receives cash of $100,000 and Eduardo's notes for the balance of $300,000.The notes are payable over the next five years ($60,000 per year)and carry an appropriate interest rate.Immediately after the sale,Condor Corporation distributes the cash and notes to Maria,the sole shareholder of Condor Corporation.Maria has a basis of $80,000 in the Condor stock.The installment notes have a value equal to their face amount.If Maria wishes to defer as much gain as possible on the transaction,which of the following is correct?

(Multiple Choice)

4.9/5  (40)

(40)

The stock in Lark Corporation is owned equally by Olaf and his son Pete.In a liquidation of the corporation,Lark Corporation distributes to Olaf land that it had purchased three years ago for $550,000.The property has a fair market value on the date of distribution of $400,000.Later,Olaf sells the land for $420,000.What loss will Lark Corporation recognize with respect to the distribution of the land?

(Multiple Choice)

4.8/5  (38)

(38)

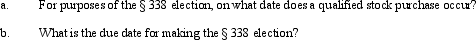

On April 17,2009,Blue Corporation purchased 15% of the Gold Corporation stock outstanding.Blue Corporation purchased an additional 50% of the stock in Gold on November 23,2009,and an additional 20% on May 4,2010.On September 24,2010,Blue Corporation purchased the remaining 15% of Gold Corporation stock outstanding.

(Essay)

4.9/5  (28)

(28)

In a corporate liquidation governed by § 332,what considerations should be given in the distribution of property to a minority shareholder?

(Essay)

4.7/5  (46)

(46)

United States tax policy tries to encourage business development.

(True/False)

4.8/5  (41)

(41)

Skylark Corporation owns 90% of the outstanding stock of Quail Corporation,having purchased the stock five years ago for $550,000.Pursuant to a plan of liquidation adopted by Quail Corporation on March 4,2010,Quail distributes all its property on December 1,2010,to its shareholders.Quail Corporation had never been insolvent and had E & P of $830,000 on the date of liquidation.Pursuant to the liquidation,Quail distributed property worth $690,000 (basis $580,000)to Skylark Corporation.How much gain must the parties recognize in 2010 on the transfer of this property to Skylark Corporation?

(Multiple Choice)

4.9/5  (31)

(31)

Silver Corporation redeems all of Alluvia's 3,000 shares and distributes to her 1,000 shares of Gold Corporation stock plus $20,000 cash.Alluvia's basis in her 30% interest in Silver is $80,000 and the stock's market value is $120,000.At the time Silver is acquired by Gold,the accumulated earnings and profits of Silver are $100,000 and Gold's are $50,000.How does Alluvia treat this transaction for tax purposes?

(Multiple Choice)

4.9/5  (38)

(38)

A subsidiary is liquidated pursuant to § 332.The parent has held 100% of the stock in the subsidiary for the past ten years.The subsidiary has E & P of $600,000 at the time of liquidation.The subsidiary's E & P disappears as a result of the liquidation.

(True/False)

4.7/5  (43)

(43)

Which of the following statements is correct with respect to the § 338 election?

(Multiple Choice)

4.9/5  (36)

(36)

For purposes of the built-in loss limitation,the 2-year presumptive rule of tax avoidance can be rebutted if there is a clear and substantial relationship between the contributed property and the corporation's business.

(True/False)

4.9/5  (41)

(41)

Corporate shareholders would prefer to have a gain on a reorganization treated as a dividend rather than as a capital gain,because of the dividends received deduction.

(True/False)

4.9/5  (36)

(36)

The gain postponed by a corporation in a corporate reorganization is the difference between the realized gain and the boot recognized.

(True/False)

4.9/5  (43)

(43)

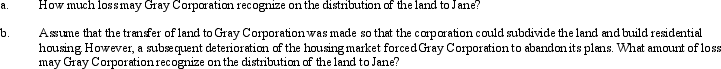

Mary and Jane,unrelated taxpayers,own Gray Corporation's stock equally.One year before the complete liquidation of Gray,Mary transfers land (basis of $300,000,fair market value of $280,000)to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $10,000 and fair market value of $50,000.In liquidation,Gray distributes the land to Jane.At the time of the liquidation,the land is worth $200,000.

(Essay)

4.8/5  (39)

(39)

During the current year,Ecru Corporation is liquidated and distributes its only asset,land,to Kena,the sole shareholder.On the date of distribution,the land has a basis of $300,000,a fair market value of $650,000,and is subject to a liability of $400,000.Kena,who takes the land subject to the liability,has a basis of $75,000 in the Ecru stock.With respect to the distribution of the land,which of the following statements is correct?

(Multiple Choice)

4.8/5  (38)

(38)

One similarity between the tax treatment accorded nonliquidating and liquidating distributions is with respect to the recognition of losses by the distributing corporation.As a general rule,a corporation recognizes losses on both nonliquidating and liquidating distributions of depreciated property (fair market value less than basis).

(True/False)

4.9/5  (37)

(37)

The stock of Tan Corporation (E & P of $800,000)is owned as follows: 85% by Egret Corporation (basis of $470,000),and 15% by Zoe (basis of $45,000).Both shareholders acquired their shares in Tan more than six years ago.In the current year,Tan Corporation liquidates and distributes land (fair market value of $870,000,basis of $950,000)and equipment (fair market value of $405,000,basis of $280,000)to Egret Corporation,and securities (fair market value of $225,000,basis of $250,000)to Zoe.What are the tax consequences of these distributions to Egret,to Tan,and to Zoe?

(Essay)

4.9/5  (34)

(34)

The text discusses four different limitations on loss recognition by liquidating corporations.Provide a brief description of each of these loss limitations.

(Essay)

4.8/5  (37)

(37)

Three years ago,Loon Corporation purchased 100% of the stock of Pelican Corporation for $950,000.Currently,Pelican Corporation has assets with a basis of $700,000 and a fair market value of $1.2 million.If Loon liquidates Pelican,what basis will Loon have in the assets it acquires from Pelican Corporation?

(Multiple Choice)

4.9/5  (37)

(37)

As a general rule,a liquidating corporation recognizes gains and losses on the distribution of property in complete liquidation.

(True/False)

4.8/5  (41)

(41)

Showing 41 - 60 of 66

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)