Exam 16: How Well Am I Doing Financial Statement Analysis

Exam 1: Managerial Accounting and the Business Environment25 Questions

Exam 2: Managerial Accounting and Cost Concepts148 Questions

Exam 3: Systems Design: Job-Order Costing163 Questions

Exam 4: Systems Design: Process Costing106 Questions

Exam 5: Cost Behavior Analysis and Use119 Questions

Exam 6: Cost-Volume-Profit Relationship213 Questions

Exam 7: Variable Costing: a Tool for Management136 Questions

Exam 8: Activity Based Costing: a Tool to Aid Decision-Making77 Questions

Exam 9: Profit Planning144 Questions

Exam 10: Flexible Budgets and Performance Analysis294 Questions

Exam 11: Standard Costs and Operating Performance Measures163 Questions

Exam 12: Segment Reporting, Decentralization, and the Balanced Scorecard99 Questions

Exam 13: Relevant Costs for Decision Making131 Questions

Exam 14: Capital Budgeting Decisions138 Questions

Exam 15: How Well Am I Doing Statement of Cash Flows103 Questions

Exam 16: How Well Am I Doing Financial Statement Analysis207 Questions

Exam 17: Pricing Products and Services61 Questions

Exam 18: Profitability Analysis72 Questions

Exam 19: Further Classification of Labor Costs18 Questions

Exam 20: Cost of Quality24 Questions

Exam 21: the Predetermined Overhead Rate and Capacity25 Questions

Exam 22: Fifo Method72 Questions

