Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

Factors contributing to a decline in the usefulness of a fixed asset may be divided into the following two categories

(Multiple Choice)

4.9/5  (40)

(40)

A machine with a cost of $75,000 has an estimated residual value of $5,000 and an estimated life of 4 years or 18,000 hours. What is the amount of depreciation for the second full year, using the double declining-balance method?

(Multiple Choice)

4.8/5  (37)

(37)

For each of the following fixed assets, determine the depreciation expense and the book value for the dates requested:

Disposal date is N/A if asset is still in use.

Method: SL = Straight Line; DDB = Double Declining Balance

Assume the estimated life was 5 years for each asset.

Depr Expense 2011 Depr Method Disposal date Purchase Date Residual Value Cost Item SL N/A 7/1/2011 \ 4,000 \ 40,000 A SL S/31/2011 1/1/2009 \ 5,000 \ 50,000 B DDB N/A 10/1/2011 \ 2,000 \ 60,000 C DDB 4/1/2011 1/1/2010 \ 10,000 \ 80,000 D

(Essay)

5.0/5  (37)

(37)

Both the initial cost of the asset and the accumulated depreciation will be taken off the books with the disposal of the asset.

(True/False)

4.9/5  (43)

(43)

Though a piece of equipment is still being used, the equipment should be removed from the accounts if it has been fully depreciated.

(True/False)

4.8/5  (42)

(42)

Macon Co. acquired drilling rights for $7,500,000. The oil deposit is estimated at 37,500,000 gallons. During the current year, 3,000,000 gallons were drilled. Journalize the adjusting entry at December 31, 2011 to recognize the depletion expense.

Journal

(Essay)

4.7/5  (42)

(42)

On December 31, Bowman Company estimated that goodwill of $80,000 was impaired. In addition, a patent with an estimated useful economic life of 10 years was acquired for $252,000 on June 1.

Required:

(1) Journalize the adjusting entry on December 31 for the impaired goodwill.

(2) Journalize the adjusting entry on December 31 for the amortization of the patent rights.

(Essay)

5.0/5  (35)

(35)

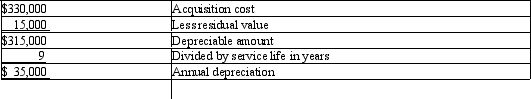

On July 1st, Harding Construction purchases a bulldozer for $330,000. The equipment has a 9 year life with a residual value of $15,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

(Essay)

4.9/5  (42)

(42)

The cost of repairing damage to a machine during installation is debited to a fixed asset account.

(True/False)

4.7/5  (44)

(44)

All of the following below are needed for the calculation of straight-line depreciation except

(Multiple Choice)

4.8/5  (40)

(40)

Equipment was purchased on January 5, 2011, at a cost of $90,000. The equipment had an estimated useful life of 8 years and an estimated residual value of $8,000.

(Essay)

4.9/5  (30)

(30)

When a major corporation develops its own trademark and over time it becomes very valuable, the trademark may be shown on their balance sheet due to lack of a material cost.

(True/False)

4.9/5  (37)

(37)

A fixed asset with a cost of $30,000 and accumulated depreciation of $28,500 is sold for $3,500. What is the amount of the gain or loss on disposal of the fixed asset?

(Multiple Choice)

4.9/5  (37)

(37)

Solare Company acquired mineral rights for $60,000,000. The diamond deposit is estimated at 6,000,000 tons. During the current year, 2,300,000 tons were mined and sold.

a.Determine the depletion rate.

b.Detemine the amount of depletion expense for the current year:

c.Joumalize the adjusting entry to recognize the depletion expense.

(Essay)

4.8/5  (35)

(35)

On December 31, Strike Company has decided to discard one of its batting cages. The initial cost of the equipment was $215,000 with an accumulated depreciation of $185,000. Depreciation has been taken up to the end of the year. The following will be included in the entry to record the disposal.

(Multiple Choice)

4.8/5  (31)

(31)

The cost of new equipment is called a revenue expenditure because it will help generate revenues in the future.

(True/False)

4.9/5  (40)

(40)

Computer equipment was acquired at the beginning of the year at a cost of $63,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years. Determine the (a) depreciable cost (b) double-declining-balance rate, and (c) double-declining-balance depreciation for the first year.

(Essay)

4.8/5  (44)

(44)

When land is purchased to construct a new building, the cost of removing any structures on the land should be charged to the building account.

(True/False)

4.9/5  (35)

(35)

The transfer to expense of the cost of intangible assets attributed to the passage of time or decline in usefulness is called amortization.

(True/False)

4.8/5  (41)

(41)

Showing 141 - 160 of 175

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)