Exam 17: An Introduction to Decision Theory

Exam 1: What Is Statistics79 Questions

Exam 2: Describing Data: Frequency Tables, Frequency Distributions, and Graphic Presentation87 Questions

Exam 3: Describing Data: Numerical Measures191 Questions

Exam 4: A Survey of Probability Concepts130 Questions

Exam 5: Discrete Probability Distributions121 Questions

Exam 6: Continuous Probability Distributions143 Questions

Exam 7: Sampling Methods and the Central Limit Theorem78 Questions

Exam 8: Estimation and Confidence Intervals134 Questions

Exam 9: One-Sample Tests of Hypothesis139 Questions

Exam 10: Two-Sample Tests of Hypothesis103 Questions

Exam 11: Analysis of Variance97 Questions

Exam 12: Linear Regression and Correlation166 Questions

Exam 13: Multiple Regression and Correlation Analysis128 Questions

Exam 14: Chi-Square Applications126 Questions

Exam 15: Index Numbers93 Questions

Exam 16: Time Series and Forecasting90 Questions

Exam 17: An Introduction to Decision Theory54 Questions

Select questions type

The alternative which offers the lowest EOL is the same as the one which

(Multiple Choice)

4.9/5  (41)

(41)

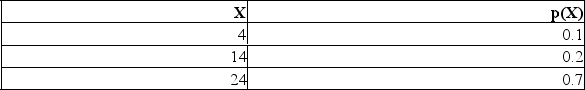

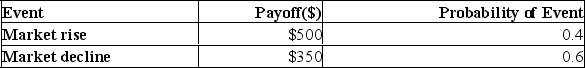

Determine the expected profit for the following distribution.

(Multiple Choice)

4.7/5  (32)

(32)

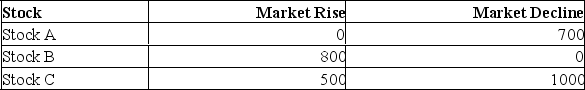

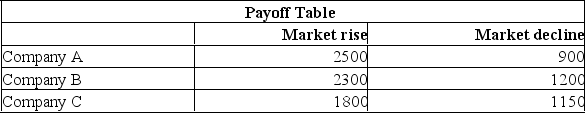

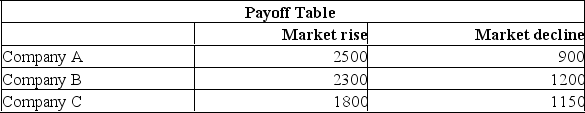

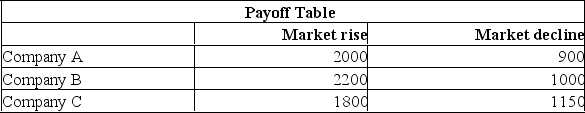

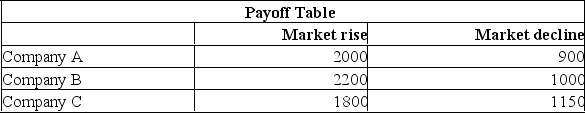

Suppose that the below represents the opportunity loss table for three stocks based on whether the market rises or declines. If there is a 30% chance of the market rising and a 70% chance of it declining, what is the expected opportunity loss for stock C?

(Multiple Choice)

5.0/5  (42)

(42)

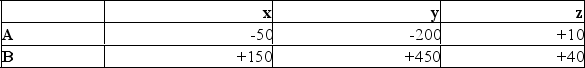

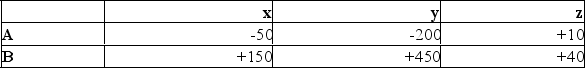

Given the following decision table in which x, y, and z are decision alternatives and A and B are states of nature.  Which alternative would be chosen if using the maximax criterion?

Which alternative would be chosen if using the maximax criterion?

(Multiple Choice)

5.0/5  (39)

(39)

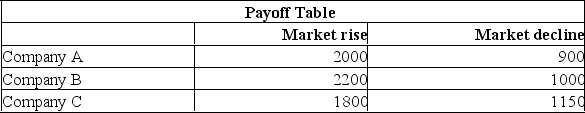

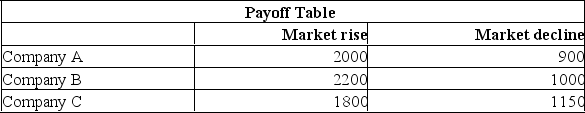

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

(Multiple Choice)

4.8/5  (31)

(31)

i. EVPI = Expected value under conditions of certainty-Optimal decision under conditions of uncertainty.

ii. Three regret strategies that are often used are Maximin, Maximax, and Minimax.

iii. Rankings of the decision alternatives are frequently not highly sensitive to changes in the applied probabilities within a plausible range.

