Exam 12: Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk

Exam 1: Introduction to Business Combinations and the Conceptual Framework35 Questions

Exam 2: Accounting for Business Combinations42 Questions

Exam 3: Consolidated Financial Statements Date of Acquisition37 Questions

Exam 4: Consolidated Financial Statements After Acquisition42 Questions

Exam 5: Allocation and Depreciation of Differences Between Implied and Book Values36 Questions

Exam 6: Elimination of Unrealized Profit on Intercompany Sales of Inventory35 Questions

Exam 7: Elimination of Unrealized Gains or Losses on Intercompany Sales of Property and Equipment33 Questions

Exam 8: Changes in Ownership Interest32 Questions

Exam 9: Intercompany Bond Holdings and Miscellaneous Topics Consolidated Financial Statements33 Questions

Exam 10: Insolvency Liquidation and Reorganization35 Questions

Exam 11: International Financial Reporting Standards28 Questions

Exam 12: Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk35 Questions

Exam 13: Translation of Financial Statements of Foreign Affiliates29 Questions

Exam 14: Reporting for Segments and for Interim Financial Periods44 Questions

Exam 15: Partnerships: Formation, operation and Ownership Changes39 Questions

Exam 16: Partnership Liquidation35 Questions

Exam 17: Introduction to Fund Accounting29 Questions

Exam 18: Introduction to Accounting for State and Local Governmental Units34 Questions

Exam 19: Accounting for Nongovernment Nonbusiness Organizations: Colleges and Universities, hospitals, and Other Health Care Organizations38 Questions

Select questions type

On October 1,2016,Philly Company purchased inventory from a foreign customer for 750,000 units of foreign currency (FCU)due on January 31,2017.Simultaneously,Philly entered into a forward contract for 750,000 units of FC for delivery on January 31,2017,at the forward rate of $0.75.Payment was made to the foreign customer on January 31,2017.Spot rates on October 1,December 31,and January 31,were $0.72,$0.73,and $0.76,respectively.Philly amortizes all premiums and discounts on forward contracts and closes its books on December 31.

Required:

A.Prepare all journal entries relative to the above to be made by Philly on October 1,2016.

B.Prepare all journal entries relative to the above to be made by Philly on December 31,2016.

C.Compute the transaction gain or loss on the forward contract that would be recorded in 2017.Indicate clearly whether the amount is a gain or loss.

(Essay)

4.7/5  (40)

(40)

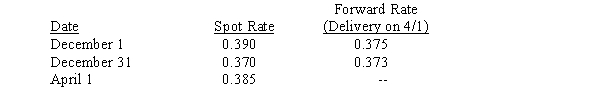

On December 1,2016,Dorn Corporation agreed to purchase a machine to be manufactured by a company in Brazil.The purchase price is 1,150,000 Brazilian reals.To hedge against fluctuations in the exchange rate,Dorn entered into a forward contract on December 1 to buy 1,150,000 reals on April 1,the agreed date of machine delivery,for $0.375 per real.The following exchange rates were quoted:

Required:

Prepare journal entries necessary for Dorn during 2016 and 2017 to account for the transactions described above.

Required:

Prepare journal entries necessary for Dorn during 2016 and 2017 to account for the transactions described above.

(Essay)

4.7/5  (45)

(45)

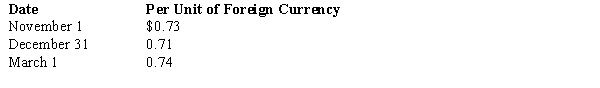

On November 1,2017,American Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of $450,000 foreign currency units (FCU).On November 1,American also entered into a forward contract to hedge the exposed asset.The forward rate is $0.70 per unit of foreign currency.American has a December 31 fiscal year-end.Spot rates on relevant dates were:  What will be the adjusted balance in the Accounts Receivable account on December 31,and how much gain or loss was recorded as a result of the adjustment?

What will be the adjusted balance in the Accounts Receivable account on December 31,and how much gain or loss was recorded as a result of the adjustment?

