Exam 4: Process Costing and Hybrid Product-Costing Systems

Exam 1: The Changing Role of Managerial Accounting in a Dynamic Business Environment62 Questions

Exam 2: Basic Cost Management Concepts85 Questions

Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment80 Questions

Exam 4: Process Costing and Hybrid Product-Costing Systems84 Questions

Exam 5: Activity-Based Costing and Management85 Questions

Exam 6: Activity Analysis, Cost Behavior, and Cost Estimation93 Questions

Exam 7: Cost-Volume-Profit Analysis89 Questions

Exam 8: Variable Costing and the Costs of Quality and Sustainability64 Questions

Exam 9: Financial Planning and Analysis: the Master Budget95 Questions

Exam 10: Standard Costing and Analysis of Direct Costs80 Questions

Exam 11: Flexible Budgeting and Analysis of Overhead Costs91 Questions

Exam 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard72 Questions

Exam 13: Investment Centers and Transfer Pricing95 Questions

Exam 14: Decision Making: Relevant Costs and Benefits90 Questions

Exam 15: Target Costing and Cost Analysis for Pricing Decisions99 Questions

Exam 16: Capital Expenditure Decisions104 Questions

Exam 17: Allocation of Support Activity Costs and Joint Costs81 Questions

Exam 18: The Sarbanes-Oxley Act, Internal Controls, and Management Accounting14 Questions

Exam 19: Compound Interest and the Concept of Present Value24 Questions

Exam 20: Inventory Management14 Questions

Select questions type

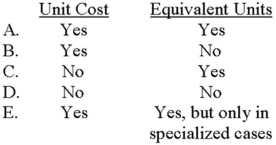

Which of the following are needed under weighted-average process costing to calculate the cost of goods completed during the period?

(Multiple Choice)

4.8/5  (35)

(35)

Agora Company uses a process-cost system for its single product. Material A is added at the beginning of the process; in contrast, material B is added when the units are 75% complete. The firm's ending work-in-process inventory consists of 6,000 units that are 80% complete. Which of the following correctly expresses the equivalent units of production with respect to materials A and B in the ending work-in-process inventory?

(Multiple Choice)

4.7/5  (38)

(38)

Lester Corporation had 8,200 units of work in process on November 1. During November, 26,800 units were started and as of November 30, 7,900 units remained in production. How many units were completed during November?

(Multiple Choice)

4.9/5  (41)

(41)

Chen Corporation, a new company, adds material at the beginning of its production process; conversion cost, in contrast, is incurred evenly throughout manufacturing. During May, the firm completed 15,000 units and had ending work in process of 2,000 units, 60% complete. Equivalent-unit costs were: materials, $15; conversion, $22.

The cost of Chen's completed production is:

(Multiple Choice)

4.9/5  (39)

(39)

Chen Corporation, a new company, adds material at the beginning of its production process; conversion cost, in contrast, is incurred evenly throughout manufacturing. During May, the firm completed 15,000 units and had ending work in process of 2,000 units, 60% complete. Equivalent-unit costs were: materials, $15; conversion, $22.

The cost of the company's ending work-in-process inventory is:

(Multiple Choice)

4.9/5  (36)

(36)

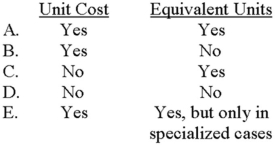

Which of the following are needed to calculate the total cost of the ending work-in-process inventory under the weighted-average process-costing method?

(Multiple Choice)

4.8/5  (34)

(34)

All of the following statements about an operation-costing system are true except:

(Multiple Choice)

5.0/5  (38)

(38)

On May 1, Dawdle Company had a work-in-process inventory of 10,000 units. The units were 100% complete for material and 30% complete for conversion, with respective costs of $30,000 and $1,850.

During the month, 150,000 units were completed and transferred to finished goods. The May 31 ending work-in-process inventory consisted of 10,000 units that were 100% complete with respect to materials and 80% complete with respect to conversion.

Costs added during the month were $330,000 for materials and $503,750 for conversion.