Exam 23: Service Department Allocations51 Questions

Exam 24: Least-Squares Regression Computations14 Questions

Exam 25: Abc Action Analysis14 Questions

Exam 26: Using a Modified Form of Activity-Based Costing to17 Questions

Exam 27: Predetermined Overhead Rates and Overhead Analysis88 Questions

Exam 28: Journal Entries to Record Variances46 Questions

Exam 29: Transfer Pricing20 Questions

Exam 30: Service Department Charges34 Questions

Exam 31: The Concept of Present Value14 Questions

Exam 32: Income Taxes in Capital Budgeting Decisions33 Questions

Exam 33: The Direct Method of Determining the Net Cash Provided by42 Questions

Select questions type

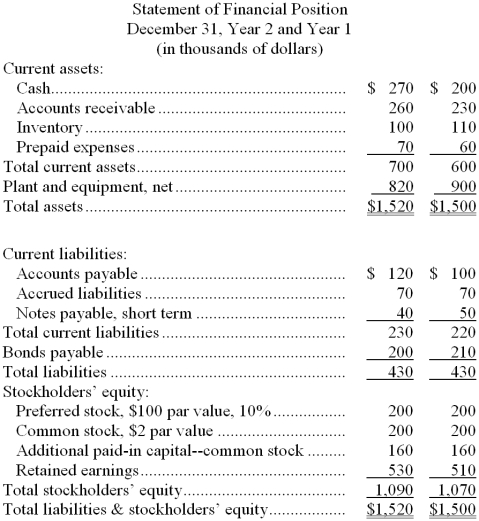

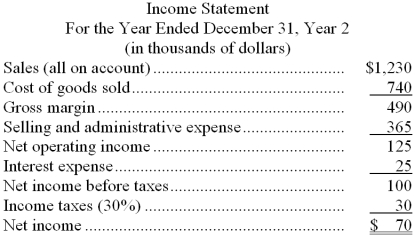

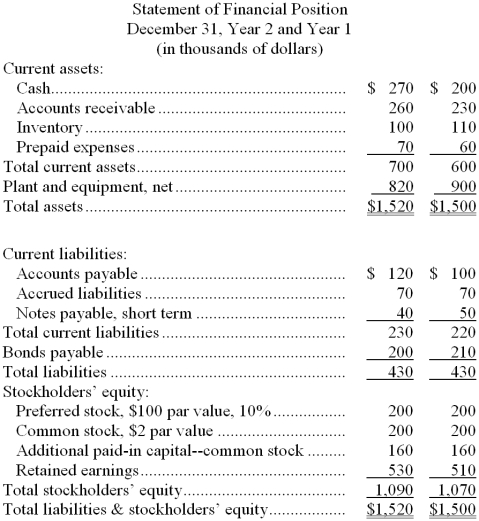

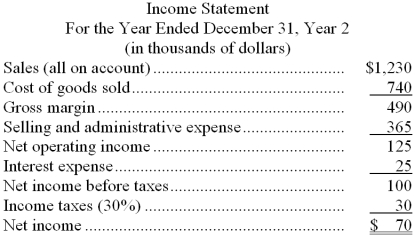

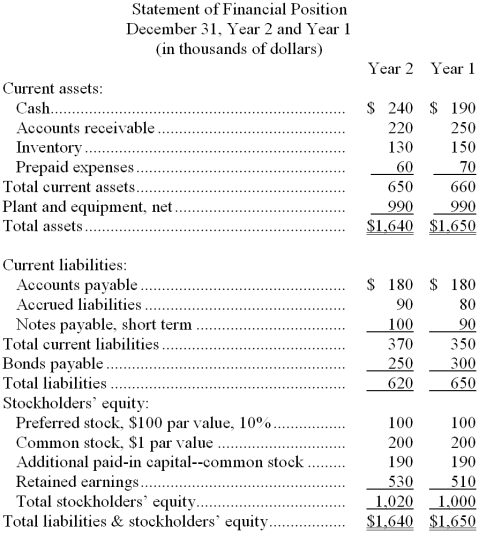

Dadisman Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $30 thousand. Dividends on preferred stock totaled $20 thousand. The market price of common stock at the end of Year 2 was $6.75 per share.

-The dividend payout ratio for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $30 thousand. Dividends on preferred stock totaled $20 thousand. The market price of common stock at the end of Year 2 was $6.75 per share.

-The dividend payout ratio for Year 2 is closest to:

(Multiple Choice)

4.9/5  (27)

(27)

