Exam 20: Master Budgets and Performance Planning

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

A plan that shows the expected cash inflows and cash outflows during the budget period, including receipts from loans needed to maintain a minimum cash balance and repayments of such loans, is called a(n):

(Multiple Choice)

4.8/5  (40)

(40)

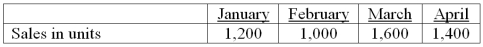

Tappet Corporation is preparing its master budget for the quarter ending March 31. It sells a single product for $25 a unit. Budget sales are 40% cash and 60% on credit. All credit sales are collected in the month following the sales. Budgeted sales for the next four months follow:

At December 31, the balance in accounts receivable is $10,000, which represents the uncollected portion of December sales. The company desires merchandise inventory equal to 30% of the next month's sales in units. The December 31 balance of merchandise inventory is 340 units, and inventory cost is $10 per unit. Forty percent of the purchases are paid in the month of purchase and 60% are paid in the following month. At December 31, the balance of Accounts Payable is $8,000, which represents the unpaid portion of December's purchases. Operating expenses are paid in the month incurred and consist of:

Sales commissions (10% of sales)

Freight (2% of sales)

Office salaries ($2,400 per month)

Rent ($4,800 per month)

Depreciation expense is $4,000 per month.

The income tax rate is 40%, and income taxes will be paid on April 1. A minimum cash balance of $10,000 is required, and the cash balance at December 31 is $10,200. Loans are obtained at the end of a month in which a cash shortage occurs. Interest is 1% per month, based on the beginning of the month loan balance, and must be paid each month. If an excess of cash exists, loan repayments are made at the end of the month. At December 31, the loan balance is $0.

Prepare a master budget (round all dollar amounts to the nearest whole dollar) for each of the months of January, February, and March that includes the:

Sales budget

Table of cash receipts

Merchandise purchases budget

Table of cash disbursements for merchandise purchases

Table of cash disbursements for selling and administrative expenses

Cash budget, including information on the loan balance

Budgeted income statement

At December 31, the balance in accounts receivable is $10,000, which represents the uncollected portion of December sales. The company desires merchandise inventory equal to 30% of the next month's sales in units. The December 31 balance of merchandise inventory is 340 units, and inventory cost is $10 per unit. Forty percent of the purchases are paid in the month of purchase and 60% are paid in the following month. At December 31, the balance of Accounts Payable is $8,000, which represents the unpaid portion of December's purchases. Operating expenses are paid in the month incurred and consist of:

Sales commissions (10% of sales)

Freight (2% of sales)

Office salaries ($2,400 per month)

Rent ($4,800 per month)

Depreciation expense is $4,000 per month.

The income tax rate is 40%, and income taxes will be paid on April 1. A minimum cash balance of $10,000 is required, and the cash balance at December 31 is $10,200. Loans are obtained at the end of a month in which a cash shortage occurs. Interest is 1% per month, based on the beginning of the month loan balance, and must be paid each month. If an excess of cash exists, loan repayments are made at the end of the month. At December 31, the loan balance is $0.

Prepare a master budget (round all dollar amounts to the nearest whole dollar) for each of the months of January, February, and March that includes the:

Sales budget

Table of cash receipts

Merchandise purchases budget

Table of cash disbursements for merchandise purchases

Table of cash disbursements for selling and administrative expenses

Cash budget, including information on the loan balance

Budgeted income statement

(Essay)

4.9/5  (42)

(42)

A plan that states the number of units to be manufactured during each future period covered by the budget, based on the budgeted sales for the period and the levels of inventory needed to support future sales, is the:

(Multiple Choice)

4.9/5  (32)

(32)

The process of evaluating performance can be improved by using budgets.

(True/False)

4.8/5  (29)

(29)

Traditional budgeting is generally better than activity-based budgeting when attempting to reduce costs by eliminating nonvalue-added activities.

(True/False)

4.8/5  (35)

(35)

The budget that lists the dollar amounts to be both received from plant asset disposals and spent to purchase additional plant assets to carry out the budgeted business activities is the __________________________.

(Short Answer)

4.8/5  (35)

(35)

The budget process is usually administered by a _____________________.

(Short Answer)

4.9/5  (34)

(34)

In preparing a budgeted balance sheet, the amount for Accounts Receivable is primarily determined from:

(Multiple Choice)

4.9/5  (34)

(34)

A department store has budgeted cost of goods sold for August of $60,000 for its women's coats. Management wants to have $12,000 of coats in inventory at the end of the month to prepare for the winter season. Beginning inventory in August was $8,000. What dollar amount of coats should be purchased to meet the above plans?

(Essay)

4.7/5  (26)

(26)

The financial budgets of a business include the cash budget, the budgeted income statement, and the budgeted balance sheet.

(True/False)

4.7/5  (32)

(32)

Nano, Inc. is preparing its budget for the second quarter. The following sales data have been forecasted: April May June July August Sales in units 640 720 780 620 660

Additional information follows:

Inventory on March 31: 192 units Desired ending inventory each month: 30\% of next month's sales

How many units should be purchased in April, May, and June? How many units should be purchased in the second quarter in total?

(Essay)

4.9/5  (36)

(36)

Which of the following would not be used in preparing a cash budget for October?

(Multiple Choice)

4.9/5  (40)

(40)

Fairway's April sales forecast projects that 6,000 units will sell at a price of $10.50 per unit. The desired ending inventory is 30% higher than the beginning inventory, which was 1,000 units. Budgeted purchases of units in April would be:

(Multiple Choice)

4.8/5  (40)

(40)

The budgeted balance sheet is prepared with data contained in the previously prepared components of the master budget.

(True/False)

4.8/5  (37)

(37)

Long-term liability data for the budgeted balance sheet is derived from:

(Multiple Choice)

4.8/5  (42)

(42)

The merchandise purchases budget is the starting point for preparing the master budget.

(True/False)

4.9/5  (41)

(41)

The __________________________ shows expected cash inflows and outflows during the budget period.

(Short Answer)

4.8/5  (39)

(39)

Next year's sales forecast shows that 20,000 units of Product A and 22,000 units of Product B are going to be sold for prices of $10 and $12, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2,500 units. The desired ending inventory of B is 3,000 units.

-Total budgeted sales of both products for the year would be:

(Multiple Choice)

4.8/5  (27)

(27)

A rolling budget is a specific budget application relevant only to a merchandising company.

(True/False)

4.9/5  (38)

(38)

Showing 121 - 140 of 158

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)