Exam 11: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

The declaration of a stock dividend decreases a corporation's stockholders' equity and increases its liabilities.

(True/False)

4.8/5  (44)

(44)

Cash dividends become a liability to a corporation on the date of record.

(True/False)

4.9/5  (37)

(37)

Treasury stock that had been purchased for $6,400 last month was reissued this month for $8,500. The journal entry to record the reissuance would include a credit to

(Multiple Choice)

4.7/5  (43)

(43)

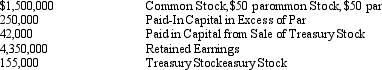

Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet. Fifty thousand shares of common stock are authorized, and 5,000 shares have been reacquired.

(Essay)

4.9/5  (32)

(32)

Solar Company has 600,000 shares of $75 par common stock outstanding. On February 13, Solar declared a 3% stock dividend to be issued April 30 to stockholders of record on March 14. The market price of the stock was $90 per share on February 13.

Required: Journalize the entries required on February 13, March 14, and April 30.

(Essay)

4.8/5  (45)

(45)

The price at which a stock can be sold depends upon a number of factors. Which statement below is not one of those factors?

(Multiple Choice)

4.8/5  (39)

(39)

Preferred stockholders must receive their current year dividends before the common stockholders can receive any dividends.

(True/False)

4.9/5  (32)

(32)

A corporation is a separate entity for accounting purposes but for legal purposes.

(True/False)

4.8/5  (31)

(31)

If Everly Company issues 1,000 shares of $5 par value common stock for $75,000, the account

(Multiple Choice)

4.7/5  (41)

(41)

The financial loss that each stockholder in a corporation can incur is usually limited to the amount invested by the stockholder.

(True/False)

4.7/5  (36)

(36)

A company with 100,000 authorized shares of $4 par common stock issued 50,000 shares at $9. Subsequently, the company declared a 2% stock dividend on a date when the market price was $10 a share. The effect of the declaration and issuance of the stock dividend is to

(Multiple Choice)

4.8/5  (42)

(42)

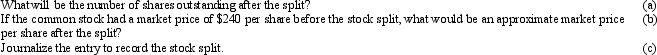

A corporation, which had 18,000 shares of common stock outstanding, declared a 3-for-1 stock split.

(Essay)

4.9/5  (29)

(29)

If paid-in-capital in excess of par/preferred stock is $30,000, preferred stock is $200,000, paid-in-capital in excess of par/common stock is $20,000, common stock is $525,000, and retained earnings is $105,000 (deficit), the total stockholders' equity is $880,000.

(True/False)

4.8/5  (43)

(43)

A corporation has 50,000 shares of $25 par value stock outstanding that has a current market value of $120. If the corporation issues a 5-for-1 stock split, the par value of the stock after the split will be:

(Multiple Choice)

4.9/5  (39)

(39)

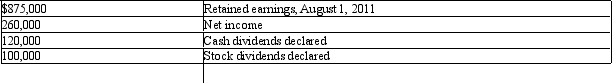

Future Sources, Inc. reported the following results for the year ending July 31, 2012:

Prepare a retained earnings statement for the fiscal year ended July 31, 2012.

Prepare a retained earnings statement for the fiscal year ended July 31, 2012.

(Essay)

4.9/5  (39)

(39)

On January 1, 2011 a company had the following data:

- issued 10,000 shares of $2.00 par value common stock for $12.00 per share

- issued 3,000 shares of $50 par value 6% cumulative preferred stock for $70 per share

- purchased 1,000 shares of previously issued common stock for $15.00 per share

The company had the following dividend information available:

2011 - No dividend paid

2012 - Paid a $2,000 total dividend

2013 - Paid a $17,000 total dividend

2014 - paid a $32,000 total dividend

Using the following format, fill in the correct values for each year;

2011 2012 2013 2014

Common stock dividend

Preferred stock dividend

Dividends in arrears

(Essay)

4.7/5  (33)

(33)

A sale of treasury stock may result in a decrease in paid-in-capital. All decreases should be charged to the Paid-In-Capital from Sale of Treasury account.

(True/False)

4.9/5  (38)

(38)

Nexis Corp. issues 1,000 shares of $15 par value common stock at $25 per share. When the transaction is recorded, credits are made to:

(Multiple Choice)

4.8/5  (34)

(34)

Showing 121 - 140 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)