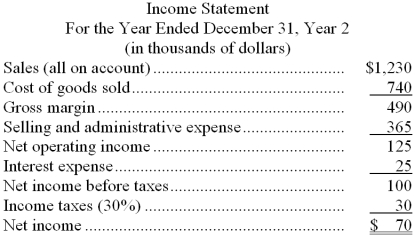

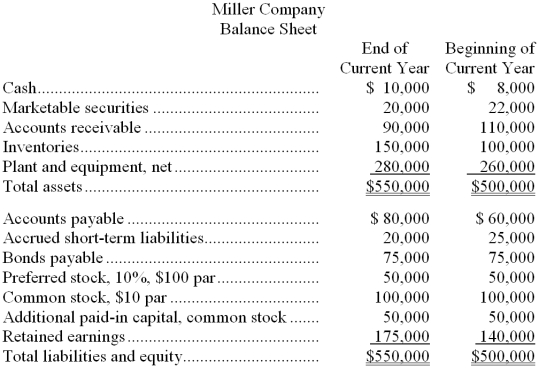

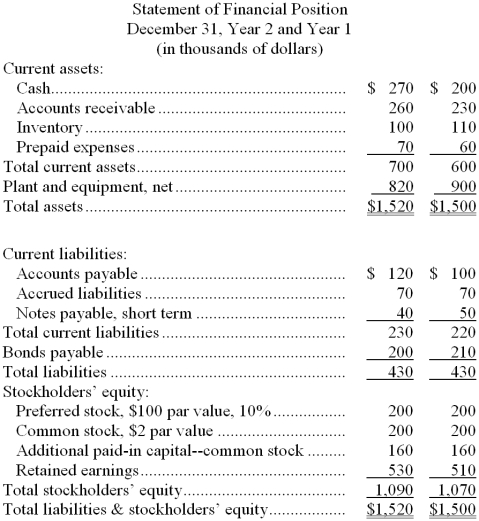

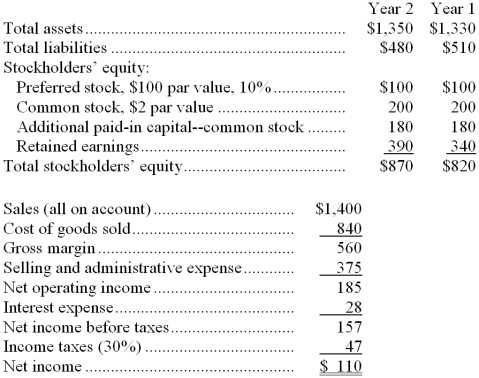

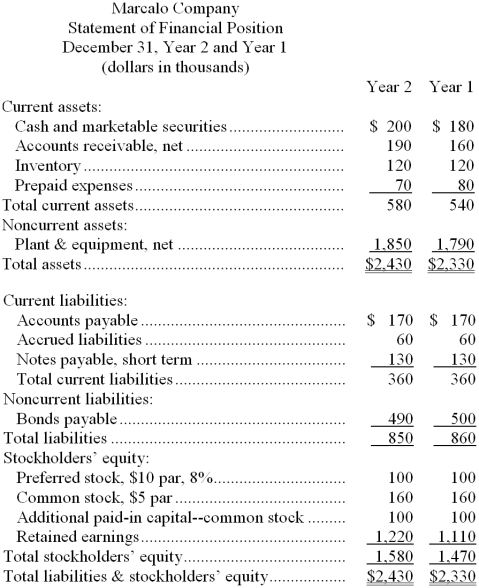

Condensed financial statements of Miller Company at the beginning and at the end of the current year are given below:

The company paid total dividends of $15,000 during the year, of which $5,000 were to preferred stockholders. The market price of a share of common stock at the end of the year was $30.

Required:

On the basis of the information given above, fill in the blanks with the appropriate figures.

Example: The current ratio at the end of the current year would be computed by dividing $270,000 by $100,000

a. The acid-test ratio at the end of the current year would be computed by dividing _______________ by _________________.

b. The inventory turnover for the year would be computed by dividing _______________ by _________________.

c. The debt-to-equity ratio at the end of the current year would be computed by dividing _______________ by _________________.

d. The earnings per share of common stock would be computed by dividing _______________ by _________________.

e. The accounts receivable turnover for the year would be computed by dividing _______________ by _________________.

f. The times interest earned for the year would be computed by dividing _______________ by _________________.

g. The return on common stockholders' equity for the year would be computed by dividing _______________ by _________________.

h. The dividend yield would be computed by dividing _______________ by _________________.

The company paid total dividends of $15,000 during the year, of which $5,000 were to preferred stockholders. The market price of a share of common stock at the end of the year was $30.

Required:

On the basis of the information given above, fill in the blanks with the appropriate figures.

Example: The current ratio at the end of the current year would be computed by dividing $270,000 by $100,000

a. The acid-test ratio at the end of the current year would be computed by dividing _______________ by _________________.

b. The inventory turnover for the year would be computed by dividing _______________ by _________________.

c. The debt-to-equity ratio at the end of the current year would be computed by dividing _______________ by _________________.

d. The earnings per share of common stock would be computed by dividing _______________ by _________________.

e. The accounts receivable turnover for the year would be computed by dividing _______________ by _________________.

f. The times interest earned for the year would be computed by dividing _______________ by _________________.

g. The return on common stockholders' equity for the year would be computed by dividing _______________ by _________________.

h. The dividend yield would be computed by dividing _______________ by _________________.

(Essay)

4.8/5  (35)

(35)

Naser Corporation's total current assets are $390,000, its noncurrent assets are $500,000, its total current liabilities are $330,000, its long-term liabilities are $370,000, and its stockholders' equity is $190,000. Working capital is:

(Multiple Choice)

4.8/5  (39)

(39)

