Exam 11: The Monetary System

Exam 1: Ten Principles of Economics439 Questions

Exam 2: Thinking Like an Economist615 Questions

Exam 3: Interdependence and the Gains From Trade527 Questions

Exam 4: The Market Forces of Supply and Demand697 Questions

Exam 5: Measuring a Nations Income518 Questions

Exam 6: Measuring the Cost of Living543 Questions

Exam 7: Production and Growth507 Questions

Exam 8: Saving, Investment, and the Financial System565 Questions

Exam 9: The Basic Tools of Finance510 Questions

Exam 10: Unemployment and Its Natural Rate698 Questions

Exam 11: The Monetary System517 Questions

Exam 12: Money Growth and Inflation484 Questions

Exam 13: Open-Economy Macroeconomics: Basic Concepts520 Questions

Exam 14: A Macroeconomic Theory of the Open Economy478 Questions

Exam 15: Aggregate Demand and Aggregate Supply563 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand510 Questions

Exam 17: The Short-Run Tradeoff Between Inflation and Unemployment516 Questions

Exam 18: Six Debates Over Macroeconomic Policy372 Questions

Select questions type

Suppose that in a country people gain more confidence in the banking system and so hold relatively less currency and more deposits. As a result, bank reserves will

(Multiple Choice)

4.9/5  (37)

(37)

If an economy uses silver as money, then that economy's money

(Multiple Choice)

4.8/5  (29)

(29)

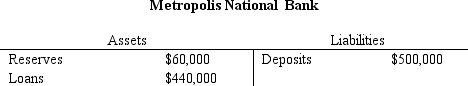

Table 29-9

Metropolis National Bank is currently holding 2% of its deposits as excess reserves.

-Refer to Table 29-9. Metropolis National Bank is currently holding 2% of deposits as excess reserves. Assuming that all banks have the same required reserve ratio, and then none want to hold excess reserves what is the value of the money multiplier?

-Refer to Table 29-9. Metropolis National Bank is currently holding 2% of deposits as excess reserves. Assuming that all banks have the same required reserve ratio, and then none want to hold excess reserves what is the value of the money multiplier?

(Multiple Choice)

4.9/5  (29)

(29)

Federal Reserve governors are given long terms to insulate them from politics.

(True/False)

4.8/5  (30)

(30)

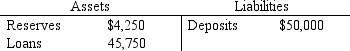

Table 29-3. An economy starts with $50,000 in currency. All of this currency is deposited into a single bank, and the bank then makes loans totaling $45,750. The T-account of the bank is shown below.

-Refer to Table 29-3. If all banks in the economy have the same reserve ratio as this bank, then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

-Refer to Table 29-3. If all banks in the economy have the same reserve ratio as this bank, then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

(Multiple Choice)

4.7/5  (42)

(42)

Marc puts prices on surfboards and skateboards at his sporting goods store. He is using money as a unit of account.

(True/False)

4.9/5  (40)

(40)

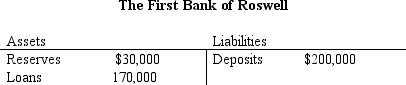

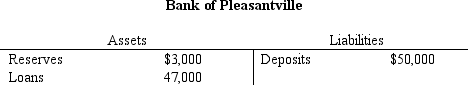

Table 29-5.

-Refer to Table 29-5. If the bank faces a reserve requirement of 20 percent, then it

-Refer to Table 29-5. If the bank faces a reserve requirement of 20 percent, then it

(Multiple Choice)

4.7/5  (42)

(42)

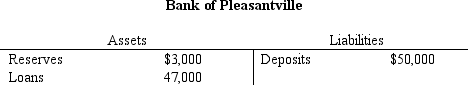

Table 29-6.

-Refer to Table 29-6. Assume the Fed's reserve requirement is 5 percent and all banks besides the Bank of Pleasantville are exactly in compliance with the 5 percent requirement. Further assume that people hold only deposits and no currency. Starting from the situation as depicted by the T-account, if the Bank of Pleasantville decides to make new loans so as to end up with no excess reserves, then by how much does the money supply eventually increase?

-Refer to Table 29-6. Assume the Fed's reserve requirement is 5 percent and all banks besides the Bank of Pleasantville are exactly in compliance with the 5 percent requirement. Further assume that people hold only deposits and no currency. Starting from the situation as depicted by the T-account, if the Bank of Pleasantville decides to make new loans so as to end up with no excess reserves, then by how much does the money supply eventually increase?

(Multiple Choice)

4.9/5  (27)

(27)

Which of the following increase when the Fed makes open market purchases?

(Multiple Choice)

4.9/5  (46)

(46)

Dollar bills, rare paintings, and emerald necklaces are all

(Multiple Choice)

4.7/5  (29)

(29)

The agency responsible for regulating the money supply in the United States is

(Multiple Choice)

5.0/5  (42)

(42)

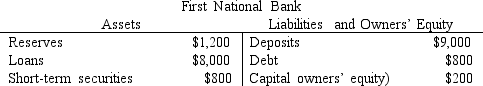

Table 29-8

-Refer to Table 29-8. The required reserve ratio is 12 percent and First National Bank sells $120 of its short-term securities to the Federal Reserve. This action will

-Refer to Table 29-8. The required reserve ratio is 12 percent and First National Bank sells $120 of its short-term securities to the Federal Reserve. This action will

(Multiple Choice)

4.8/5  (49)

(49)

Table 29-6.

-Refer to Table 29-6. Assume there is a reserve requirement and the Bank of Pleasantville is exactly in compliance with that requirement. Assume the same is true for all other banks. Lastly, assume people hold only deposits and no currency. What is the money multiplier?

-Refer to Table 29-6. Assume there is a reserve requirement and the Bank of Pleasantville is exactly in compliance with that requirement. Assume the same is true for all other banks. Lastly, assume people hold only deposits and no currency. What is the money multiplier?

(Multiple Choice)

4.9/5  (32)

(32)

Showing 221 - 240 of 517

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)