Exam 4: Consolidated Financial Statements and Outside Ownership

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information107 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership116 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes115 Questions

Exam 8: Segment and Interim Reporting116 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission77 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations83 Questions

Exam 14: Partnerships: Formation and Operation88 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments49 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations62 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

Jax Company uses the acquisition method for accounting for its investment in Saxton Company. Jax sells some of its shares of Saxton such that neither control nor significant influence exists. Which of the following statements is true?

(Multiple Choice)

4.9/5  (36)

(36)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2014. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

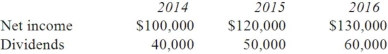

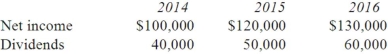

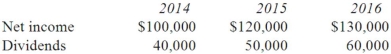

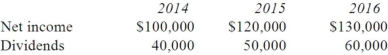

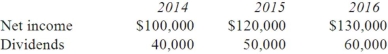

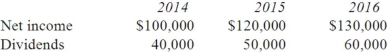

Demers earns income and pays dividends as follows:  Assume the INITIAL VALUE is applied.

Compute the non-controlling interest in Demers at December 31, 2014.

Assume the INITIAL VALUE is applied.

Compute the non-controlling interest in Demers at December 31, 2014.

(Multiple Choice)

4.7/5  (46)

(46)

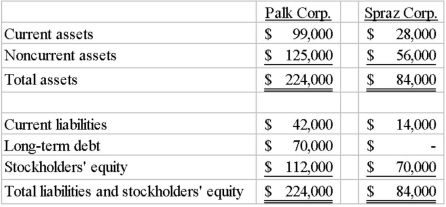

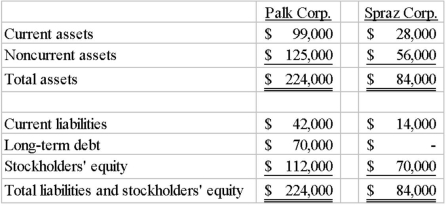

On January 1, 2014, Palk Corp. and Spraz Corp. had condensed balance sheets as follows:  On January 2, 2014, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2014. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.

What is consolidated stockholders' equity at January 2, 2014?

On January 2, 2014, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2014. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.

What is consolidated stockholders' equity at January 2, 2014?

(Multiple Choice)

4.8/5  (35)

(35)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2014. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

Demers earns income and pays dividends as follows:  Assume the INITIAL VALUE is applied.

Compute Pell's investment in Demers at December 31, 2016.

Assume the INITIAL VALUE is applied.

Compute Pell's investment in Demers at December 31, 2016.

(Multiple Choice)

5.0/5  (45)

(45)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2014. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

Demers earns income and pays dividends as follows:  Assume the EQUITY METHOD is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2015.

Assume the EQUITY METHOD is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2015.

(Multiple Choice)

4.7/5  (41)

(41)

Where should a non-controlling interest appear on a consolidated balance sheet?

(Essay)

4.9/5  (36)

(36)

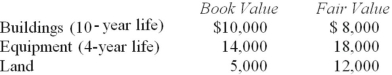

McGuire Company acquired 90 percent of Hogan Company on January 1, 2014, for $234,000 cash. This amount is reflective of Hogan's total fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:  Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.

In consolidation at January 1, 2014, what adjustment is necessary for Hogan's Patent account?

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.

In consolidation at January 1, 2014, what adjustment is necessary for Hogan's Patent account?

(Multiple Choice)

4.9/5  (45)

(45)

When Jolt Co. acquired 75% of the common stock of Yelts Corp., Yelts owned land with a book value of $70,000 and a fair value of $100,000.

What is the amount of excess land allocation attributed to the controlling interest at the acquisition date?

(Multiple Choice)

4.9/5  (46)

(46)

MacHeath Inc. bought 60% of the outstanding common stock of Nomes Inc. in an acquisition business combination that resulted in the recognition of goodwill. Nomes owned a piece of land that cost $250,000 but was worth $600,000 at the date of acquisition. What value would be attributed to this land in a consolidated balance sheet at the date of acquisition?

(Multiple Choice)

4.8/5  (41)

(41)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2014. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

Demers earns income and pays dividends as follows:  Assume the PARTIAL EQUITY method is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2016.

Assume the PARTIAL EQUITY method is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2016.

(Multiple Choice)

4.7/5  (38)

(38)

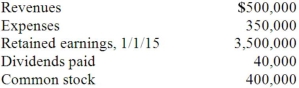

McLaughlin, Inc. acquires 70 percent of Ellis Corporation on September 1, 2014, and an additional 10 percent on November 1, 2015. Annual amortization of $8,400 attributed to the controlling interest relates to the first acquisition. Ellis reports the following figures for 2015:  Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2015.

Required: Prepare a schedule of consolidated net income and apportionment to non-controlling and controlling interests for 2015.

Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2015.

Required: Prepare a schedule of consolidated net income and apportionment to non-controlling and controlling interests for 2015.

(Essay)

4.7/5  (41)

(41)

Perch Co. acquired 80% of the common stock of Float Corp. for $1,600,000. The fair value of Float's net assets was $1,850,000, and the book value was $1,500,000. The non-controlling interest shares of Float Corp. are not actively traded.

What amount of goodwill should be attributed to the non-controlling interest at the date of acquisition?

(Multiple Choice)

4.8/5  (37)

(37)

On January 1, 2014, Glenville Co. acquired an 80% interest in Acron Corp. for $500,000. There is no active trading market for Acron's stock. The fair value of Acron's net assets was $600,000 and Glenville accounts for its interest using the acquisition method.

Determine the amount of goodwill to be recognized in this acquisition.

(Essay)

4.9/5  (40)

(40)

Caldwell Inc. acquired 65% of Club Corp. for $2,600,000. Club owned a building and equipment with ten-year useful lives. The book value of these assets was $830,000, and the fair value was $950,000. For Club's other assets and liabilities, book value was equal to fair value. The total fair value of Club's net assets was $3,500,000.

Using the acquisition method, determine the amount of goodwill associated with Caldwell's purchase of Club.

(Essay)

4.9/5  (23)

(23)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2014. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

Demers earns income and pays dividends as follows:  Assume the INITIAL VALUE is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2016.

Assume the INITIAL VALUE is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2016.

(Multiple Choice)

4.7/5  (33)

(33)

On January 1, 2014, Palk Corp. and Spraz Corp. had condensed balance sheets as follows:  On January 2, 2014, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2014. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.

What are the total consolidated current liabilities at January 2, 2014?

On January 2, 2014, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2014. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.

What are the total consolidated current liabilities at January 2, 2014?

(Multiple Choice)

4.9/5  (42)

(42)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2014. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

Demers earns income and pays dividends as follows:  Assume the INITIAL VALUE is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2014.

Assume the INITIAL VALUE is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2014.

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following statements is true regarding the sale of subsidiary shares when using the acquisition method for accounting for business combinations?

(Multiple Choice)

5.0/5  (38)

(38)

Alonzo Co. acquired 60% of Beazley Corp. by paying $240,000 cash. There is no active trading market for Beazley Corp. At the time of the acquisition, the book value of Beazley's net assets was $300,000.

Required:

What amount should have been assigned to the non-controlling interest immediately after the combination?

(Essay)

4.8/5  (40)

(40)

Which of the following statements is false regarding multiple acquisitions of a subsidiary's existing common stock?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 41 - 60 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)