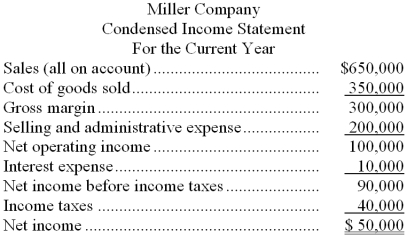

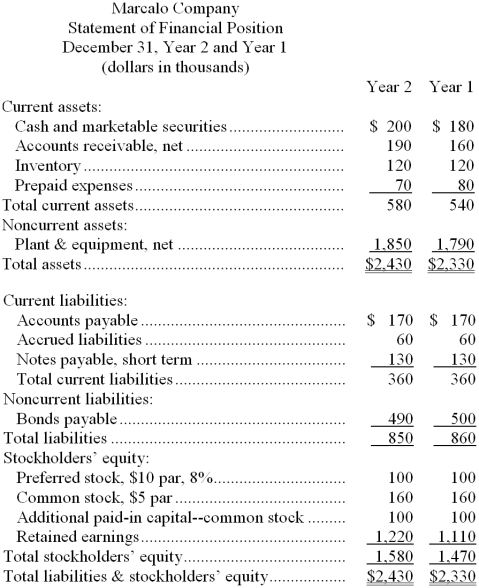

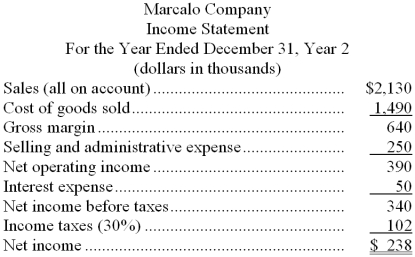

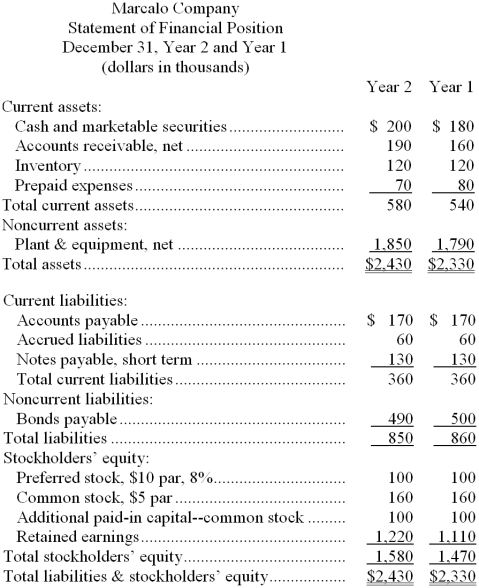

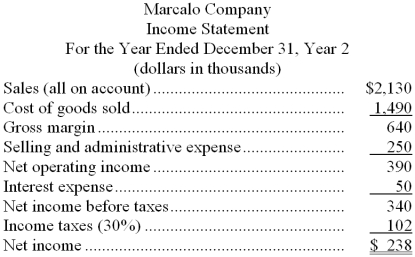

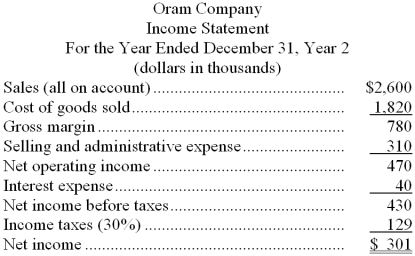

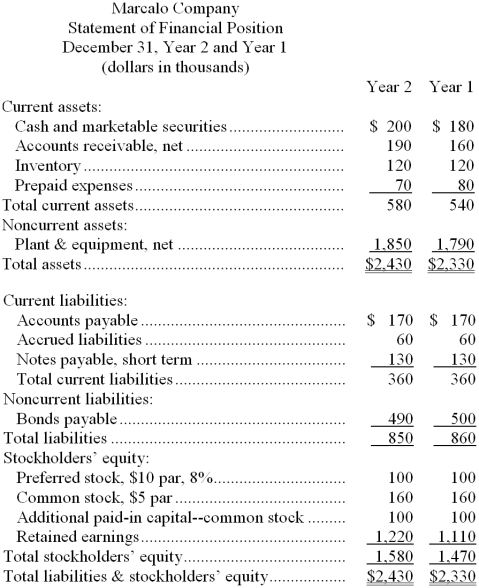

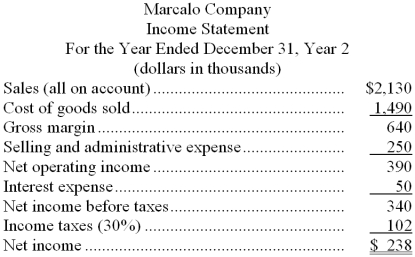

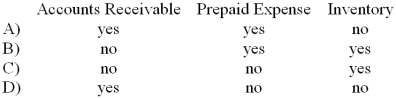

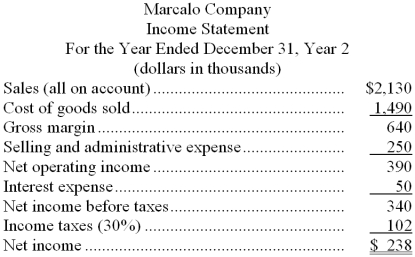

Financial statements for Marcalo Company appear below:

