Exam 6: Differential Analysis: The Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Cost-Volume-Profit Relationships241 Questions

Exam 3: Job-Order Costing119 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making139 Questions

Exam 6: Differential Analysis: The Key to Decision Making152 Questions

Exam 7: Capital Budgeting Decisions145 Questions

Exam 9: Capital Budgeting Decisions36 Questions

Exam 10: Profit Planning106 Questions

Exam 11: Flexible Budgets and Performance Analysis294 Questions

Exam 12: Standard Costs and Variances179 Questions

Exam 13: Performance Measurement in Decentralized Organizations93 Questions

Exam 14: Managerial Accounting and Cost Concepts22 Questions

Exam 15: Job-Order Costing27 Questions

Exam 16: Activity-Based-Costing: a Tool to Aid Decision Making15 Questions

Exam 17: A Capital Budgeting Decisions12 Questions

Exam 18: Standard Costs and Variances105 Questions

Exam 19: Performance Measurement in Decentralized Organizations21 Questions

Exam 20: Performance Measurement in Decentralized Organizations41 Questions

Exam 21: Profitability Analysis71 Questions

Exam 22: Pricing Products and Services67 Questions

Select questions type

Scherer Corporation is preparing a bid for a special order that would require 720 liters of material U48N. The company already has 560 liters of this raw material in stock that originally cost $6.30 per liter. Material U48N is used in the company's main product and is replenished on a periodic basis. The resale value of the existing stock of the material is $5.80 per liter. New stocks of the material can be readily purchased for $6.65 per liter. What is the relevant cost of the 720 liters of the raw material when deciding how much to bid on the special order?

(Multiple Choice)

4.8/5  (36)

(36)

Rank the products in order of their current profitability from most profitable to least profitable. In other words, rank the products in the order in which they should be emphasized.

(Multiple Choice)

4.8/5  (43)

(43)

At what selling price per unit should Immanuel be indifferent between accepting or rejecting the special offer?

(Multiple Choice)

4.9/5  (42)

(42)

Galluzzo Corporation processes sugar beets in batches. A batch of sugar beets costs $51 to buy from farmers and $14 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $20 or processed further for $18 to make the end product industrial fiber that is sold for $45. The beet juice can be sold as is for $41 or processed further for $21 to make the end product refined sugar that is sold for $62. How much profit (loss) does the company make by processing one batch of sugar beets into the end products industrial fiber and refined sugar?

(Multiple Choice)

4.8/5  (41)

(41)

Cung Inc. has some material that originally cost $68,400. The material has a scrap value of $30,100 as is, but if reworked at a cost of $1,400, it could be sold for $30,800. What would be the incremental effect on the company's overall profit of reworking and selling the material rather than selling it as is as scrap?

(Multiple Choice)

4.8/5  (38)

(38)

Two products, IF and RI, emerge from a joint process. Product IF has been allocated $25,300 of the total joint costs of $46,000. A total of 2,000 units of product IF are produced from the joint process. Product IF can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,000 and then sold for $13 per unit. If product IF is processed further and sold, what would be the effect on the overall profit of the company compared with sale in its unprocessed form directly after the split-off point?

(Multiple Choice)

4.9/5  (43)

(43)

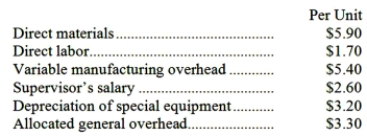

Part N29 is used by Farman Corporation to make one of its products. A total of 11,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make the part and sell it to the company for $21.20 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part N29 could be used to make more of one of the company's other products, generating an additional segment margin of $29,000 per year for that product. What would be the impact on the company's overall net operating income of buying part N29 from the outside supplier?

An outside supplier has offered to make the part and sell it to the company for $21.20 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part N29 could be used to make more of one of the company's other products, generating an additional segment margin of $29,000 per year for that product. What would be the impact on the company's overall net operating income of buying part N29 from the outside supplier?

(Multiple Choice)

4.9/5  (32)

(32)

What would the selling price per unit of product N need to be after further processing in order for Payne Company to be economically indifferent between selling N at the split-off point or processing N further?

(Multiple Choice)

4.9/5  (35)

(35)

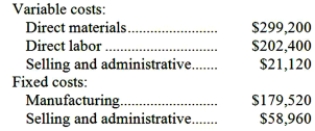

Nowlan Co. manufactures and sells trophies for winners of athletic and other events. Its manufacturing plant has the capacity to produce 11,000 trophies each month; current monthly production is 8,800 trophies. The company normally charges $87 per trophy. Cost data for the current level of production are shown below:  The company has just received a special one-time order for 500 trophies at $50 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

Required:

Should the company accept this special order? Why?

The company has just received a special one-time order for 500 trophies at $50 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

Required:

Should the company accept this special order? Why?

(Essay)

4.8/5  (39)

(39)

A sunk cost is a cost that has already been incurred and that cannot be avoided regardless of what action is chosen.

(True/False)

4.8/5  (33)

(33)

Showing 141 - 152 of 152

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)