Exam 7: Accounts and Notes Receivable

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

60 million for year 2011. The company estimates that 2% of sales will be uncollectible. On December 31, 2011, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $13,164. Corona prepares a schedule of its December 31, 2011, accounts receivable by age. Based on past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here:

December 31,2011 Age of Accounts Expected Percent Accounts Receivable Receivable Uncollectible \ 720,000 Not yet due 1.05\% 252,000 1 to 30 days past due 1.80 49,600 31 to 60 days past due 6.30 14,100 61 to 90 days past due 31.75 2,850 Over 90 days past due 66.00

Assuming the company used the percent of sales method determine the amount that should be recorded for Bad Debt Expense on December 31, 2011.

(Short Answer)

4.7/5  (34)

(34)

Acme Company has an agreement with a major credit card company which calls for cash to be received immediately upon deposit of Acme customers' credit card sales receipts. The credit card company receives 3.5% of card sales as its fee. If Acme has $2,000 in credit card sales, which of the following statements are true?

(Multiple Choice)

4.9/5  (32)

(32)

The following information is from the annual financial statements of Nancy Company.

2010 2009 2008 Net Sales \ 307,000 \ 238,000 \ 285,000 Accounts Receivable, net (year-end) 47,900 45,700 42,400

What is the accounts receivable turnover ratio for 2009?

(Multiple Choice)

4.9/5  (35)

(35)

Corona Company has credit sales of $4.60 million for year 2011. The company estimates that 1.42% of accounts receivable will be uncollectible. On December 31, 2011, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $13,164. Corona prepares a schedule of its December 31, 2011, accounts receivable by age. Based on past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here:

December 31,2011 Age of Accounts Expected Percent Accounts Receivable Receivable Uncollectible \ 720,000 Not yet due 1.05\% 252,000 1 to 30 days past due 1.80 49,600 31 to 60 days past due 6.30 14,100 61 to 90 days past due 31.75 2,850 Over 90 days past due 66.00

Assuming the company uses the percent of accounts receivable method, determine the amount that should be recorded for Bad Debt Expense on December 31, 2011.

(Short Answer)

4.9/5  (39)

(39)

Companies follow both the matching principle and the materiality principle when applying the direct write-off method.

(True/False)

4.9/5  (31)

(31)

A company had an accounts receivable turnover ratio of 8 and net sales of $600,000 for a given period. What was the average accounts receivable amount for this period?

(Multiple Choice)

4.8/5  (27)

(27)

Receivables can be used to obtain cash by either selling them or using them as security for a loan.

(True/False)

4.8/5  (30)

(30)

The ________________________ methods use balance sheet relationships to estimate bad debts-mainly the relation between accounts receivable and the allowance amount.

(Short Answer)

4.7/5  (40)

(40)

Welles Company uses the direct write-off method of accounting for uncollectible accounts receivable. On December 6, 2010, Welles sold $6,300 of merchandise to the Fleming Company. On August 8, 2011, after numerous attempts to collect the account, Welles determined that the $6,300 account of the Fleming Company was uncollectible.

A. Prepare the general journal entries required to record the transactions on August 8, 2011

B. Assuming that the $6,300 is material, explain how the direct write-off method violates the matching principle in this case

(Essay)

4.9/5  (37)

(37)

The percent of sales method for estimating bad debts assumes that a given percent of a company's credit sales for the period are uncollectible.

(True/False)

4.8/5  (33)

(33)

Under the allowance method of accounting for uncollectible accounts receivable, no estimate is made to predict bad debts expense.

(True/False)

4.8/5  (37)

(37)

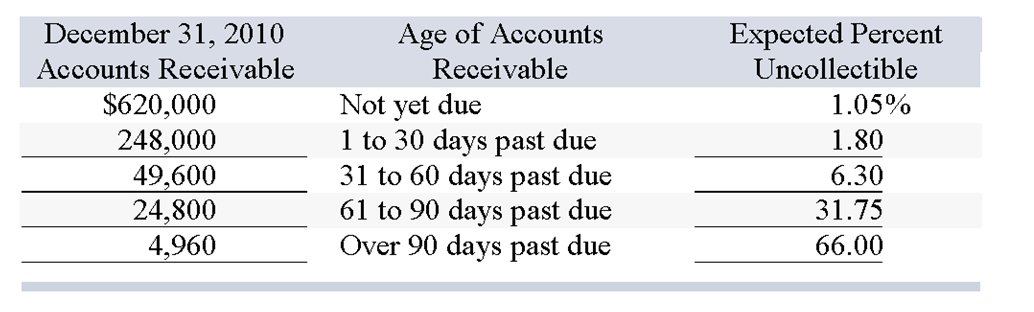

Temper Company has credit sales of $3.10 million for year 2010. Temper estimates that 2% of accounts receivable will remain uncollectible. Historically, .9% of sales have been uncollectible. On December 31, 2010, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $2,575. Temper prepares a schedule of its December 31, 2010, accounts receivable by age. Based on past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here:

Assuming the company uses the percent of accounts receivable method, what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

Assuming the company uses the percent of accounts receivable method, what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

(Multiple Choice)

4.8/5  (35)

(35)

The aging method of determining bad debts expense is based on the knowledge that the longer a receivable is past due, the lower the likelihood of collection.

(True/False)

4.8/5  (37)

(37)

Credit sales are recorded by crediting an account receivable for the specific customer who is making the purchase.

(True/False)

4.8/5  (37)

(37)

Chiller Company has credit sales of $5.60 million for year 2010. Chiller estimates that 1.32% of the credit sales will not be collected. Historically, 4% of outstanding accounts receivable is uncollectible. On December 31, 2010, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $3,561. Chiller prepares a schedule of its December 31, 2010, accounts receivable by age. Based on past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here:

December 31,2010 Age of Accounts Expected Percent Accounts Receivable Receivable Uncollectible \ 1,095,000 Not yet due 0.85\% 322,550 1 to 30 days past due 1.42 84,700 31 to 60 days past due 7.60 50,420 61 to 90 days past due 42.50 12,500 Over 90 days past due 81.00

Assuming the company uses the aging of accounts receivable method, what is the amount that Chiller will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

(Multiple Choice)

4.9/5  (27)

(27)

Describe how accounts receivable arise and how they are accounted for, including the use of a subsidiary ledger and an allowance account.

(Essay)

4.7/5  (39)

(39)

The quality of receivables refers to the likelihood of collection without loss.

(True/False)

4.8/5  (41)

(41)

The process of using accounts receivable as security for a loan is known as factoring accounts receivable.

(True/False)

4.9/5  (38)

(38)

Showing 61 - 80 of 163

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)