-Marcalo Company's accounts receivable turnover for Year 2 was closest to:

-Marcalo Company's accounts receivable turnover for Year 2 was closest to:

(Multiple Choice)

4.9/5  (36)

(36)

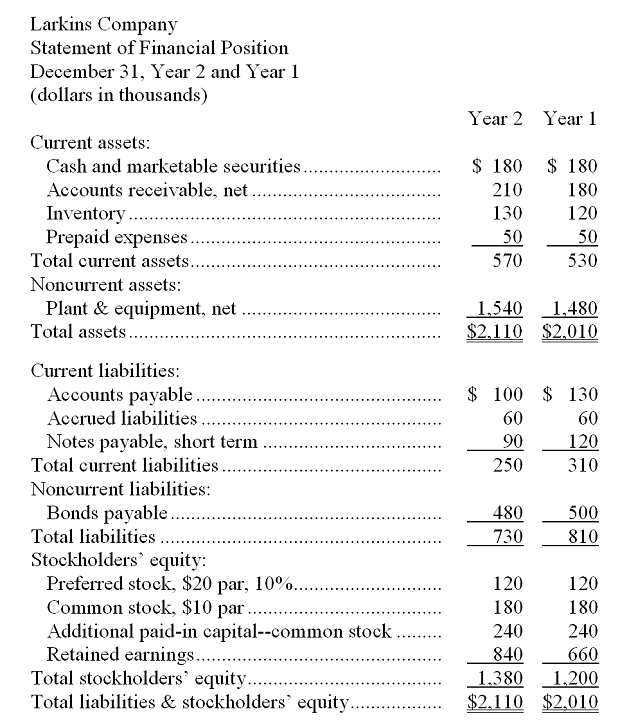

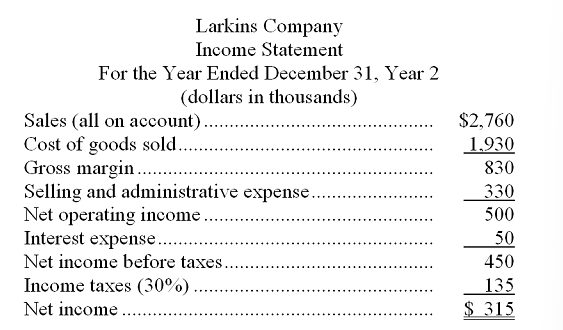

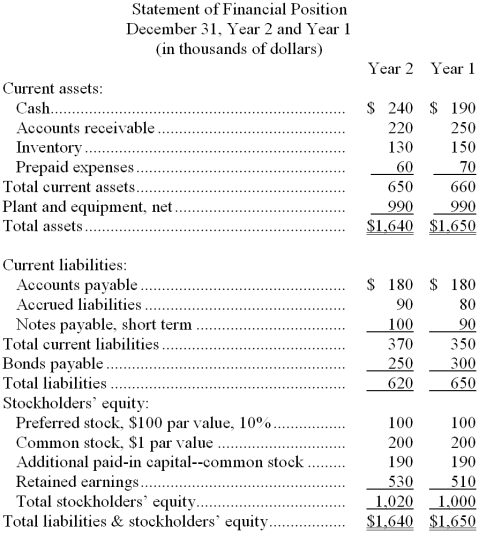

Financial statements for Larkins Company appear below:

Dividends during Year 2 totaled $135 thousand, of which $12 thousand were preferred dividends. The market price of a share of common stock on December 31, Year 2 was $150.

-Larkins Company's dividend payout ratio for Year 2 was closest to:

Dividends during Year 2 totaled $135 thousand, of which $12 thousand were preferred dividends. The market price of a share of common stock on December 31, Year 2 was $150.

