Exam 1: Accounting in Business

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

Flash reported net income of $17,500 for the past year. At the beginning of the year the company had $200,000 in assets and $50,000 in liabilities. By the end of the year, assets had increased to $300,000 and liabilities were $75,000. Calculate its return on assets:

(Multiple Choice)

4.8/5  (44)

(44)

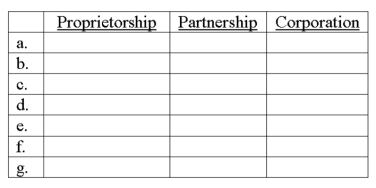

The characteristics below apply to at least one of the forms of business organization.

a. Is a separate legal entity.

b. Is allowed to be owned by one person only.

c. Owner or owners are personally liable for debts of the business.

d. Is a taxable entity.

e. Is a business entity.

f. May have a contract specifying the division of profits among the owners.

g. Has an unlimited life

Use the following format to indicate (with a "yes" or "no") whether or not a characteristic applies to each type of business organization.

(Not Answered)

This question doesn't have any answer yet

You are reviewing the accounting records of Cathy's Antiques, owned by Cathy Miller. You have uncovered the following situations. Compose a memo to Ms. Miller. Cite the appropriate accounting principle and suggest an action for each separate item.

1. In August, a check for $500 was written to Wee Day Care Center. This amount represents child care for her son Brandon.

2. Cathy plans a Going Out of Business Sale for May, since she will be closing her business for a month-long vacation in June. She plans to reopen July 1 and will continue operating Cathy's Antiques indefinitely.

3. Cathy received a shipment of pine furniture from Quebec, Canada. The invoice was stated in Canadian dollars.

4. Joseph Clark paid $1,500 for a dining table. The amount was recorded as revenue. The table will be delivered to Mr. Clark in six weeks.

(Essay)

4.9/5  (42)

(42)

In the partnership form of business, the owners are called stockholders.

(True/False)

4.9/5  (38)

(38)

If a parcel of land that was originally purchased for $85,000 is offered for sale at $150,000, is assessed for tax purposes at $95,000, is recognized by its purchasers as easily being worth $140,000, and is sold for $137,000. At the time of the sale, assume that the seller still owed $30,000 to TrustOne Bank on the land that was purchased for $85,000. Immediately after the sale, the seller paid off the loan to TrustOne Bank. What is the effect of the sale and the payoff of the loan on the accounting equation?

(Multiple Choice)

4.9/5  (40)

(40)

Owners of a corporation are called shareholders or stockholders.

(True/False)

4.9/5  (36)

(36)

The question of when revenue should be recognized on the income statement (according to GAAP) is addressed by the:

(Multiple Choice)

4.8/5  (36)

(36)

Return on assets reflects the effectiveness of a company's ability to generate profit through productive use of its assets.

(True/False)

4.8/5  (39)

(39)

Assets removed from the business by the business owner for personal use are called ___________.

(Short Answer)

4.9/5  (33)

(33)

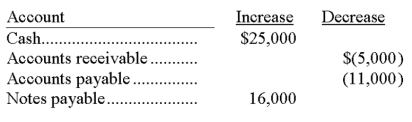

The accounts of Garfield Company with the increases or decreases that occurred during the past year are as follows:  Except for net income, an investment of $3,000 by the owner, and a withdrawal of $11,000 by the owner, no other items affected the owner's capital account. Using the balance sheet equation, compute net income for the past year.

Except for net income, an investment of $3,000 by the owner, and a withdrawal of $11,000 by the owner, no other items affected the owner's capital account. Using the balance sheet equation, compute net income for the past year.

(Not Answered)