Required:

Using the weighted-average method, calculate:

A. total equivalent units for material and conversion.

B. the cost per equivalent unit for material and conversion.

C. the cost transferred to finished goods.

D. the cost of ending work in process.

(Essay)

4.7/5  (38)

(38)

Fedora, Inc., uses a weighted-average process-costing system and has one production department. All materials are introduced at the start of manufacturing; in contrast, conversion cost is incurred uniformly throughout production. The company had respective work-in-process inventories on May 1 and May 31 of 62,000 units and 70,000 units, the latter of which was 40% complete. The production supervisor noted that Federal completed 100,000 units during the month.

Costs in the May 1 work-in-process inventory were subdivided as follows: materials, $40,000; conversion, $90,000. During May, Fedora charged production with $300,000 of material and $710,000 of conversion, resulting in a material cost per equivalent unit of $2.

Required:

A. Determine the number of units that Fedora started during May.

B. Compute the number of equivalent units with respect to conversion cost.

C. Determine the conversion cost per equivalent unit.

D. Compute the cost of the May 31 work-in-process inventory.

E. What account would have been credited to record Fedora's completed production?

(Essay)

4.8/5  (35)

(35)

When calculating unit costs under the weighted-average process-costing method, the unit cost is based on:

(Multiple Choice)

4.8/5  (39)

(39)

Process costing would likely be used in all of the following industries except:

(Multiple Choice)

4.8/5  (36)

(36)

EnviroSmart Chemical Company refines a variety of petrochemical products. The following data pertain to the firm's Baton Rouge plant: Work in process, August 1: 100,000 gallons Direct material 100\% complete Conversion 25\% complete Units started into production 1,375,000 gallons Work in process, August 31: 120,000 gallons Direct material 100\% complete Conversion 80\% complete

Required:

Compute the equivalent units of direct materials and conversion for August.

(Essay)

4.9/5  (39)

(39)

CFF, Inc. overstated the percentage of work completed with respect to conversion cost on the ending work-in-process inventory. This overstatement caused conversion-cost equivalent units to be overstated.

(True/False)

4.9/5  (49)

(49)

Which of the following is a key document in a typical process-costing system?

(Multiple Choice)

4.8/5  (36)

(36)

Yes! Co., had 3,000 units of work in process on April 1 that were 60% complete. During April, 11,000 units were started and as of April 30, 4,000 units that were 40% complete remained in production. How many units were completed during April?

(Multiple Choice)

4.9/5  (42)

(42)

Southern Lake Chemical manufactures a product called Zubek. Direct materials are added at the beginning of the process, and conversion activity occurs uniformly throughout production. The beginning work-in-process inventory is 60% complete with respect to conversion; the ending work-in-process inventory is 20% complete. The following data pertain to May: Units Work in process, May 1 15,000 Units started during May 60,000 Units completed and transferred out 68,000 Work in process, May 31 7,000

Direct Conversion Total Materials Costs Work in process, May 1 \ 41,250 \ 16,500 \ 24,750 Costs incurred during May Totals Using the weighted-average method of process costing, the equivalent units of conversion activity total:

(Multiple Choice)

4.9/5  (36)

(36)

Operation costing might be used to determine the cost of all of the following products except:

(Multiple Choice)

4.7/5  (40)

(40)

Universal Manufacturing uses a weighted-average process-costing system. All materials are introduced at the start of manufacturing, and conversion costs are incurred evenly throughout the process. The company's beginning and ending work-in-process inventories totaled 10,000 units and 15,000 units, respectively, with the latter units being 2/3 complete at the end of the period. Universal started 30,000 units into production and completed 25,000 units. Manufacturing costs follow.

Beginning work in process: Materials, $60,000; conversion cost, $150,000

Current costs: Materials, $180,000; conversion cost, $480,000

Universal's equivalent-unit cost for conversion cost is:

(Multiple Choice)

4.9/5  (34)

(34)

Forest Company, which uses a weighted-average process-costing system, had 7,000 units in production at the end of the current period that were 60% complete. Material A is introduced at the beginning of the process; material B is introduced at the end of the process; and conversion cost is introduced evenly throughout manufacturing. Equivalent-unit production costs follow.

Material A: $12.50

Material B: $2.00

Conversion cost: $6.60

The cost of the company's ending work-in-process inventory is:

(Multiple Choice)

4.9/5  (37)

(37)

Showing 41 - 60 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)