Exam 20: Master Budgets and Performance Planning

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

Kyoto, Inc. predicts the following sales in units for the coming four months:

April May June July Sales in units 240 280 300 240

Although each month's ending inventory of finished units should be 60% of the next month's sales, the March 31 finished goods inventory is only 100 units. A finished unit requires five pounds of raw material B. The March 31 raw materials inventory has 200 pounds of B. Each month's ending inventory of raw materials should be 30% of the following month's production needs.

-Kyoto's budgeted production for the second quarter is:

(Multiple Choice)

4.8/5  (36)

(36)

Bentels Co. desires a December 31 ending inventory of 2,840 units. Budgeted sales for December are 4,000 units. The November 30 inventory was 1,800 units. Budgeted purchases are:

(Multiple Choice)

4.7/5  (38)

(38)

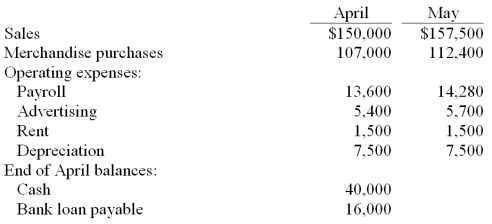

Sweeny Co. is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:  Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $40,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $40,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

(Essay)

4.8/5  (35)

(35)

A company's gross profit rate is 30% of sales. Expected January sales are $78,000 and desired January 31st inventory is $7,500. Assuming the December 31st inventory is $6,200 what amount of purchases should this company budget for the month of January?

(Multiple Choice)

4.9/5  (40)

(40)

If budgeted beginning inventory is $8,300, budgeted ending inventory is $9,400, and cost of goods sold is expected to be $10,260, then budgeted purchases should be $9,160.

(True/False)

4.9/5  (28)

(28)

The Lamb Company budgeted sales for January, February, and March of $96,000, $88,000, and $72,000, respectively. Seventy percent of sales are on credit. The company collects 60% of its credit sales in the month following sale, 35% in the second month following sale, and 5% is not collected. What are Lamb's expected cash receipts for March related to all current and past sales?

(Essay)

5.0/5  (23)

(23)

When preparing the cash budget, all the following should be considered except:

(Multiple Choice)

4.8/5  (34)

(34)

Miles Company is preparing a cash budget for February. The company has $30,000 cash at the beginning of February and anticipates $75,000 in cash receipts and $96,250 in cash disbursements during February. Miles Company has an agreement with its bank to maintain a cash balance of $10,000. What amount, if any, must the company borrow during February to maintain a $10,000 cash balance?

(Essay)

4.9/5  (36)

(36)

Budgets are normally more effective when all levels of management are involved in the budgeting process.

(True/False)

4.8/5  (34)

(34)

The set of periodic budgets that are prepared and periodically revised in the practice of continuous budgeting is called:

(Multiple Choice)

4.8/5  (38)

(38)

Next year's sales forecast shows that 20,000 units of Product A and 22,000 units of Product B are going to be sold for prices of $10 and $12, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2,500 units. The desired ending inventory of B is 3,000 units.

-Budgeted purchases of Product B for the year would be:

(Multiple Choice)

4.8/5  (39)

(39)

The purchases budget depends on information provided by the sales budget.

(True/False)

4.9/5  (43)

(43)

Julia's Candy Co. reports the following information from its sales account and sales budget:

Sales May \ 105,000 June 93,000 Expected July \ 90,000 Sales: August 110,000 September 120,000

Cash sales are normally 25% of total sales and all credit sales are expected to be collected in the month following the date of sale.

-Based on the information from Julia's, the total amount of cash expected to be received from customers in September is:

(Multiple Choice)

4.8/5  (39)

(39)

Julia's Candy Co. reports the following information from its sales account and sales budget:

Sales May \ 105,000 June 93,000 Expected July \ 90,000 Sales: August 110,000 September 120,000

Cash sales are normally 25% of total sales and all credit sales are expected to be collected in the month following the date of sale.

-If Julia's pays sales commission of 10% each month, in addition to fixed costs of $4,000, calculate the selling expenses for the third quarter.

(Multiple Choice)

4.9/5  (37)

(37)

Kyoto, Inc. predicts the following sales in units for the coming four months:

April May June July Sales in units 240 280 300 240

Although each month's ending inventory of finished units should be 60% of the next month's sales, the March 31 finished goods inventory is only 100 units. A finished unit requires five pounds of raw material B. The March 31 raw materials inventory has 200 pounds of B. Each month's ending inventory of raw materials should be 30% of the following month's production needs.

-Kyoto's budgeted production for May is:

(Multiple Choice)

4.8/5  (38)

(38)

The financial budgets include the cash budget and the capital expenditures budget.

(True/False)

4.9/5  (43)

(43)

Showing 101 - 120 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)