Exam 19: Corporations: Distributions Not in Complete Liquidation

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law211 Questions

Exam 2: Working with the Tax Law102 Questions

Exam 3: Computing the Tax180 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: In General156 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses94 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion120 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses153 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses130 Questions

Exam 12: Tax Credits and Payments111 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges285 Questions

Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions167 Questions

Exam 15: Taxing Business Income60 Questions

Exam 16: Accounting Periods and Methods88 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure109 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation185 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations71 Questions

Exam 21: Partnerships248 Questions

Exam 22: S Corporations129 Questions

Exam 23: Exempt Entities153 Questions

Exam 24: Multistate Corporate Taxation204 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics184 Questions

Exam 27: The Federal Gift and Estate Taxes141 Questions

Exam 28: Income Taxation of Trusts and Estates161 Questions

Select questions type

In applying the § 318 stock attribution rules to a stock redemption, a shareholder is treated as owning the stock of her spouse, children, grandchildren, parents, and siblings.

Free

(True/False)

4.7/5  (31)

(31)

Correct Answer:

False

Navy Corporation has E & P of $240,000. It distributes land with a fair market value of $70,000 (adjusted basis of $25,000) to its sole shareholder, Troy. The land is subject to a liability of $55,000 that Troy assumes. Troy has:

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

A

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2018.

a. Increase

b. Decrease

c. No effect

-Gain realized, but not recognized, in a like-kind exchange transaction in 2018.

Free

(Short Answer)

4.9/5  (27)

(27)

Correct Answer:

c

Which of the following is an incorrect statement regarding the application of the § 318 stock attribution rules?

(Multiple Choice)

4.8/5  (37)

(37)

Reginald and Roland (Reginald's son) each own 50% of the stock of Robin Corporation. Reginald's stock interest is entirely redeemed by Robin Corporation. Two years later, Reginald loans Robin Corporation $250,000. The loan to Robin Corporation does not constitute a prohibited interest for purposes of the family attribution waiver.

(True/False)

4.9/5  (36)

(36)

Bristlebird Corporation (E & P of $700,000) has 3,000 shares of common stock outstanding. Juan owns 1,500 shares and his wife, Roberta, owns 1,500 shares. Juan and Roberta each have a basis of $90,000 in their Bristlebird stock. In the current year, Bristlebird Corporation redeems 1,000 shares from Juan for $250,000. With respect to the distribution in redemption of the Bristlebird stock:

(Multiple Choice)

4.8/5  (34)

(34)

Betty's adjusted gross estate is $18 million. The death taxes and funeral and administration expenses of her estate total $2.4 million. Included in Betty's gross estate is stock in Heron Corporation, valued at $6.6 million as of the date of her death. Betty had acquired the stock six years ago at a cost of $1,620,000. If Heron Corporation redeems $2.4 million of Heron stock from the estate, the transaction will qualify under § 303 as a redemption to pay death taxes and receive sale or exchange treatment.

(True/False)

4.9/5  (35)

(35)

A corporation borrows money to purchase State of Texas bonds. The interest on the loan has no impact on either taxable income or current E & P.

(True/False)

4.8/5  (35)

(35)

Robin Corporation distributes furniture (basis of $40,000? fair market value of $50,000) as a property dividend to its shareholders. The furniture is subject to a liability of $55,000. Robin Corporation recognizes gain of:

(Multiple Choice)

4.7/5  (41)

(41)

Tungsten Corporation, a calendar year cash basis taxpayer, made estimated tax payments of $800 each quarter in 2018, for a total of $3,200. Tungsten filed its 2018 tax return in 2019 and the return showed a tax liability $4,200. At the time of filing, March 15, 2019, Tungsten paid an additional $1,000 in Federal income taxes. How does the additional payment of $1,000 impact Tungsten's E & P?

(Multiple Choice)

5.0/5  (29)

(29)

Lucinda owns 1,100 shares of Blackbird Corporation stock at a time when Blackbird has 2,000 shares of stock outstanding. The remaining shareholders are unrelated to Lucinda. What is the minimum number of shares Blackbird must redeem from Lucinda so that the transaction will qualify as a disproportionate redemption?

(Multiple Choice)

4.9/5  (35)

(35)

Under certain circumstances, a distribution can generate (or add to) a deficit in E & P.

(True/False)

4.8/5  (32)

(32)

Which of the following statements is correct with respect to the § 338 election?

(Multiple Choice)

4.9/5  (43)

(43)

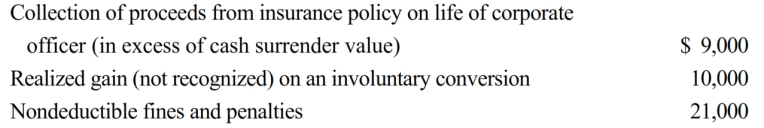

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

(Essay)

4.9/5  (38)

(38)

Purple Corporation makes a property distribution to its sole shareholder, Kyung. The property distributed is a house (fair market value of $189,000? basis of $154,000) that is subject to a $245,000 mortgage that Kyung assumes. Before considering the consequences of the distribution, Purple's current E & P is $35,000 and its accumulated E & P is $140,000. Purple makes no other distributions during the current year. What is Purple's taxable gain on the distribution of the house?

(Multiple Choice)

4.8/5  (35)

(35)

If a distribution of stock rights is taxable and their fair market value is less than 15 percent of the value of the old stock, then either a zero basis or a portion of the old stock basis may be assigned to the rights, at the shareholder's option.

(True/False)

4.9/5  (35)

(35)

At the beginning of the current year, Paul and John each own 50% of Apple Corporation. In July, Paul sold his stock to Sarah for $110,000. At the beginning of the year, Apple Corporation had accumulated E & P of $200,000 and its current E & P is $250,000 (prior to any distributions). Apple distributed $260,000 on March 1 ($130,000 to Paul and $130,000 to John) and distributed another $260,000 on October 1 ($130,000 to Sarah and $130,000 to John). What are the tax implications of the $130,000 distribution to Sarah?

(Essay)

4.8/5  (33)

(33)

Steve has a capital loss carryover in the current year of $30,000. He owns 3,000 shares of stock in Carmine Corporation, which he purchased six years ago for $20 per share. In the current year, Carmine Corporation (E & P of $750,000) redeems all of his shares for $140,000. Steve is in the 32% tax bracket. What is his income tax liability with respect to the corporate distribution if:

a. The redemption qualifies for sale or exchange treatment, and Steve has no other transactions in the current year involving capital assets?

b. The redemption does not qualify for sale or exchange treatment?

(Essay)

4.9/5  (47)

(47)

Falcon Corporation ended its first year of operations with taxable income of $250,000. At the time of Falcon's formation, it incurred $50,000 of organizational expenses. In calculating its taxable income for the year, Falcon claimed an $8,000 deduction for the organizational expenses. What is Falcon's current E & P?

(Multiple Choice)

4.9/5  (34)

(34)

Dividends paid to shareholders who hold both long and short positions do not qualify for the reduced tax rate available to individuals in certain years.

(True/False)

4.9/5  (38)

(38)

Showing 1 - 20 of 185

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)