(Multiple Choice)

4.8/5  (32)

(32)

The exchange rate quoted for future delivery of foreign currency is the definition of a(n):

(Multiple Choice)

4.9/5  (39)

(39)

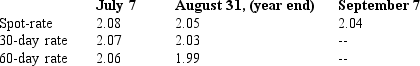

Madison Paving Company purchased equipment for 350,000 British pounds from a supplier in London on July 7,2017.Payment in British pounds is due on Sept.7,2017.The exchange rates to purchase one pound is as follows:  On its August 31,2017 income statement,what amount should Madison Paving report as a foreign exchange transaction gain:

On its August 31,2017 income statement,what amount should Madison Paving report as a foreign exchange transaction gain:

(Multiple Choice)

4.8/5  (40)

(40)

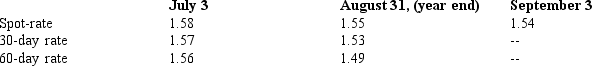

Kettle Company purchased equipment for 375,000 British pounds from a supplier in London on July 3,2017.Payment in British pounds is due on Sept.3,2017.The exchange rates to purchase one pound is as follows:  On its August 31,2017,income statement,what amount should Kettle report as a foreign exchange transaction gain:

On its August 31,2017,income statement,what amount should Kettle report as a foreign exchange transaction gain:

(Multiple Choice)

4.8/5  (30)

(30)

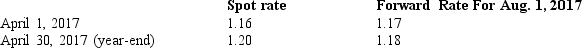

On April 1,2017,Manatee Company entered into two forward exchange contracts to purchase 300,000 euros each in 90 days.The relevant exchange rates are as follows:  The second forward contract was strictly for speculation.On April 30,2017,what amount of foreign currency transaction gain should Manatee report in income.

The second forward contract was strictly for speculation.On April 30,2017,what amount of foreign currency transaction gain should Manatee report in income.

(Multiple Choice)

4.8/5  (29)

(29)

A transaction gain or loss on a forward contract entered into as a hedge of an identifiable foreign currency commitment may be:

(Multiple Choice)

4.7/5  (32)

(32)

From the viewpoint of a U.S.company,a foreign currency transaction is a transaction:

(Multiple Choice)

4.7/5  (34)

(34)

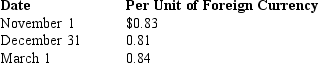

On November 1,2017,National Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of 200,000 foreign currency units (FCU).On November 1,National also entered into a forward contract to hedge the exposed asset.The forward rate is $0.80 per unit of foreign currency.National has a December 31 fiscal year-end.Spot rates on relevant dates were:  What will be the adjusted balance in the Accounts Receivable account on December 31,and how much gain or loss was recorded as a result of the adjustment?

What will be the adjusted balance in the Accounts Receivable account on December 31,and how much gain or loss was recorded as a result of the adjustment?

(Multiple Choice)

4.7/5  (34)

(34)

Accounting for a foreign currency transaction involves the terms measured and denominated.Describe a foreign currency transaction and distinguish between the terms measured and denominated.

(Essay)

4.7/5  (38)

(38)

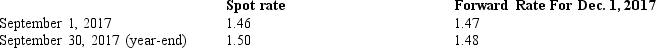

On September 1,2017,Mudd Plating Company entered into two forward exchange contracts to purchase 250,000 euros each in 90 days.The relevant exchange rates are as follows:  The first forward contract was to hedge a purchase of inventory on September 1,payable on December 1.On September 30,what amount of foreign currency transaction loss should Mudd Plating report in income?

The first forward contract was to hedge a purchase of inventory on September 1,payable on December 1.On September 30,what amount of foreign currency transaction loss should Mudd Plating report in income?

(Multiple Choice)

4.8/5  (34)

(34)

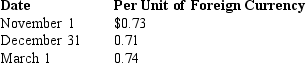

On November 1,2017,American Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of $500,000 foreign currency units (FCU).On November 1,American also entered into a forward contract to hedge the exposed asset.The forward rate is $0.70 per unit of foreign currency.American has a December 31 fiscal year-end.Spot rates on relevant dates were:  The entry to record the forward contract is

The entry to record the forward contract is

(Multiple Choice)

4.9/5  (36)

(36)

An indirect exchange rate quotation is one in which the exchange rate is quoted:

(Multiple Choice)

4.8/5  (43)

(43)

Showing 21 - 35 of 35

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)