Exam 11: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

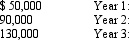

Sabas Company has 40,000 shares of $100 par, 1% preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

(Essay)

4.9/5  (33)

(33)

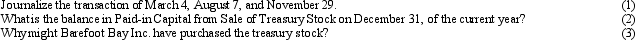

On March 4, of the current year, Barefoot Bay, Inc. reacquired 5,000 shares of its common stock at $89 per share. On August 7, Barefoot Bay sold 3,500 of the reacquired shares at $100 per share. The remaining 1,500 shares were sold at $88 per share on November 29.

Required:

(Essay)

4.9/5  (38)

(38)

Treasury stock which was purchased for $3,000 is sold for $3,500. As a result of these two transactions combined

(Multiple Choice)

4.7/5  (39)

(39)

Alma Corp. issues 1,000 shares of $10 par value common stock at $16 per share. When the transaction is recorded, credits are made to:

(Multiple Choice)

4.7/5  (36)

(36)

Paid-in capital may originate from real estate donated to the corporation.

(True/False)

4.7/5  (41)

(41)

A corporation has 10,000 shares of $100 par value stock outstanding. If the corporation issues a 5-for-1 stock split, the number of shares outstanding after the split will be 40,000.

(True/False)

5.0/5  (35)

(35)

The amount of a corporation's retained earnings that has been restricted/appropriated should be reported in the notes to the financial statements.

(True/False)

4.9/5  (42)

(42)

A large public corporation normally uses registrars and transfer agents to maintain records of the stockholders.

(True/False)

4.7/5  (38)

(38)

The liability for a dividend is recorded on which of the following dates?

(Multiple Choice)

4.8/5  (40)

(40)

The day on which the board of directors of the corporation distributes a dividend is called the declaration date.

(True/False)

4.8/5  (34)

(34)

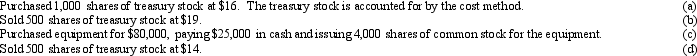

A company has 10,000 shares of $10 par common stock outstanding. Prepare entries to record the following:

(Essay)

4.9/5  (34)

(34)

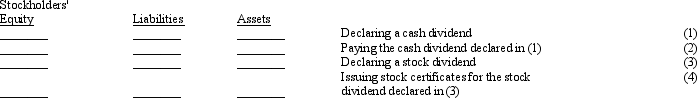

Indicate whether the following actions would (+) increase, (-) decrease, or (0) not affect a company's total assets, liabilities, and stockholders' equity.

(Essay)

4.8/5  (33)

(33)

Wonder Sales is authorized to issue 100,000 shares of $100 par, 2% preferred stock and 1,000,000 shares of $10 par common stock.

(a) On January 2nd, Wonder Sales issues 5,000 shares of preferred stock for $107 per share and 65,000 shares of common stock at $10 per share. Journalize this issuance.

(b) On January 25th, Wonder Sales issued 250 shares of preferred stock to a Morton Law Firm for settlement of an invoice for incorporation services. The invoice was for $36,000. Journalize this issuance.

(c) On January 31st, Wonder Sales issues 500 shares of common stock to Setup Inc. for fixtures. The fixtures have a fair market value of $6,500. Journalize this issuance.

(Essay)

4.8/5  (40)

(40)

Before a stock dividend can be declared or paid, there must be sufficient cash.

(True/False)

4.9/5  (40)

(40)

A stock split results in a transfer at market value from retained earnings to paid-in capital.

(True/False)

4.9/5  (30)

(30)

If common stock is issued for an amount greater than par value, the excess should be credited to

(Multiple Choice)

4.9/5  (40)

(40)

Treasury stock should be reported in the financial statements of a corporation as a(n)

(Multiple Choice)

4.8/5  (36)

(36)

The date on which a cash dividend becomes a binding legal obligation is on the

(Multiple Choice)

4.7/5  (29)

(29)

A corporation has 50,000 shares of $28 par value stock outstanding that has a current market value of $150. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately

(Multiple Choice)

4.9/5  (30)

(30)

Showing 21 - 40 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)