Exam 20: Master Budgets and Performance Planning

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

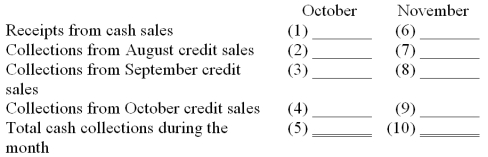

Rich Company's experience shows that 20% of its sales are for cash and 80% are on credit. An analysis of credit sales shows that 50% are collected in the month following the sale, 45% are collected in the second month, and 5% prove to be uncollectible. Calculate items (1) through (10) below:

August September October November Sales \ 500,000 \ 525,000 \ 535,000 \ 560,000

(Essay)

4.8/5  (32)

(32)

Stritch Company is trying to decide how many units of merchandise to order each month. The company's policy is to have 20% of the next month's sales in inventory at the end of each month. Projected sales for August, September, and October are 30,000 units, 20,000 units, and 40,000 units, respectively. How many units must be purchased in September?

(Multiple Choice)

4.8/5  (37)

(37)

Big Company manufactures keyboards. Management wishes to develop budgets for the upcoming quarter based on the following data:

Sales in units 800 units Selling price per unit \ 60 Inventory at beginning of the quarter () 80 units Desired ending inventory () 130 units Direct Materials per unit: 4 ounces plastic Plastic Inventory at beginning of quarter 136 ounces Desired ending inventory of plastic 84 ounces Plastic Cost \ .18 per ounce

Compute the budgeted quantity of plastic which needs to be purchased for the next quarter.

(Multiple Choice)

4.9/5  (32)

(32)

Next year's sales forecast shows that 20,000 units of Product A and 22,000 units of Product B are going to be sold for prices of $10 and $12, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2,500 units. The desired ending inventory of B is 3,000 units.

-Budgeted purchases of Product A for the year would be:

(Multiple Choice)

4.9/5  (31)

(31)

Budget preparation is best determined in a top-down managerial approach.

(True/False)

4.9/5  (45)

(45)

A June sales forecast projects that 6,000 units are going to be sold at a price of $10.50 per unit. The desired ending inventory of units is 15% higher than the beginning inventory of 1,000 units. Merchandise purchases for June are projected to include how many units?

(Multiple Choice)

4.8/5  (35)

(35)

The master budget process nearly always begins with the preparation of the ___________________ and usually finishes with the preparation of the ______________________, the ________________, and the ______________________.

(Essay)

4.7/5  (37)

(37)

Larger, more complex organizations usually require a longer time to prepare their budgets than smaller organizations because of the considerable effort to coordinate the different units within the business.

(True/False)

4.7/5  (40)

(40)

Part of the cash budget is based on information drawn from the capital expenditures budget.

(True/False)

4.8/5  (34)

(34)

Merchandising companies prepare the production budget after preparing the sales budget.

(True/False)

4.9/5  (31)

(31)

Kyoto, Inc. predicts the following sales in units for the coming four months:

April May June July Sales in units 240 280 300 240

Although each month's ending inventory of finished units should be 60% of the next month's sales, the March 31 finished goods inventory is only 100 units. A finished unit requires five pounds of raw material B. The March 31 raw materials inventory has 200 pounds of B. Each month's ending inventory of raw materials should be 30% of the following month's production needs.

-The budgeted purchases of pounds of raw material B during May should be:

(Multiple Choice)

4.7/5  (40)

(40)

The usual starting point for preparing a master budget is forecasting or estimating:

(Multiple Choice)

4.9/5  (42)

(42)

The master budget is a small component of the comprehensive budget.

(True/False)

4.9/5  (34)

(34)

To determine the production budget for an accounting period, consideration is not given to which of the following:

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following statements about budgeting is false?

(Multiple Choice)

4.8/5  (41)

(41)

Kabuki Company's policy is to have 16% of the next month's sales as desired ending inventory. Estimated sales are shown in the table below. Given this data, what is Kabuki's estimated purchases for April?

March April May Expected Sales Units 9,400 8,900 7,300

(Multiple Choice)

4.8/5  (41)

(41)

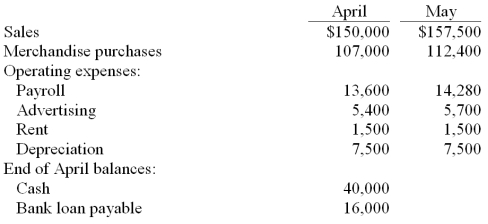

Sweeny Co. is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:  Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $40,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Required: Calculate the following items for May

(a) Cash collections from customers.

(b) Cash payments made for merchandise purchases.

(c) Cash paid for other operating expenses, including interest.

(d) What is the preliminary cash balance for May 31?

(e) What loan activity will take place at the end of May?

(f) What is the ending cash balance?

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $40,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Required: Calculate the following items for May

(a) Cash collections from customers.

(b) Cash payments made for merchandise purchases.

(c) Cash paid for other operating expenses, including interest.

(d) What is the preliminary cash balance for May 31?

(e) What loan activity will take place at the end of May?

(f) What is the ending cash balance?

(Essay)

4.8/5  (32)

(32)

A Company is preparing a cash budget for June. The company has $67,000 cash at the beginning of June and anticipates $82,330 in cash receipts and $93,520 in cash disbursements during June. This company has an agreement with its bank to maintain a cash balance of at least $65,000. As of May 31, the company owes $25,000 to the bank. To maintain the $65,000 required balance, during June the company must:

(Multiple Choice)

4.9/5  (42)

(42)

A plan showing the units of goods to be sold and the revenue to be derived from sales, that is the usual starting point in the budgeting process, is called the:

(Multiple Choice)

4.7/5  (38)

(38)

Kyoto, Inc. predicts the following sales in units for the coming four months:

April May June July Sales in units 240 280 300 240

Although each month's ending inventory of finished units should be 60% of the next month's sales, the March 31 finished goods inventory is only 100 units. A finished unit requires five pounds of raw material B. The March 31 raw materials inventory has 200 pounds of B. Each month's ending inventory of raw materials should be 30% of the following month's production needs.

-If each unit of Kyoto's product takes two hours to produce and the labor rate is expected to be $10 per hour, what is the budgeted labor cost for May?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 21 - 40 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)