Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

What is the cost of the land, based upon the following data?

\ 178,000 Land purchase price 15,000 Broker's commission Payment for the demolition 5,000 and removal of existing building Cashreceived from the sale of materials 2,000 salvaged from the demolished building

(Short Answer)

4.9/5  (41)

(41)

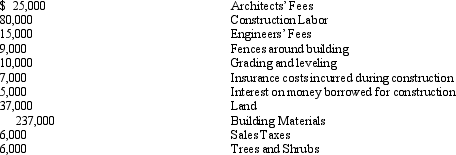

Eagle Country Club has acquired a lot to construct a clubhouse. Eagle had the following costs related to the construction:

Determine the cost of the Club House to be reported on the balance sheet.

Determine the cost of the Club House to be reported on the balance sheet.

(Essay)

4.8/5  (41)

(41)

The amount of depreciation expense for a fixed asset costing $95,000, with an estimated residual value of $5,000 and a useful life of 5 years or 20,000 operating hours, is $21,375 by the units-of-production method during a period when the asset was used for 4,500 hours.

(True/False)

4.9/5  (34)

(34)

Once the useful life of a depreciable asset has been estimated and the amount to be depreciated each year has been determined, the amounts can be changed.

(True/False)

4.8/5  (40)

(40)

The cost of computer equipment does include the consultant's fee to supervise installation of the equipment.

(True/False)

4.9/5  (36)

(36)

An asset was purchased for $58,000 and originally estimated to have a useful life of 10 years with a residual value of $3,000. After two years of straight line depreciation, it was determined that the remaining useful life of the asset was only 2 years with a residual value of $2,000.

a) Determine the amount of the annual depreciation for the first two years.

b) Determine the book value at the end of the 2nd year.

c) Determine the depreciation expense for each of the remaining years after revision.

(Short Answer)

4.8/5  (32)

(32)

A building with an appraisal value of $147,000 is made available at an offer price of $152,000. The purchaser acquires the property for $35,000 in cash, a 90-day note payable for $45,000, and a mortgage amounting to $65,000. The cost basis recorded in the buyer's accounting records to recognize this purchase is

(Multiple Choice)

4.8/5  (40)

(40)

On April 15, Compton Co. paid $1,350 to upgrade a delivery truck and $45 for an oil change. Journalize the entries for the delivery truck and oil change expenditures.

(Essay)

4.7/5  (34)

(34)

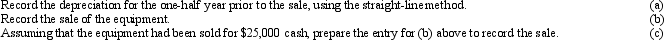

Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Journalize the following entries:

(Essay)

4.8/5  (38)

(38)

On October 1, Sebastian Company acquired new equipment with a fair market value of $458,000. Sebastian received a trade-in allowance of $92,000 on the old equipment of a similar type and paid cash of $366,000. The following information about the old equipment is obtained from the account in the equipment ledger: Cost, $336,000; accumulated depreciation on December 31, the end of the preceding fiscal year, $220,000; annual depreciation, $20,000. Assuming the exchange has commercial substance, journalize the entries to record: (a) the current depreciation of the old equipment to the date of trade-in and (b) the exchange transaction on October 1.

(Essay)

4.9/5  (45)

(45)

The double-declining-balance method is an accelerated depreciation method.

(True/False)

4.8/5  (32)

(32)

Costs associated with normal research and development activities should be treated as intangible assets.

(True/False)

4.8/5  (30)

(30)

The Bacon Company acquired new machinery with a price of $15,200 by trading in similar old machinery and paying $12,700. The old machinery originally cost $9,000 and had accumulated depreciation of $5,000. In recording this transaction, Bacon Company should record

(Multiple Choice)

4.9/5  (35)

(35)

Residual value is incorporated in the initial calculations for double-declining-balance depreciation.

(True/False)

4.9/5  (44)

(44)

Capital expenditures are costs of acquiring, constructing, adding, or replacing property, plant and equipment.

(True/False)

4.9/5  (36)

(36)

Computer equipment was acquired at the beginning of the year at a cost of $45,000 that has an estimated residual value of $3,000 and an estimated useful life of 4 years. Determine the (a) depreciable cost, (b) straight-line rate, and (c) annual straight-line depreciation.

(Essay)

4.8/5  (34)

(34)

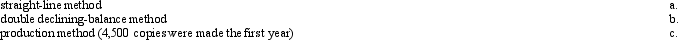

A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the

(Essay)

4.8/5  (42)

(42)

During construction of a building, the cost of interest on a construction loan should be charged to an expense account.

(True/False)

4.7/5  (41)

(41)

The calculation for annual depreciation using the straight-line depreciation method is

(Multiple Choice)

4.8/5  (37)

(37)

Showing 101 - 120 of 175

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)