Exam 14: Reporting for Segments and for Interim Financial Periods

Exam 1: Introduction to Business Combinations and the Conceptual Framework35 Questions

Exam 2: Accounting for Business Combinations42 Questions

Exam 3: Consolidated Financial Statements Date of Acquisition37 Questions

Exam 4: Consolidated Financial Statements After Acquisition42 Questions

Exam 5: Allocation and Depreciation of Differences Between Implied and Book Values36 Questions

Exam 6: Elimination of Unrealized Profit on Intercompany Sales of Inventory35 Questions

Exam 7: Elimination of Unrealized Gains or Losses on Intercompany Sales of Property and Equipment33 Questions

Exam 8: Changes in Ownership Interest32 Questions

Exam 9: Intercompany Bond Holdings and Miscellaneous Topics Consolidated Financial Statements33 Questions

Exam 10: Insolvency Liquidation and Reorganization35 Questions

Exam 11: International Financial Reporting Standards28 Questions

Exam 12: Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk35 Questions

Exam 13: Translation of Financial Statements of Foreign Affiliates29 Questions

Exam 14: Reporting for Segments and for Interim Financial Periods44 Questions

Exam 15: Partnerships: Formation, operation and Ownership Changes39 Questions

Exam 16: Partnership Liquidation35 Questions

Exam 17: Introduction to Fund Accounting29 Questions

Exam 18: Introduction to Accounting for State and Local Governmental Units34 Questions

Exam 19: Accounting for Nongovernment Nonbusiness Organizations: Colleges and Universities, hospitals, and Other Health Care Organizations38 Questions

Select questions type

The computation of a company's third quarter provision for income taxes should be based upon earnings:

(Multiple Choice)

4.8/5  (34)

(34)

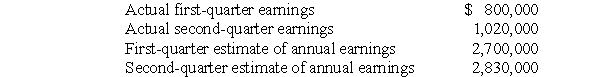

Itchy Company's actual earnings for the first two quarters of 2017 and its estimate during each quarter of its annual earnings are:

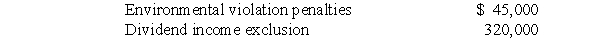

Itchy Company estimated its permanent differences between accounting income and taxable income for 2017 as:

Itchy Company estimated its permanent differences between accounting income and taxable income for 2017 as:

These estimates did not change during the second quarter.The combined state and federal tax rate for Itchy Company for 2017 is 40%.

Required:

Prepare journal entries to record Itchy Company's provisions for income taxes for each of the first two quarters of 2017.

These estimates did not change during the second quarter.The combined state and federal tax rate for Itchy Company for 2017 is 40%.

Required:

Prepare journal entries to record Itchy Company's provisions for income taxes for each of the first two quarters of 2017.

(Essay)

4.8/5  (35)

(35)

For external reporting purposes,it is appropriate to use estimated gross profit rates to determine the ending inventory value for:

(Multiple Choice)

4.8/5  (38)

(38)

To determine whether a substantial portion of a firm's operations are explained by its segment information,the combined revenue from sales to unaffiliated customers of all reportable segments must constitute at least:

(Multiple Choice)

4.9/5  (29)

(29)

For interim financial reporting,a company's income tax provision for the second quarter of 2017 should be determined using the:

(Multiple Choice)

4.8/5  (38)

(38)

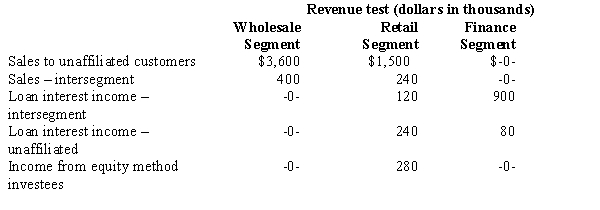

Determine the amount of revenue for each of the three segments that would be used to identify the reportable industry segments in accordance with the revenues test specified by SFAS 131.

(Multiple Choice)

4.8/5  (29)

(29)

Companies using the LIFO method may encounter a liquidation of base period inventories at an interim date that is expected to be replaced by the end of the year.In these cases,cost of goods sold should be charged with the:

(Multiple Choice)

4.9/5  (49)

(49)

Gains and losses that arise in an interim period should be:

(Multiple Choice)

4.8/5  (42)

(42)

An enterprise determines that it must report segment data in annual reports for the year ended December 31,2017.Which of the following would NOT be an acceptable way of reporting segment information?

(Multiple Choice)

4.8/5  (36)

(36)

Inventory losses from market declines that are expected to be temporary:

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following statements most accurately describes interim period tax expense?

