Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

Residual value is also known as all of the following except

(Multiple Choice)

4.9/5  (39)

(39)

Land acquired as a speculation is reported under Investments on the balance sheet.

(True/False)

4.7/5  (38)

(38)

On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the equipment was $215,000 with an accumulated depreciation of $185,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $55,000. What is the amount of the gain or loss on this transaction?

(Multiple Choice)

5.0/5  (40)

(40)

When a company discards machinery that is fully depreciated, this transaction would be recorded with the following entry

(Multiple Choice)

4.9/5  (36)

(36)

Minerals removed from the earth are classified as intangible assets.

(True/False)

4.8/5  (34)

(34)

If a fixed asset, such as a computer, were purchased on January 1st for $3,750 with an estimated life of 3 years and a salvage or residual value of $150, the journal entry for monthly expense under straight-line depreciation is:

(Note: EOM indicates the last day of each month.)

(Multiple Choice)

4.8/5  (42)

(42)

On the first day of the fiscal year, a new walk-in cooler with a list price of $52,000 was acquired in exchange for an old cooler and $42,000 cash. The old cooler had a cost $24,000 and accumulated depreciation of $17,000.

a)Determine the gain to be recorded on the exchange.

b)Joumalize the entry to recort the exchange.

(Essay)

4.8/5  (36)

(36)

An operating lease is accounted for as if the lessee has purchased the asset.

(True/False)

4.8/5  (34)

(34)

A fixed asset with a cost of $52,000 and accumulated depreciation of $47,500 is traded for a similar asset priced at $60,000 in a transaction with commercial substance. Assuming a trade-in allowance of $5,000, the cost basis of the new asset is

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following below is an example of a capital expenditure?

(Multiple Choice)

4.8/5  (33)

(33)

When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that best matches allocation of cost with revenue is

(Multiple Choice)

4.7/5  (37)

(37)

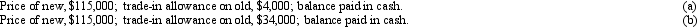

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $50,000 (including depreciation for the current year to date) is exchanged for similar machinery. For financial reporting purposes, present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

(Essay)

4.9/5  (33)

(33)

When exchanging equipment, if the trade-in allowance is greater than the book value a loss results.

(True/False)

4.9/5  (38)

(38)

When a company exchanges machinery and receives a trade-in allowance greater than the book value, this transaction would be recorded with the following entry (assuming the exchange was considered to have commercial substance):

(Multiple Choice)

4.8/5  (39)

(39)

Copy equipment was acquired at the beginning of the year at a cost of $56,000 that has an estimated residual value of $8,000 and an estimated useful life of 5 years. It is estimated that the machine has an estimated 1,000,000 copies. This year 240,000 copies were made. Determine the (a) depreciable cost, (b) depreciation rate, and (c) the units-of-production depreciation for the year.

(Essay)

4.9/5  (34)

(34)

A fixed asset's estimated value at the time it is to be retired from service is called

(Multiple Choice)

4.9/5  (43)

(43)

The process of transferring the cost of metal ores and other minerals removed from the earth to an expense account is called

(Multiple Choice)

4.8/5  (26)

(26)

The Weber Company purchased a mining site for $500,000 on July 1, 2011. The company expects to mine ore for the next 10 years and anticipates that a total of 100,000 tons will be recovered. The estimated residual value of the property is $80,000. During 2011 the company extracted 4,000 tons of ore. The depletion expense for 2011 is

(Multiple Choice)

4.8/5  (27)

(27)

Showing 81 - 100 of 175

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)