Exam 11: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

Under the Internal Revenue Code, corporations are required to pay federal income taxes.

(True/False)

4.9/5  (36)

(36)

The excess of sales price of treasury stock over its cost should be credited to

(Multiple Choice)

4.9/5  (28)

(28)

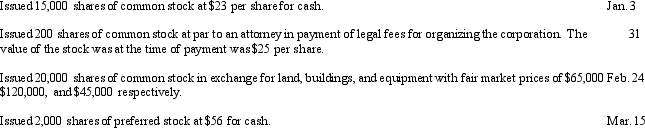

A corporation was organized on January 1 of the current year, with an authorization of 20,000 shares of $4 preferred stock, $12 par, and 100,000 shares of $3 par common stock.

The following selected transactions were completed during the first year of operations:

(Essay)

4.7/5  (36)

(36)

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 45,000 shares were originally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding?

(Multiple Choice)

4.9/5  (42)

(42)

A corporation has 12,000 shares of $20 par value stock outstanding that has a current market value of $150. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately $50.

(True/False)

4.9/5  (34)

(34)

On April 10, Maranda Corporation issued for cash 11,000 shares of no-par common stock at $25. On May 5, Maranda issued at par 1,000 shares of 4%, $50 par preferred stock for cash. On May 25, Maranda issued for cash 15,000 shares of 4%, $50 par preferred stock at $55.

Journalize the entries to record the April 10, May 5, and May 25 transactions.

(Essay)

4.8/5  (37)

(37)

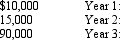

Sabas Company has 20,000 shares of $100 par, 1% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

(Essay)

4.8/5  (44)

(44)

The retained earnings statement may be combined with the income statement.

(True/False)

4.8/5  (36)

(36)

The reduction in the par or stated value of common stock, accompanied by the issuance of a proportionate number of additional shares, is called a stock split.

(True/False)

4.9/5  (38)

(38)

When the board of director's declares a cash or stock dividend, this action decreases retained earnings.

(True/False)

4.9/5  (36)

(36)

Which of the following is not classified as paid-in capital on the balance sheet?

(Multiple Choice)

4.9/5  (41)

(41)

The stock dividends distributable account is listed in the current liability section of the balance sheet.

(True/False)

4.8/5  (33)

(33)

Which of the following is not a prerequisite to paying a cash dividend?

(Multiple Choice)

4.7/5  (27)

(27)

Organizational expenses are classified as intangible assets on the balance sheet.

(True/False)

4.8/5  (43)

(43)

When a stock dividend is declared, which of the following accounts is credited?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 81 - 100 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)