(Multiple Choice)

4.9/5  (37)

(37)

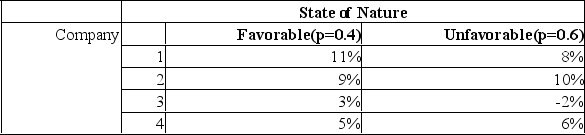

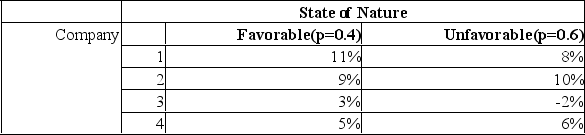

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  What is the expected value for Company 4?

What is the expected value for Company 4?

(Multiple Choice)

4.7/5  (32)

(32)

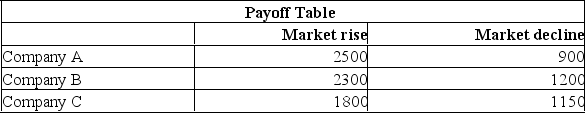

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $50.

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $50.

(Multiple Choice)

4.9/5  (38)

(38)

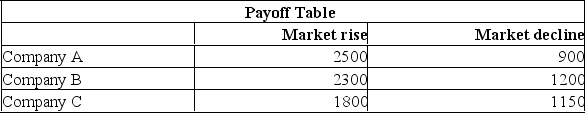

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of stock purchased under conditions of certainty is $120.

iii. The Expected value of stock purchased under conditions of certainty is $440.

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of stock purchased under conditions of certainty is $120.

iii. The Expected value of stock purchased under conditions of certainty is $440.

(Multiple Choice)

4.9/5  (36)

(36)

Determine the expected value for the following payoff table.

(Multiple Choice)

4.8/5  (38)

(38)

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $250.

ii. The Opportunity Loss for Company B is $150.

iii. The Opportunity Loss for Company C is $0.

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $250.

ii. The Opportunity Loss for Company B is $150.

iii. The Opportunity Loss for Company C is $0.

(Multiple Choice)

4.7/5  (24)

(24)

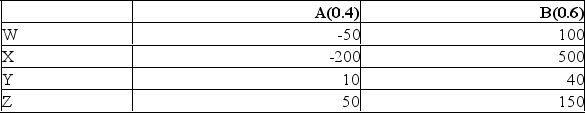

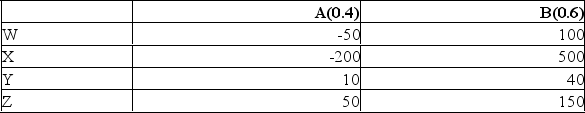

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision W is ___________.

The expected value for decision W is ___________.

(Multiple Choice)

4.8/5  (31)

(31)

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

(Multiple Choice)

4.8/5  (33)

(33)

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $300.

ii. The Expected Opportunity Loss for Company B is $30.

iii. The Expected Opportunity Loss for Company C is $500.

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $300.

ii. The Expected Opportunity Loss for Company B is $30.

iii. The Expected Opportunity Loss for Company C is $500.

(Multiple Choice)

4.9/5  (46)

(46)

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market rises in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $400.

If the market rises in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $400.

(Multiple Choice)

4.8/5  (42)

(42)

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision Z is ___________.

The expected value for decision Z is ___________.

(Multiple Choice)

4.8/5  (34)

(34)

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  What is the expected value for Company 1?

What is the expected value for Company 1?

(Multiple Choice)

4.8/5  (33)

(33)

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $30.

iii. The Opportunity Loss for Company C is $500.

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $30.

iii. The Opportunity Loss for Company C is $500.

(Multiple Choice)

5.0/5  (32)

(32)

Given the following decision table in which x, y, and z are decision alternatives and A and B are states of nature.  Which alternative would be chosen if using the maximin criterion?

Which alternative would be chosen if using the maximin criterion?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 21 - 40 of 54

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)