Exam 11: The Monetary System

Exam 1: Ten Principles of Economics347 Questions

Exam 2: Thinking Like an Economist528 Questions

Exam 3: Interdependence and the Gains From Trade413 Questions

Exam 4: The Market Forces of Supply and Demand568 Questions

Exam 5: Measuring a Nations Income428 Questions

Exam 6: Measuring the Cost of Living420 Questions

Exam 7: Production and Growth417 Questions

Exam 8: Saving, Investment, and the Financial System473 Questions

Exam 9: The Basic Tools of Finance419 Questions

Exam 10: Unemployment562 Questions

Exam 11: The Monetary System421 Questions

Exam 12: Money Growth and Inflation384 Questions

Exam 13: Open-Economy Macroeconomic Models447 Questions

Exam 14: A Macroeconomic Theory of the Open Economy375 Questions

Exam 15: Aggregate Demand and Aggregate Supply466 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand416 Questions

Exam 17: The Short-Run Trade-Off Between Inflation and Unemployment367 Questions

Exam 18: Six Debates Over Macroeconomic Policy235 Questions

Select questions type

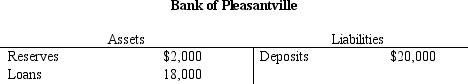

Table 11-5.

-Refer to Table 11-5. Assume the Fed's reserve requirement is 9 percent and all banks besides the Bank of Pleasantville are exactly in compliance with the 9 percent requirement. Further assume that people hold only deposits and no currency. Starting from the situation as depicted by the T-account, if the Bank of Pleasantville decides to make new loans so as to end up with no excess reserves, then by how much does the money supply eventually increase?

-Refer to Table 11-5. Assume the Fed's reserve requirement is 9 percent and all banks besides the Bank of Pleasantville are exactly in compliance with the 9 percent requirement. Further assume that people hold only deposits and no currency. Starting from the situation as depicted by the T-account, if the Bank of Pleasantville decides to make new loans so as to end up with no excess reserves, then by how much does the money supply eventually increase?

(Multiple Choice)

4.7/5  (29)

(29)

The manager of the bank where you work tells you that your bank has $10 million in excess reserves. She also tells you that the bank has $400 million in deposits and $355 million dollars in loans. Given this information you find that the reserve requirement must be

(Multiple Choice)

4.8/5  (35)

(35)

Table 11-5.

-Refer to Table 11-5. The Bank of Pleasantville's reserve ratio is

-Refer to Table 11-5. The Bank of Pleasantville's reserve ratio is

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following does the U.S. president appoint and the U.S. Senate confirm?

(Multiple Choice)

4.8/5  (39)

(39)

The manager of the bank where you work tells you that your bank has $5 million in excess reserves. She also tells you that the bank has $300 million in deposits and $255 million dollars in loans. Given this information you find that the reserve requirement must be

(Multiple Choice)

4.8/5  (37)

(37)

If the Fed buys bonds in the open market, the money supply decreases.

(True/False)

4.9/5  (40)

(40)

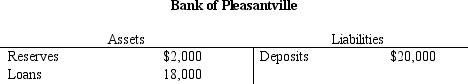

Refer to

Value Values of Assets

-Refer to Value of Assets. What is the value of M1 in billions of dollars?

-Refer to Value of Assets. What is the value of M1 in billions of dollars?

(Multiple Choice)

5.0/5  (42)

(42)

If the reserve ratio is 5 percent, then $1,000 of additional reserves can create up to

(Multiple Choice)

4.9/5  (30)

(30)

Sandra routinely uses currency to purchase her groceries. She is using money as a medium of exchange.

(True/False)

5.0/5  (39)

(39)

When the Fed purchases $200 worth of government bonds from the public, the U.S. money supply eventually increases by

(Multiple Choice)

4.9/5  (34)

(34)

The Fed can decrease the money supply by conducting open-market

(Multiple Choice)

4.9/5  (34)

(34)

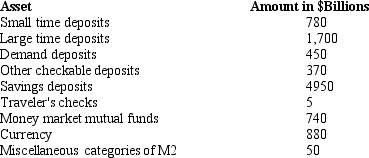

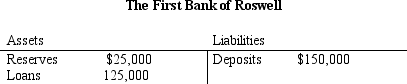

Table 11-4.

-Refer to Table 11-4. If the bank faces a reserve requirement of 10 percent, then the bank

-Refer to Table 11-4. If the bank faces a reserve requirement of 10 percent, then the bank

(Multiple Choice)

4.9/5  (42)

(42)

Scenario 11-2.

The Monetary Policy of Tazi is controlled by the country's central bank known as the Bank of Tazi. The local unit of currency is the taz. Aggregate banking statistics show that collectively the banks of Tazi hold 300 million tazes of required reserves, 75 million tazes of excess reserves, have issued 7,500 million tazes of deposits, and hold 225 million tazes of Tazian Treasury bonds. Tazians prefer to use only demand deposits and so all money is on deposit at the bank.

-Refer to Scenario 11-2. Suppose that the Bank of Tazi changes the reserve requirement to 3 percent. Assuming that the banks still want to hold the same percentage of excess reserves what is the value of the money supply after the change in the reserve requirement?

(Multiple Choice)

4.8/5  (42)

(42)

Other things the same, if reserve requirements are increased, the reserve ratio

(Multiple Choice)

4.9/5  (40)

(40)

You use U.S. currency to pay the owner of a restaurant for a delicious meal. The currency

(Multiple Choice)

4.9/5  (39)

(39)

Showing 361 - 380 of 421

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)