Exam 21: Incremental Analysis

Exam 1: Accounting: Information for Decision Making135 Questions

Exam 2: Basic Financial Statements158 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events161 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals160 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results136 Questions

Exam 6: Merchandising Activities144 Questions

Exam 7: Financial Assets233 Questions

Exam 8: Inventories and the Cost of Goods Sold169 Questions

Exam 9: Plant and Intangible Assets154 Questions

Exam 10: Liabilities221 Questions

Exam 11: Stockholders Equity: Paid-In Capital166 Questions

Exam 12: Income and Changes in Retained Earnings153 Questions

Exam 13: Statement of Cash Flows181 Questions

Exam 14: Financial Statement Analysis165 Questions

Exam 15: Global Business and Accounting95 Questions

Exam 16: Management Accounting: a Business Partner124 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations116 Questions

Exam 18: Process Costing103 Questions

Exam 19: Costing and the Value Chain89 Questions

Exam 20: Cost-Volume-Profit Analysis147 Questions

Exam 21: Incremental Analysis119 Questions

Exam 22: Responsibility Accounting and Transfer Pricing108 Questions

Exam 23: Operational Budgeting115 Questions

Exam 24: Standard Cost Systems130 Questions

Exam 25: Rewarding Business Performance71 Questions

Exam 26: Capital Budgeting125 Questions

Exam 28: Forms of Business Organization52 Questions

Exam 27: The Time Value of Money: Future Amounts and Present Values Answer Key49 Questions

Select questions type

If BT&T reworks the defective telephones, by how much will its operating income change?

(Multiple Choice)

4.9/5  (41)

(41)

The average total cost of producing Z-12 is $35 per unit. The average variable cost associated with the production of Z-12 is $12 per unit, of which $2 is manufacturing overhead. The normal selling price of Z-12 is $50 per unit. If excess capacity exists, a special order for Z-12 will increase net operating income if it is priced at least:

(Multiple Choice)

4.9/5  (37)

(37)

Seidman Company manufactures and sells 30,000 units of product X per month. Each unit of product X sells for $16 and has a contribution margin of $7. If product X is discontinued, $85,000 in fixed monthly overhead costs would be eliminated and there would be no effect on the sales volume of Seidman Company's other products. If product X is discontinued, Seidman Company's monthly income before taxes should:

(Multiple Choice)

4.9/5  (32)

(32)

A sunk cost is the benefit that could have been obtained by pursuing an alternate course of action.

(True/False)

4.9/5  (42)

(42)

Assume that the price offered by the foreign company is $43 per unit. Accepting the special order will cause JCN's operating income to:

(Multiple Choice)

4.8/5  (44)

(44)

Assuming John Boyd wants to earn a pretax profit of $10,000 on this special order, what price must it charge Joan Reid?

(Multiple Choice)

4.8/5  (45)

(45)

An opportunity cost is a relevant cost when making a business decision.

(True/False)

4.8/5  (38)

(38)

Incremental analysis

Information regarding current operations of the Farrell Corporation is given below:

Sales \ 950,000 Variable Costs \ 450,000 Fixed Costs \ 310,000 A proposed addition to Farrell's factory is estimated by the sales manager to increase sales by a maximum of $750,000. The company's accountants have determined that the proposed addition will add $320,000 to fixed costs each year.

(a) Explain why the existing $310,000 of fixed costs is a sunk cost while the $320,000 of fixed costs associated with the proposed addition is an out-of-pocket cost.

(b) Calculate by how much the proposed addition will either increase or reduce operating income.

(Essay)

4.8/5  (30)

(30)

A decision to discontinue a given product on the basis of contribution margin data should include consideration of the probable impact of the discontinuance on the sales of other products.

(True/False)

4.8/5  (35)

(35)

Limited resources

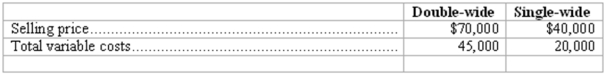

Portable Enterprises produces two lines of mobile homes: double-wide and single-wide. Unit cost and revenue data pertaining to each product are shown below:

Each double-wide home requires 350 different labor hours and 125 machine hours. Each single-wide home requires 175 direct labor hours and 150 machine hours. Demand for each line of homes far exceeds the company's total production capacity.

(a) If Portable's production capacity is constrained by limited direct labor hours, which line of homes should it produce? ___________________ (b) If Portable's total production capacity is constrained by machine hours, which line of homes should it produce? ____________________ Computations

Each double-wide home requires 350 different labor hours and 125 machine hours. Each single-wide home requires 175 direct labor hours and 150 machine hours. Demand for each line of homes far exceeds the company's total production capacity.

(a) If Portable's production capacity is constrained by limited direct labor hours, which line of homes should it produce? ___________________ (b) If Portable's total production capacity is constrained by machine hours, which line of homes should it produce? ____________________ Computations

(Essay)

4.9/5  (41)

(41)

By choosing to go into business for himself, Jim Lazar foregoes the possibility of getting a highly paid job with a large company. This is called a(n):

(Multiple Choice)

4.9/5  (35)

(35)

Using an incremental analysis approach, Burns should consider accepting this special order only if the price per unit offered by Allen is at least:

(Multiple Choice)

4.8/5  (38)

(38)

In deciding whether to rework the tables or sell them as is, management should:

(Multiple Choice)

4.9/5  (45)

(45)

ILF makes 2,000 waterproof mattresses annually to be used in one of its products. The unit cost of the mattresses includes variable costs of $45 and fixed costs of $30. If the mattresses were purchased from an outside supplier, 60% of the fixed costs could be eliminated. Buying mattresses from an outside supplier at a price of $50 each would cause ILF's operating income to:

(Multiple Choice)

4.8/5  (33)

(33)

Assume that Phoenix decides to accept the special order at a unit sales price that will add $400,000 per month to its operating income. The unit price of the special order will be:

(Multiple Choice)

4.8/5  (42)

(42)

Even though costs, revenues, and other factors do not vary among possible courses of action, they may be relevant to a decision.

(True/False)

4.8/5  (38)

(38)

Showing 41 - 60 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)