(Multiple Choice)

4.7/5  (43)

(43)

The following information is available for Pink Company for 2017:

a.In early April Pink made major repairs to its equipment at a cost of $90,000.These repairs will benefit the remainder of 2017 operations.

b.At the end of May,Pink sold machinery with a book value of $35,000 for $45,000.

c.An inventory loss of $60,000 from market decline occurred in July.In the fourth quarter the inventory had a market value recovery that exceeded the market decline by $30,000.

Required:

Compute the amount of expense/loss that would appear in Pink Company's June 30,September 30,and December 31,2017,quarterly financial statements.

(Essay)

4.8/5  (35)

(35)

During the second quarter of 2017,Clearwater Company sold a piece of equipment at a gain of $90,000.What portion of the gain should Clearwater report in its income statement for the second quarter of 2017?

(Multiple Choice)

4.8/5  (34)

(34)

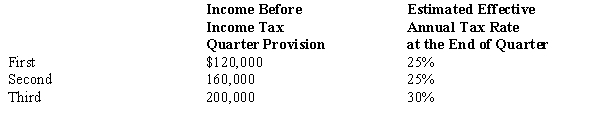

Bjork,a calendar year company,has the following income before income tax provision and estimated effective annual income tax rates for the first three quarters of 2017:  Bjork's income tax provision in its interim income statement for the third quarter should be

Bjork's income tax provision in its interim income statement for the third quarter should be

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following disclosures is NOT required to be presented for a firm's reportable segments?

(Multiple Choice)

4.9/5  (32)

(32)

An entity is permitted to aggregate operating segments that have similar economic characteristics under certain circumstances.Which of the following circumstances would allow aggregation of Entity A into Segment B?

(Multiple Choice)

4.8/5  (47)

(47)

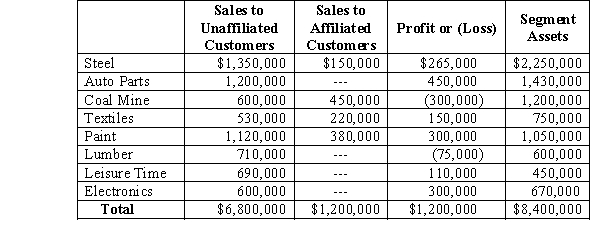

XYZ Corporation has eight industry segments with sales,operating profit and loss,and identifiable assets at and for the year ended December 31,2017,as follows:

Required:

A.Identify the segments,which are reportable segments under one or more of the 10 percent revenue,operating profit,or assets tests.

B.After reportable segments are determined under the 10 percent tests,they must be reevaluated under a 75 percent revenue test before a final determination of reportable segments can be made.Under this 75 percent test,identify if any other segments may have to be reported.

Required:

A.Identify the segments,which are reportable segments under one or more of the 10 percent revenue,operating profit,or assets tests.

B.After reportable segments are determined under the 10 percent tests,they must be reevaluated under a 75 percent revenue test before a final determination of reportable segments can be made.Under this 75 percent test,identify if any other segments may have to be reported.

(Essay)

4.8/5  (44)

(44)

An entity is permitted to aggregate operating segments if the segments are similar regarding the:

(Multiple Choice)

4.9/5  (45)

(45)

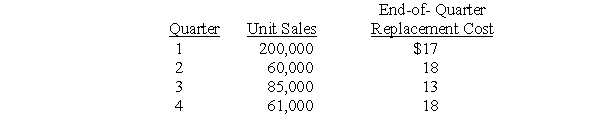

Blink Company,which uses the FIFO inventory method,had 508,000 units in inventory at the beginning of the year at a FIFO cost per unit of $20.No purchases were made during the year.Quarterly sales information and end-of-quarter replacement cost figures follow:

The market decline in the first quarter was expected to be nontemporary.Declines in other quarters were expected to be permanent.

Required:

Determine cost of goods sold for the four quarters and verify the amounts by computing cost of goods sold using the lower-of-cost-or-market method applied on an annual basis.

The market decline in the first quarter was expected to be nontemporary.Declines in other quarters were expected to be permanent.

Required:

Determine cost of goods sold for the four quarters and verify the amounts by computing cost of goods sold using the lower-of-cost-or-market method applied on an annual basis.

(Essay)

4.7/5  (37)

(37)

SFAS No.131 requires the disclosure of information on an enterprise's operations in different industries for:

(Multiple Choice)

4.8/5  (42)

(42)

Showing 21 - 40 of 44

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)