Exam 6: Inventories and Cost of Sales

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

Net realizable value for damaged or obsolete goods is sales price plus the cost of making the sale.

(True/False)

4.8/5  (32)

(32)

LIFO is preferred when purchase costs are rising and managers have incentives to report higher income for reasons such as bonus plans, job security, and reputation.

(True/False)

4.8/5  (35)

(35)

Some companies choose to avoid assigning incidental costs of acquiring merchandise to inventory by recording them as expenses when incurred. The argument that supports this is called:

(Multiple Choice)

4.8/5  (34)

(34)

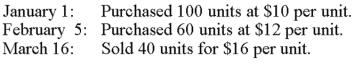

Using the information given below, prepare the general journal entry to record the March 16 sale assuming a cash sale and the LIFO method is used:

(Not Answered)

This question doesn't have any answer yet

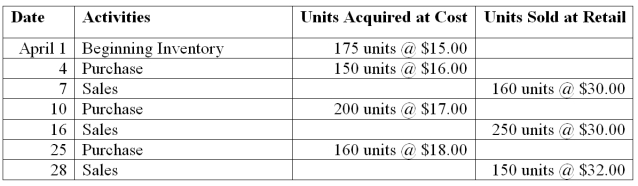

A company reported the current month purchase and sales data for its only product and uses the perpetual inventory system. Determine the cost assigned to ending inventory and cost of goods sold using LIFO.

(Not Answered)

This question doesn't have any answer yet

When units are purchased at different costs over time, determining the cost per unit assigned to inventory items is simple.

(True/False)

4.8/5  (39)

(39)

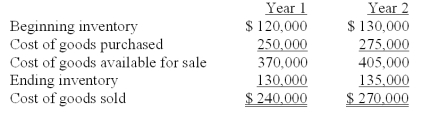

Thelma Company reported cost of goods sold for Year 1 and Year 2 as follows:  Thelma Company made two errors: 1) ending inventory at the end of Year 1 was understated by $15,000 and 2) ending inventory at the end of Year 2 was overstated by $6,000. Given this information, the correct cost of goods sold figure for Year 2 would be:

Thelma Company made two errors: 1) ending inventory at the end of Year 1 was understated by $15,000 and 2) ending inventory at the end of Year 2 was overstated by $6,000. Given this information, the correct cost of goods sold figure for Year 2 would be:

(Multiple Choice)

4.9/5  (37)

(37)

Using the retail inventory method, if the cost to retail ratio is 60% and ending inventory at retail is $45,000, then estimated ending inventory at cost is $27,000.

$45,000 * .60 = $27,000

(True/False)

4.7/5  (38)

(38)

A company that has operated with a 30% average gross profit ratio for a number of years had $100,000 in sales during the first quarter of this year. If it began the quarter with $18,000 of inventory at cost and purchased $72,000 of inventory during the quarter, its estimated ending inventory by the gross profit method is:

(Multiple Choice)

4.8/5  (42)

(42)

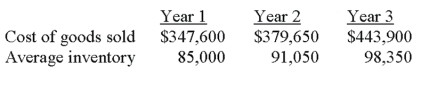

A company reported the following data:  Required:

1. Calculate the company's merchandise inventory turnover for each year.

2. Comment on the company's efficiency in managing its inventory.

Required:

1. Calculate the company's merchandise inventory turnover for each year.

2. Comment on the company's efficiency in managing its inventory.

(Not Answered)

This question doesn't have any answer yet

An overstated beginning inventory will ______________ cost of goods sold and _____________ net income.

(Short Answer)

4.8/5  (36)

(36)

All of the following statements related to goods on consignment are true except:

(Multiple Choice)

4.8/5  (38)

(38)

On December 31, a company needed to estimate its ending inventory to prepare its fourth quarter financial statements. The following information is currently available: Inventory as of October 1: $12,500

Net sales for fourth quarter: $40,000

Net purchases for fourth quarter: $27,500

This company typically achieves a gross profit ratio of 15%. Ending Inventory under the gross profit method would be:

(Multiple Choice)

5.0/5  (31)

(31)

On July 24 of the current year, The Georgia Peach Company experienced a natural disaster that destroyed the company's entire inventory. At the beginning of July, the company reported beginning inventory of $226,750. Inventory purchased during July (until the date of the disaster) was $197,800. Sales for the month of July through July 24 were $642,500. Assuming the company's typical gross profit ratio is 50%, estimate the amount of inventory destroyed in the natural disaster.

(Multiple Choice)

5.0/5  (34)

(34)

When purchase costs of inventory regularly decline, which method of inventory costing will yield the lowest cost of goods sold?

(Multiple Choice)

4.7/5  (41)

(41)

If a period-end inventory amount is reported in error, it can cause a misstatement in all of the following except:

(Multiple Choice)

4.9/5  (42)

(42)

The _____________________ is a measure of how quickly a merchandiser sells its merchandise inventory.

(Short Answer)

4.8/5  (34)

(34)

An advantage of the _________________ method of inventory valuation is that it tends to smooth out the effect of erratic changes in costs.

(Short Answer)

4.9/5  (34)

(34)

In a period of rising purchase costs, FIFO usually gives a lower taxable income and therefore, yields a tax advantage.

(True/False)

4.8/5  (36)

(36)

Showing 101 - 120 of 198

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)