Exam 11: The Monetary System

Exam 1: Ten Principles of Economics347 Questions

Exam 2: Thinking Like an Economist528 Questions

Exam 3: Interdependence and the Gains From Trade413 Questions

Exam 4: The Market Forces of Supply and Demand568 Questions

Exam 5: Measuring a Nations Income428 Questions

Exam 6: Measuring the Cost of Living420 Questions

Exam 7: Production and Growth417 Questions

Exam 8: Saving, Investment, and the Financial System473 Questions

Exam 9: The Basic Tools of Finance419 Questions

Exam 10: Unemployment562 Questions

Exam 11: The Monetary System421 Questions

Exam 12: Money Growth and Inflation384 Questions

Exam 13: Open-Economy Macroeconomic Models447 Questions

Exam 14: A Macroeconomic Theory of the Open Economy375 Questions

Exam 15: Aggregate Demand and Aggregate Supply466 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand416 Questions

Exam 17: The Short-Run Trade-Off Between Inflation and Unemployment367 Questions

Exam 18: Six Debates Over Macroeconomic Policy235 Questions

Select questions type

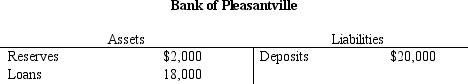

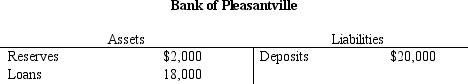

Table 11-5.

-Refer to Table 11-5. Assume there is a reserve requirement and the Bank of Pleasantville is exactly in compliance with that requirement. Assume the same is true for all other banks. Lastly, assume people hold only deposits and no currency. What is the money multiplier?

-Refer to Table 11-5. Assume there is a reserve requirement and the Bank of Pleasantville is exactly in compliance with that requirement. Assume the same is true for all other banks. Lastly, assume people hold only deposits and no currency. What is the money multiplier?

(Multiple Choice)

4.9/5  (38)

(38)

At any meeting of the Federal Open Market Committee, that committee's voting members consist of

(Multiple Choice)

4.8/5  (37)

(37)

Which group within the Federal Reserve System meets to discuss changes in the economy and determine monetary policy?

(Multiple Choice)

4.8/5  (34)

(34)

The "yardstick" people use to post prices and record debts is called

(Multiple Choice)

4.9/5  (39)

(39)

The manager of the bank where you work tells you that the bank has $400 million in deposits and $340 million dollars in loans. The Fed then raises the reserve requirement from 10 percent to 15 percent. Assuming everything else stays the same, how much is the bank holding in excess reserves after the increase in the reserve requirement?

(Multiple Choice)

4.9/5  (40)

(40)

Which tool of monetary policy does the Federal Reserve use most often?

(Multiple Choice)

4.7/5  (44)

(44)

In an economy that relies on barter, trade requires a double-coincidence of wants.

(True/False)

4.8/5  (26)

(26)

U.S. dollars are an example of commodity money and hides used to make trades are an example of fiat money.

(True/False)

4.8/5  (40)

(40)

If a bank that desires to hold no excess reserves and has just enough reserves to meet the required reserve ratio of 10 percent receives a deposit of $400 it has a

(Multiple Choice)

4.8/5  (36)

(36)

The series of bank failures in 1907 occurred despite the creation of the Federal Reserve many years earlier.

(True/False)

5.0/5  (30)

(30)

Table 11-5.

-Refer to Table 11-5. If the Fed's reserve requirement is 9 percent, then what quantity of excess reserves does the Bank of Pleasantville now hold?

-Refer to Table 11-5. If the Fed's reserve requirement is 9 percent, then what quantity of excess reserves does the Bank of Pleasantville now hold?

(Multiple Choice)

4.8/5  (40)

(40)

If the reserve ratio is 10 percent, banks do not hold excess reserves, people hold only deposits and no currency, then when the Fed sells $10 million worth of bonds to the public, bank reserves

(Multiple Choice)

4.9/5  (37)

(37)

At any given time, the voting members of the Federal Open Market Committee include

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following increase when the Fed makes open market purchases?

(Multiple Choice)

4.9/5  (29)

(29)

If the reserve ratio is 4 percent, then $81,250 of new money can be generated by

(Multiple Choice)

4.8/5  (35)

(35)

Showing 281 - 300 of 421

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)