Exam 17: Corporations: Introduction and Operating Rules

During the current year, Gray Corporation, a C corporation in the financial services business, made charitable contributions to qualified organizations as follows:

? Stock (basis of $20,000, fair market value of $45,000) in Drab Corporation, held for six months as an investment, to the Salvation Army. (Salvation Army plans on selling the stock.)

? Painting (basis of $90,000, fair market value of $250,000), held for four years as an investment, to the Museum of Fine Arts. (The Museum plans on including the painting in its collection.)

Gray Corporation's taxable income (before any charitable contribution deduction) is $1.8 million.

a. What is the total amount of Gray's charitable contributions for the year?

b. What is the amount of Gray's charitable contribution deduction in the current year, and what happens to any excess charitable contribution, if any?

a. Gray's total amount of charitable contributions is $270,000 [$20,000 (stock) +$250,000 (painting)], computed as follows:

Stock: this is ordinary income property, as a sale of the stock would not result in a long-term capital gain or a § 1231 gain for Gray (i.e., STCG). Thus, the amount of the contribution is the stock's basis, or $20,000.

Painting: this is capital gain property, as a sale of the painting would result in a long-term capital gain for Gray. The painting is tangible personal property and its use is related to the charitable organization's exempt function. Thus, the amount of the contribution is the painting's fair market value, or $250,000.

b. Gray's current year charitable deduction is limited to $180,000 [10% × $1.8 million (taxable income before charitable deduction)], and the excess charitable contribution of $90,000 ($270,000 - $180,000) is carried forward to the five succeeding tax years.

Lilac Corporation incurred $4,700 of legal and accounting fees associated with its incorporation. The $4,700 is deductible as startup expenditures on Lilac's tax return for the year in which it begins business.

False

In 2018, Bluebird Corporation had net income from operations of $100,000. Further, Bluebird recognized a long-term capital gain of $30,000, and a short-term capital loss of $45,000. Which of the following statements is correct?

A

On December 31, 2018, Lavender, Inc., an accrual basis C corporation, accrues a $50,000 bonus to Barry, its vice president and a 40% shareholder. Lavender pays the bonus to Barry, who is a cash basis taxpayer, on March 14, 2019. Lavender can deduct the bonus in 2019, the year in which it is included in Barry's gross income.

Canary Corporation, a calendar year C corporation, received an $80,000 dividend from Stork Corporation. Canary owns 18% of the Stork Corporation stock. Assuming it is not subject to the taxable income limitation, Canary's dividends received deduction is $40,000.

Luis is the sole shareholder of a regular C corporation, and Eduardo owns a proprietorship. In the current year, both businesses make a profit of $80,000 and each owner withdraws $50,000 from his business. With respect to this information, which of the following statements is incorrect?

Contrast the tax treatment of capital gains and losses of C corporations with that of individual taxpayers.

Canary Corporation, which sustained a $5,000 net short-term capital loss during the year, will enter $5,000 as an addition on Schedule M-1 of Form 1120.

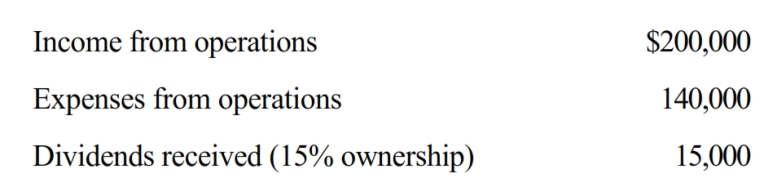

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

The accumulated earnings and personal holding company taxes are designed to prevent the accumulation of earnings within a corporation.

As a general rule, C corporations must use the cash method of accounting. However, under several exceptions to this rule (e.g., average annual gross receipts of $25 million or less for the most recent 3-year period), a C corporation can use the accrual method.

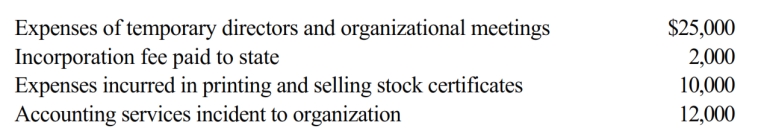

Warbler Corporation, an accrual method regular corporation, was formed and began operations on March 1, 2018.

The following expenses were incurred during its first year of operations (March 1 - December 31, 2018):

a. Assuming a valid election under § 248 to amortize organizational expenditures, what is the amount of Warbler's deduction for 2018?

b. Same asa., except that Warbler also incurred in 2018 legal fees of $15,000 for the drafting of the corporate charter and bylaws. What is the amount of Warbler's 2018 deduction for organizational expenditures?

a. Assuming a valid election under § 248 to amortize organizational expenditures, what is the amount of Warbler's deduction for 2018?

b. Same asa., except that Warbler also incurred in 2018 legal fees of $15,000 for the drafting of the corporate charter and bylaws. What is the amount of Warbler's 2018 deduction for organizational expenditures?

Eagle Corporation, a calendar year C corporation, owns stock in Hawk Corporation and has taxable income of $100,000 for the year before considering the dividends received deduction. In the current year, Hawk Corporation pays Eagle a dividend of $130,000, which was considered in calculating the $100,000. What amount of dividends received deduction may Eagle claim if it owns 15% of Hawk's stock?

For purposes of the estimated tax payment rules, a "large corporation" is defined as a corporation that had taxable income of $1 million or more in any of the three preceding years.

Robin Corporation, a calendar year C corporation, had taxable income of $700,000, $1.2 million, and $1 million for 2016, 2017, and 2018, respectively. Robin has taxable income of $1.8 million for 2018. The minimum 2019 estimated tax installment payments for Robin are:

In the current year, Crimson, Inc., a calendar C corporation, has income from operations of $180,000 and operating deductions of $225,000. Crimson also had $30,000 of dividends from a 15% stock ownership in a domestic corporation. Which of the following statements is correct with respect to Crimson for the current year?

On December 31, 2018, Flamingo, Inc., a calendar year, accrual method C corporation, accrues a bonus of $50,000 to its president (a cash basis taxpayer), who owns 75% of the corporation's outstanding stock. The $50,000 bonus is paid to the president on February 4, 2019. For Flamingo's 2018 Form 1120, the $50,000 bonus will be a subtraction item on Schedule M-1.

During the current year, Skylark Company (a calendar year entity) had operating income of $420,000 and operating expenses of $250,000. In addition, Skylark had a long-term capital loss of $20,000, and a charitable contribution of $5,000. How does Toby, the sole owner of Skylark Company, report this information on his individual income tax return under following assumptions?

a. Skylark is an LLC, and Toby does not withdraw any funds from the company during the year.

b. Skylark is an S corporation, and Toby does not withdraw any funds from the company duringthe year.

c. Skylark is a regular (C) corporation, and Toby does not withdraw any funds from the company during the year.

An expense that is deducted in computing net income per books but not deductible in computing taxable income is a subtraction item on Schedule M-1.

Wanda is the Chief Executive Officer of Pink corporation, a publicly traded, calendar year corporation. For the current year, Wanda's compensation package consists of: Cash compensation $2.5 million

Nontaxable fringe benefits 250,000

Taxable fringe benefits 150,000

Bonus tied to company performance 2 million

How much of Wanda's compensation is deductible by Pink Corporation?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)