-Larkins Company's dividend payout ratio for Year 2 was closest to:

(Multiple Choice)

4.8/5  (43)

(43)

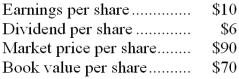

The following data have been taken from your company's financial records for the current year:  The price-earnings ratio is:

The price-earnings ratio is:

(Multiple Choice)

4.8/5  (42)

(42)

Financial statements for Marcalo Company appear below:

-Marcalo Company's average sale period for Year 2 was closest to:

-Marcalo Company's average sale period for Year 2 was closest to:

(Multiple Choice)

4.8/5  (30)

(30)

Dadisman Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $30 thousand. Dividends on preferred stock totaled $20 thousand. The market price of common stock at the end of Year 2 was $6.75 per share.

-The dividend yield ratio for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $30 thousand. Dividends on preferred stock totaled $20 thousand. The market price of common stock at the end of Year 2 was $6.75 per share.

-The dividend yield ratio for Year 2 is closest to:

(Multiple Choice)

4.8/5  (47)

(47)

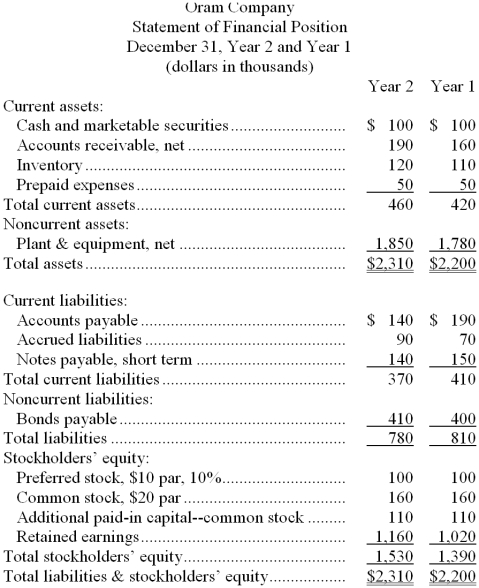

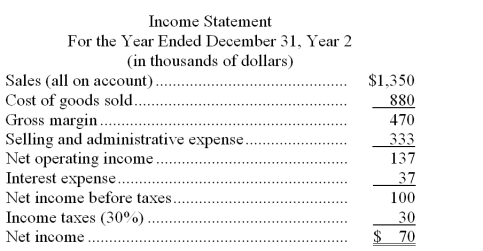

Financial statements for Oram Company appear below:

Dividends during Year 2 totaled $161 thousand, of which $10 thousand were preferred dividends. The market price of a share of common stock on December 31, Year 2 was $610.

-Oram Company's average sale period for Year 2 was closest to:

Dividends during Year 2 totaled $161 thousand, of which $10 thousand were preferred dividends. The market price of a share of common stock on December 31, Year 2 was $610.

-Oram Company's average sale period for Year 2 was closest to:

(Multiple Choice)

4.9/5  (38)

(38)

Financial statements for Marcalo Company appear below:

-Marcalo Company's inventory turnover for Year 2 was closest to:

-Marcalo Company's inventory turnover for Year 2 was closest to:

(Multiple Choice)

4.9/5  (31)

(31)

Lesmerises Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $40 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $2.85 per share.

-The average sale period for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $40 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $2.85 per share.

-The average sale period for Year 2 is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

Excerpts from Stys Corporation's most recent balance sheet and income statement appear below:  Dividends on common stock during Year 2 totaled $50 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $8.20 per share.

-The book value per share at the end of Year 2 is closest to:

Dividends on common stock during Year 2 totaled $50 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $8.20 per share.

-The book value per share at the end of Year 2 is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Wernett Corporation's net income for the most recent year was $1,509,000. A total of 200,000 shares of common stock and 100,000 shares of preferred stock were outstanding throughout the year. Dividends on common stock were $4.95 per share and dividends on preferred stock were $1.35 per share. The earnings per share of common stock is closest to:

(Multiple Choice)

4.9/5  (43)

(43)

Kramer Company has total assets of $180,000 and total liabilities of $60,000. The company's debt-to-equity ratio is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

Dadisman Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $30 thousand. Dividends on preferred stock totaled $20 thousand. The market price of common stock at the end of Year 2 was $6.75 per share.

