Exam 18: Public Choice, taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models447 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System492 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply476 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes420 Questions

Exam 5: Externalities, environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply294 Questions

Exam 7: The Economics of Health Care338 Questions

Exam 8: Firms,the Stock Market,and Corporate Governance522 Questions

Exam 9: Comparative Advantage and the Gains From International Trade377 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology,production,and Costs327 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting272 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets258 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, taxes, and the Distribution of Income258 Questions

Exam 19: Gdp: Measuring Total Production and Income261 Questions

Exam 20: Unemployment and Inflation291 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles253 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies262 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run301 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis286 Questions

Exam 25: Money,banks,and the Federal Reserve System281 Questions

Exam 26: Monetary Policy275 Questions

Exam 27: Fiscal Policy306 Questions

Exam 28: Inflation, unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System258 Questions

Select questions type

Between 1970 and 2010,the poverty rate in East Asia declined dramatically from about 60 percent to less than 1 percent,while the poverty rate in Sub-Saharan Africa decreased from 40 percent to only 24 percent.The main reason for this is that

(Multiple Choice)

4.7/5  (40)

(40)

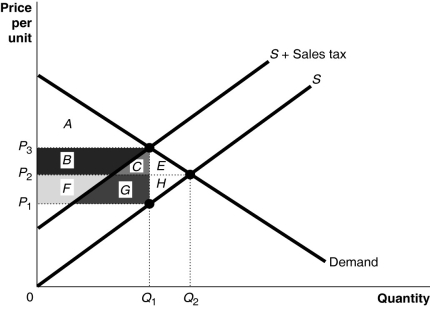

Figure 18-1  -Refer to Figure 18-1.The excess burden of the tax is represented by the area

-Refer to Figure 18-1.The excess burden of the tax is represented by the area

(Multiple Choice)

4.9/5  (46)

(46)

Congressman Flack votes for a program that will benefit the constituents of Congressman Walpole.Which of the following explanations for Flack's vote is most consistent with the public choice model?

(Multiple Choice)

4.8/5  (47)

(47)

The actual division of a tax between buyers and sellers in a market is the excess burden of the tax.

(True/False)

4.9/5  (28)

(28)

Horizontal equity means that two people in identical economic situations should pay the same amount of taxes.

(True/False)

4.8/5  (34)

(34)

When considering changes in tax policy,economists usually focus on

(Multiple Choice)

4.8/5  (35)

(35)

A tax imposed by a state or local government on retail sales of most products is

(Multiple Choice)

4.8/5  (42)

(42)

Suppose the United States has a Gini coefficient of 0.4 and Sweden has a Gini coefficient of 0.25.Which of the following statements is true?

(Multiple Choice)

4.8/5  (31)

(31)

Article Summary

Monthly marijuana sales in Colorado topped $100 million for the first time in August,2015,with $59.2 million in recreational sales and $41.4 million in medical sales.Colorado has levied three types of state taxes on recreational-use marijuana: a 2.9% standard sales tax,a 10% special marijuana sales tax,and a 15% excise tax on wholesale marijuana transfers.The 15% excise tax is earmarked for school construction projects.In August,recreational-use taxes and fees totaled $11.2 million and medical taxes and fees were $2 million,bringing total revenue-to-date for the year to over $86 million.

-Refer to the Article Summary.Colorado taxes marijuana with a 12.9% sales tax on buyers and a 15% wholesale excise tax on producers,which equates to 46 percent of the total taxes paid by retail buyers and 54 percent paid by producers.Does this necessarily mean that buyers will bear 46 percent of the burden of the tax and producers will bear 56 percent of the burden?

(Multiple Choice)

4.9/5  (32)

(32)

Gasoline taxes that are typically used for highway construction and maintenance are consistent with which of the following principles of taxation?

(Multiple Choice)

4.7/5  (39)

(39)

Unlike the market process,in the political market it is possible for some individuals to receive very large benefits from the political process without any significant impact on their tax bills.

(True/False)

4.8/5  (43)

(43)

For the top 1 percent of income distribution,the share of total income earned by households in this group was about ________ percent in 2015.

(Multiple Choice)

4.9/5  (35)

(35)

One argument advanced in favor of not increasing the income tax on individuals with high income is that

(Multiple Choice)

4.9/5  (39)

(39)

Suppose the government wants to finance housing for low-income families by placing a tax on the purchase of luxury homes.Assume the government defines a luxury home as a home that is purchased for at least $1 million.This tax is consistent with the

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following summarizes the information provided by a Lorenz curve?

(Multiple Choice)

4.9/5  (36)

(36)

A key assumption of the public choice model is that government policymakers will pursue their own self-interests.Economists assume that consumers and firms pursue their own self-interests when they interact in competitive markets and this interaction results in efficient economic outcomes.Does the pursuit of self-interest by policymakers result in efficient economic outcomes?

(Essay)

4.9/5  (32)

(32)

Showing 21 - 40 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)