Exam 8: Segment and Interim Reporting

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information107 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership116 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes115 Questions

Exam 8: Segment and Interim Reporting116 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission77 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations83 Questions

Exam 14: Partnerships: Formation and Operation88 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments49 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations62 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

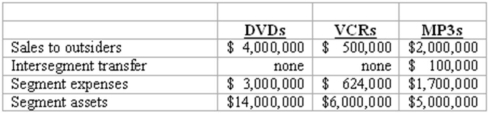

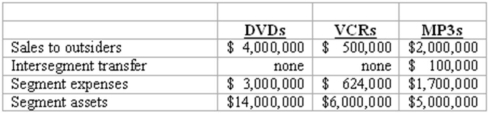

Elektronix, Inc. has three operating segments with the following information:  What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

(Multiple Choice)

4.7/5  (44)

(44)

On February 23, 2013, Cleveland, Inc. paid property taxes of $300,000 for the calendar year 2013.

(Essay)

5.0/5  (33)

(33)

Cement Company, Inc. began the first quarter with 1,000 units of inventory costing $25 per unit. During the first quarter, 3,000 units were purchased at a cost of $40 per unit, and sales of 3,400 units at $65 per units were made. During the second quarter, the company expects to replace the units of beginning inventory sold at a cost of $45 per unit. Cement Company uses the LIFO method to account for inventory.

The amount of gross profit for the first quarter is:

(Multiple Choice)

4.8/5  (38)

(38)

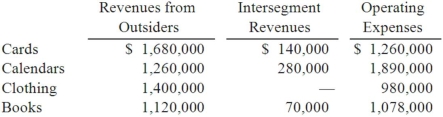

Burnside Corp. is organized into four operating segments. The following segment information was generated by the internal reporting system in 2013:  Required:

1) What was the profit or loss of each of these segments?

2) Prepare the profit or loss test to determine which of these segments was separately reportable.

Required:

1) What was the profit or loss of each of these segments?

2) Prepare the profit or loss test to determine which of these segments was separately reportable.

(Essay)

4.7/5  (36)

(36)

All of the following are required to be reported in interim financial statements for a material operating segment except:

(Multiple Choice)

4.9/5  (27)

(27)

When defining a reportable segment, which of the following conditions would be sufficient to allow a company to combine two operating segments for purposes of testing?

(Multiple Choice)

4.7/5  (44)

(44)

What are the two approaches that can be followed in preparing interim reports?

(Multiple Choice)

4.8/5  (34)

(34)

A company that generates reports by both geographic region and product line must consider additional criteria in identifying operating segments when there are multiple sets of reports. Which of the following statement(s) is correct?

(I)) An operating segment has a segment manager who is directly accountable to the chief operating decision maker for its financial performance.

(II)) If more than one set of organizational units exists, each organizational unit is considered an operating segment even if there is only one set for which segment managers are held responsible.

(III.) If segment managers exist for two or more overlapping sets of organizational units, the nature of the business activities must be considered.

(Multiple Choice)

4.8/5  (46)

(46)

What is the purpose of the U.S. GAAP seventy-five percent requirement for industry segment disclosure?

(Essay)

4.9/5  (44)

(44)

List the five aggregation criteria that need to be considered by management in determining whether business activities and environments are similar.

(Essay)

5.0/5  (42)

(42)

Elektronix, Inc. has three operating segments with the following information:  What is the minimum amount of assets an operating segment must have to be considered a reportable segment?

What is the minimum amount of assets an operating segment must have to be considered a reportable segment?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following operating segment disclosures is not required by U.S. GAAP?

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following items of information are required to be included in interim reports for each operating segment?

(I)) Revenues from external customers

(II)) Segment profit or loss

(III.) Reconciliation of segment profit or loss to the enterprise's total income before taxes

(IV)) Intersegment revenues

(Multiple Choice)

4.9/5  (33)

(33)

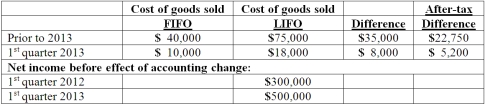

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2013?

Assuming Baker makes the change in the first quarter of 2013 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2013?

(Multiple Choice)

5.0/5  (38)

(38)

The following items are required to be disclosed for each operating segment except:

(Multiple Choice)

4.9/5  (47)

(47)

Gregor Inc. uses the LIFO cost-flow assumption to value inventory. Inventory for Gregor on January 1, 2013 was 100 units at a LIFO cost of $25 per unit. During the first quarter of 2013, 200 units were purchased costing an average of $40 per unit, and sales of 265 units at a retail price of $50 per unit were made.

Assuming Gregor does not expect to replace the units of beginning inventory sold, what is the amount of cost of goods sold for the quarter ended March 31, 2013?

(Short Answer)

4.9/5  (45)

(45)

On February 23, 2013, Cleveland, Inc. paid property taxes of $300,000 for the calendar year 2013.

Prepare the journal entry for the payment of property taxes on February 23, 2013.

(Essay)

4.8/5  (27)

(27)

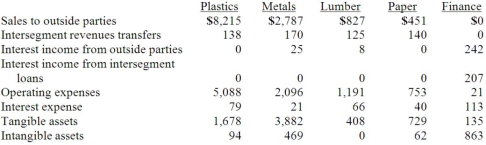

Faru Co. identified five industry segments: (1) plastics, (2) metals, (3) lumber, (4) paper, and (5) finance. Each of these segments had been consolidated appropriately by the company in producing its annual financial statements. Information describing each segment is presented below (in thousands).  Prepare the revenue test and determine which of these segments was separately reportable.

Revenues include sales to outside parties, intersegment revenues transfers, and interest income.

Prepare the revenue test and determine which of these segments was separately reportable.

Revenues include sales to outside parties, intersegment revenues transfers, and interest income.

(Essay)

4.9/5  (31)

(31)

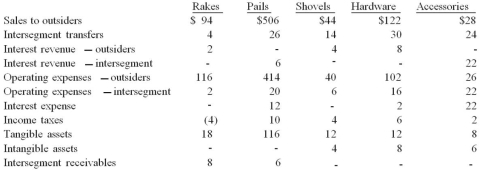

Dean Hardware, Inc. is comprised of five operating segments. Information about each of these segments is as follows (in thousands):  In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

(Multiple Choice)

4.8/5  (42)

(42)

For companies that provide quarterly reports, how is the fourth quarter reported?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 41 - 60 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)