This question doesn't have any answer yet

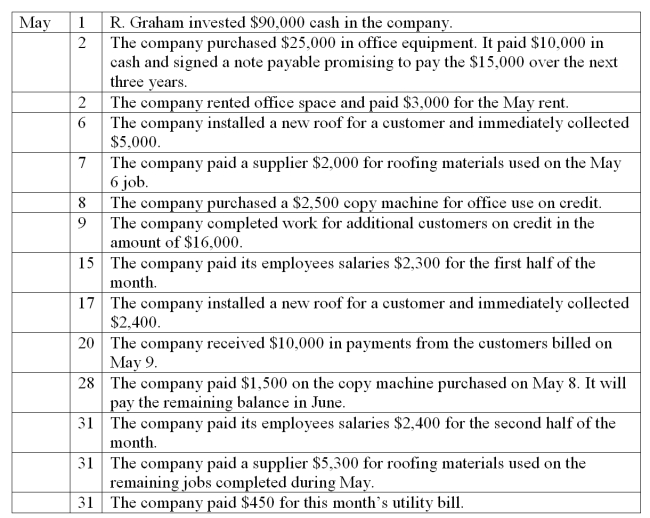

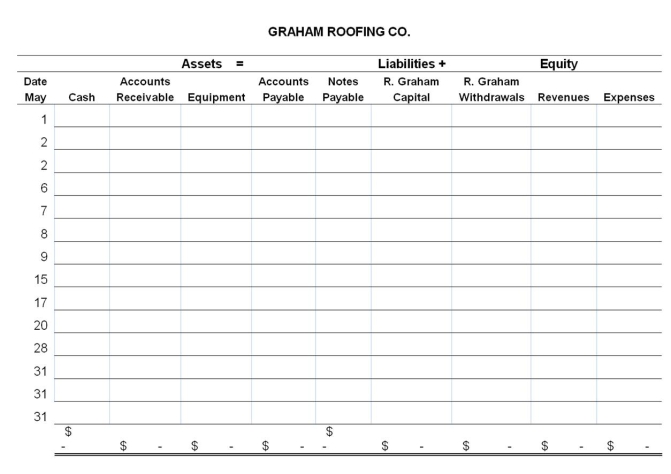

Graham Roofing Company, owned by R. Graham, began operations in May and completed the following transactions during that first month of operations. Show the effects of the transactions on the accounts of the accounting equation by recording increases and decreases in the appropriate columns in the table below. Do not determine new account balances after each transaction. Determine the final total for each account and verify that the equation is in balance.

(Not Answered)

This question doesn't have any answer yet

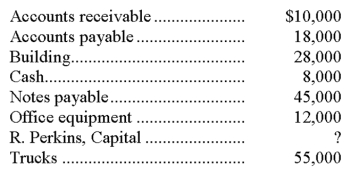

Prepare a November 30 balance sheet in proper form for Green Bay Delivery Service from the following alphabetical list of the accounts at November 30:

(Not Answered)

This question doesn't have any answer yet

The description of the relation between a company's assets, liabilities, and equity, which is expressed as Assets = Liabilities + Equity, is known as the:

(Multiple Choice)

5.0/5  (38)

(38)

Viscount Company collected $42,000 cash on its accounts receivable. The effects of this transaction as reflected in the accounting equation are:

(Multiple Choice)

4.9/5  (30)

(30)

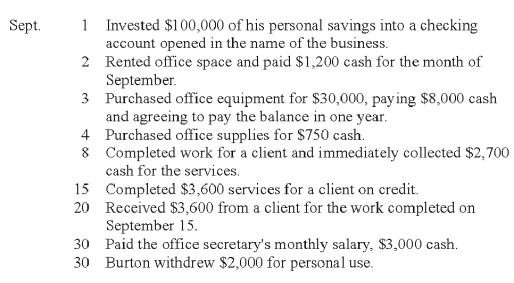

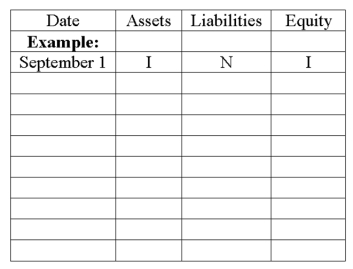

Hal Burton began a Web Consulting practice and completed these transactions during September of the current year:  Show the effects of the above transactions on the accounting equation of Halley Burton, Consultant. Use the following format for your answers. The first item is shown as an example.

Increase = I Decrease = D No effect = N

Show the effects of the above transactions on the accounting equation of Halley Burton, Consultant. Use the following format for your answers. The first item is shown as an example.

Increase = I Decrease = D No effect = N

(Not Answered)

This question doesn't have any answer yet

The International Accounting Standards Board (IASB) is the government group that establishes reporting requirements for companies that issue stock to the public.

(True/False)

4.8/5  (40)

(40)

The balance sheet shows a company's net income or loss due to earnings activities over a period of time.

(True/False)

4.8/5  (39)

(39)

Showing 181 - 200 of 240

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)