Exam 7: Accounts and Notes Receivable

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

A company had an accounts receivable turnover ratio of 12 and net sales of $744,000 for a given period. What was the average amount of accounts receivables for this period?

(Multiple Choice)

4.8/5  (46)

(46)

Writing off an uncollectible account receivable when the allowance method of accounting for uncollectible accounts is used, a company should debit _______________________ and credit accounts receivable.

(Short Answer)

4.8/5  (44)

(44)

Prepare general journal entries for the following transactions of Viking Company, assuming they use the allowance method to account for uncollectible accounts.

(Essay)

4.7/5  (39)

(39)

Hasbro had net sales of $7,875 and its average accounts receivables is $1,350. Calculate Hasbro's accounts receivable turnover:

(Short Answer)

4.9/5  (37)

(37)

The accounting principle that requires financial statements (including notes) to report all relevant information about the operations and financial condition of a company is called:

(Multiple Choice)

4.9/5  (40)

(40)

The ________________ method of accounting for bad debts records the loss from an uncollectible account receivable at the time it is determined to be uncollectible (and not before).

(Short Answer)

5.0/5  (37)

(37)

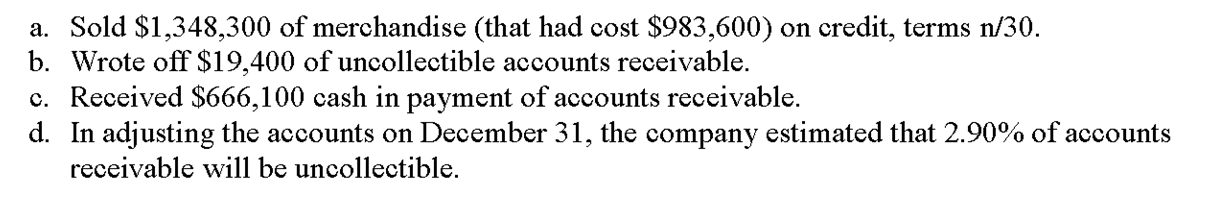

Vine Company began operations on January 1, 2010. During its first year, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows:

What is the amount required for the adjusting journal entry to record bad debt expense?

What is the amount required for the adjusting journal entry to record bad debt expense?

(Multiple Choice)

4.8/5  (44)

(44)

The percent of accounts receivable method for bad debts estimation uses only income statement account balances to estimate bad debts.

(True/False)

4.9/5  (38)

(38)

A company receives a 6.2%, 60-day note for $9,650. The total amount of cash due on the maturity date is:

(Multiple Choice)

4.8/5  (34)

(34)

The percent of sales method of estimating bad debts is focused more on realizable value of accounts receivable than matching.

(True/False)

4.8/5  (26)

(26)

Cairo Co. uses the allowance method of accounting for uncollectible accounts. Cairo Co. accepted a $5,000, 12%, 90-day note dated May 16, from Alexandria Co. as in exchange for its past-due account receivable. Make the necessary general journal entries for Cairo Co. on May 16 and the August 14 maturity date, assuming that the:

a. Note is held until maturity and collected in full at that time

b. Note is dishonored; the amount of the note and its interest are written off as uncollectible

(Essay)

4.9/5  (47)

(47)

On October 29 of the current year, a company concluded that a customer's $4,400 account receivable was uncollectible and that the account should be written off. What effect will this write-off have on this company's net income and total assets assuming the allowance method is used to account for bad debts?

(Multiple Choice)

4.7/5  (33)

(33)

A company ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $15,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a debit balance of $175. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

(Multiple Choice)

4.8/5  (38)

(38)

Tecom had net sales of $315,000 and average accounts receivable of $75,600. Its competitor, ZCom, had net sales of $299,000 and average accounts receivables of $81,350. Calculate the accounts receivable turnover for both companies. Which company is doing a better job of managing its accounts receivables?

(Essay)

4.9/5  (36)

(36)

A company has net sales of $870,000 and average accounts receivable of $174,000. What is its accounts receivable turnover for the period?

(Multiple Choice)

4.9/5  (46)

(46)

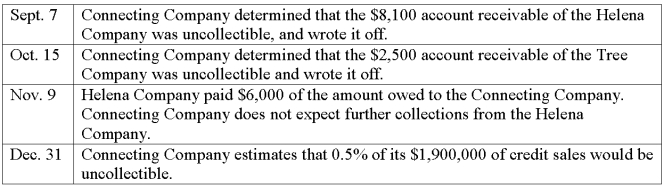

The Connecting Company uses the percent of sales method of accounting for uncollectible accounts receivable. During the current year, the following transactions occurred:

1. Prepare the general journal entries to record these transactions.

If the balance of the allowance for uncollectible accounts was an $8,000 credit on January 1 of the current year, determine the balance of the allowance for doubtful accounts at December 31 of the current year. Assume that the transactions above are the only transactions affecting the allowance for doubtful accounts during the year.

1. Prepare the general journal entries to record these transactions.

If the balance of the allowance for uncollectible accounts was an $8,000 credit on January 1 of the current year, determine the balance of the allowance for doubtful accounts at December 31 of the current year. Assume that the transactions above are the only transactions affecting the allowance for doubtful accounts during the year.

(Essay)

4.9/5  (37)

(37)

On November 15, 2010, Betty Corporation accepted a note receivable in place of an outstanding accounts receivable in the amount of $138,460. The note is due in 90 days and has an interest rate of 7.5%. What would be the amount required for the December 31, 2010 adjusting journal entry?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 81 - 100 of 163

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)