-The return on total assets for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $30 thousand. Dividends on preferred stock totaled $20 thousand. The market price of common stock at the end of Year 2 was $6.75 per share.

-The return on total assets for Year 2 is closest to:

(Multiple Choice)

4.8/5  (43)

(43)

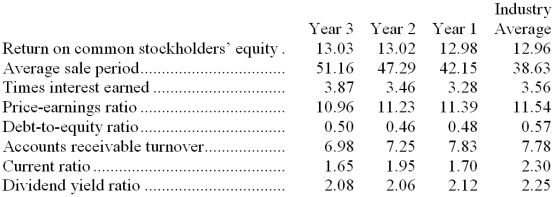

Shelzo Inc., a manufacturer of construction equipment is considering the purchase of one of its suppliers, Raritron Industries. The purchase has been given preliminary approval by Shelzo's Board of Directors, and several discussions have taken place between the management of both companies. Raritron has submitted financial data for the past several years. Shelzo's controller has analyzed Raritron's financial statements and prepared the following ratio analysis comparing Raritron's performance with the industry averages.  Required:

Using the information provided above for Raritron Industries:

a. 1. Identify the two ratios from the above list that would be of most interest to short-term creditors.

Explain what these two ratios measure.

What do these two ratios indicate about Shelzo Inc.?

b. 1. Identify the three ratios from the above list that would be of most interest to stockholders.

Explain what these three ratios measure.

What do these three ratios indicate about Shelzo Inc.?

c. 1. Identify the two ratios from the above list that would be of most interest to long-term creditors.

Explain what these two ratios measure.

What do these two ratios indicate about Shelzo Inc.?

Required:

Using the information provided above for Raritron Industries:

a. 1. Identify the two ratios from the above list that would be of most interest to short-term creditors.

Explain what these two ratios measure.

What do these two ratios indicate about Shelzo Inc.?

b. 1. Identify the three ratios from the above list that would be of most interest to stockholders.

Explain what these three ratios measure.

What do these three ratios indicate about Shelzo Inc.?

c. 1. Identify the two ratios from the above list that would be of most interest to long-term creditors.

Explain what these two ratios measure.

What do these two ratios indicate about Shelzo Inc.?

(Essay)

4.8/5  (43)

(43)

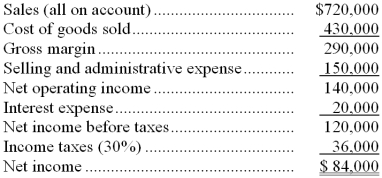

Petrosino Corporation's most recent income statement appears below:  The beginning balance of total assets was $760,000 and the ending balance was $710,000.

Required:

Compute the return on total assets. Show your work!

The beginning balance of total assets was $760,000 and the ending balance was $710,000.

Required:

Compute the return on total assets. Show your work!

(Essay)

4.7/5  (35)

(35)

Lesmerises Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $40 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $2.85 per share.

-The acid-test ratio at the end of Year 2 is closest to:

Dividends on common stock during Year 2 totaled $40 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $2.85 per share.

-The acid-test ratio at the end of Year 2 is closest to:

(Multiple Choice)

4.9/5  (46)

(46)

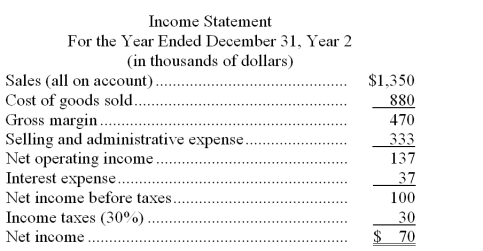

Which of the following accounts would be included in the calculation of the acid-test ratio?

(Multiple Choice)

4.9/5  (33)

(33)

Financial statements for Marcalo Company appear below:

-Marcalo Company's working capital (in thousands of dollars) at the end of Year 2 was closest to:

-Marcalo Company's working capital (in thousands of dollars) at the end of Year 2 was closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 61 - 80 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)