Exam 18: Public Choice, taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models447 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System492 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply476 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes420 Questions

Exam 5: Externalities, environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply294 Questions

Exam 7: The Economics of Health Care338 Questions

Exam 8: Firms,the Stock Market,and Corporate Governance522 Questions

Exam 9: Comparative Advantage and the Gains From International Trade377 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology,production,and Costs327 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting272 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets258 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, taxes, and the Distribution of Income258 Questions

Exam 19: Gdp: Measuring Total Production and Income261 Questions

Exam 20: Unemployment and Inflation291 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles253 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies262 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run301 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis286 Questions

Exam 25: Money,banks,and the Federal Reserve System281 Questions

Exam 26: Monetary Policy275 Questions

Exam 27: Fiscal Policy306 Questions

Exam 28: Inflation, unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System258 Questions

Select questions type

What is the United States government's formal definition of the poverty line?

(Multiple Choice)

4.8/5  (35)

(35)

Many economists believe that when the federal government establishes an agency to regulate a particular industry,the regulated firms try to influence the agency even if these actions do not benefit the public.Economists refer to this result of government regulation by which of the following terms?

(Multiple Choice)

4.9/5  (39)

(39)

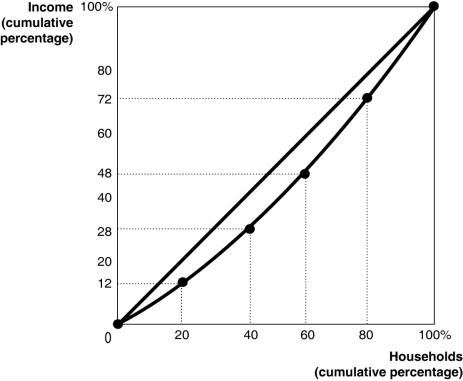

Figure 18-7 shows the Lorenz curve for a hypothetical country.

-Refer to Figure 18-7.The second lowest 20 percent of households

Figure 18-7 shows the Lorenz curve for a hypothetical country.

-Refer to Figure 18-7.The second lowest 20 percent of households

(Multiple Choice)

4.7/5  (36)

(36)

A situation where a member of Congress votes to approve a bill in exchange for favorable votes from other members on other bills is called

(Multiple Choice)

4.9/5  (37)

(37)

If you pay $2,000 in taxes on an income of $20,000,and a tax of $3,500 on an income of $30,000,then over this range of income the tax is

(Multiple Choice)

4.9/5  (43)

(43)

Logrolling refers to attempts by individuals to use government action to make themselves better off at the expense of others.

(True/False)

4.9/5  (27)

(27)

Article Summary

Monthly marijuana sales in Colorado topped $100 million for the first time in August,2015,with $59.2 million in recreational sales and $41.4 million in medical sales.Colorado has levied three types of state taxes on recreational-use marijuana: a 2.9% standard sales tax,a 10% special marijuana sales tax,and a 15% excise tax on wholesale marijuana transfers.The 15% excise tax is earmarked for school construction projects.In August,recreational-use taxes and fees totaled $11.2 million and medical taxes and fees were $2 million,bringing total revenue-to-date for the year to over $86 million.

-Refer to the Article Summary.Suppose the sale of marijuana is legalized in Florida,and the state decides to charge a tax of $50 per ounce on each sale,with the state claiming that retailers will bear the entire burden of this tax.Draw a graph illustrating the situation where retail outlets would bear the entire tax burden of $50 per ounce of marijuana.Explain what would need to be true about the demand for marijuana for retailers to bear the entire burden of this tax,and if this would likely occur if marijuana sales were legalized.

(Essay)

4.9/5  (42)

(42)

The proposition that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle is called

(Multiple Choice)

4.8/5  (40)

(40)

If you pay $2,000 in taxes on an income of $20,000,and a tax of $3,000 on an income of $30,000,then over this range of income the tax is

(Multiple Choice)

4.9/5  (42)

(42)

Table 18-2

Policy Tom Cotton David Vitter Patty Murray Homeland security 1 st 2rd 3rd Education 2rd 3rd 1 st Medical research 3rd 1 st 2rd

-Refer to Table 18-2.The table above lists three policy alternatives that the U.S.Senate will vote on,along with the ranking of these alternates.The Senate must decide which of these alternatives should receive an additional $1 billion of funding,and there is enough money in the federal budget for only one of these alternatives.If a series of votes is taken in which each pair of alternatives is considered (homeland security and education;homeland security and medical research;education and medical research)which of the following will result from these votes?

(Multiple Choice)

4.8/5  (31)

(31)

Between 1980 and 2014,income inequality in the United States has increased in part due to rapid technological change.How does technological change contribute to income inequality?

(Multiple Choice)

4.9/5  (32)

(32)

If official poverty statistics for the United States included transfer payments individuals receive from the government,such as Social Security payments and other non-cash benefits such as food stamps

(Multiple Choice)

4.8/5  (40)

(40)

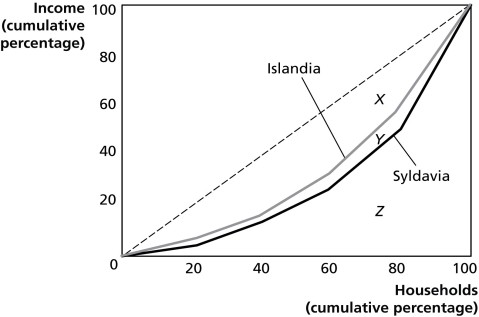

Figure 18-6 shows the Lorenz curves for Islandia and Syldavia.

-Refer to Figure 18-6.If area X = 2,060,area Y = 240,and area Z = 2,700,calculate the Gini coefficient for Islandia.

Figure 18-6 shows the Lorenz curves for Islandia and Syldavia.

-Refer to Figure 18-6.If area X = 2,060,area Y = 240,and area Z = 2,700,calculate the Gini coefficient for Islandia.

(Multiple Choice)

4.8/5  (27)

(27)

From 1970 to 2010,the poverty rate in East Asia rose slightly but the level of poverty in sub-Saharan Africa fell dramatically.

(True/False)

4.8/5  (34)

(34)

Ivy Jasmnine Rose Subsidies for educationt 2nd 3rd 1st Research on Alzheimer's 3rd 1st 2nd Increased border security 1st 2nd 3rd Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1)Subsidies for education,2)Research on Alzheimer's or 3)Increased border security.Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1.Suppose a series of votes are taken in which each pair of alternatives is considered in turn.If the vote is between allocating funds to research on Alzheimer's and increased border security

(Multiple Choice)

4.8/5  (28)

(28)

Some individuals seek to use government action to make themselves better off at the expense of others.The actions of these individuals

(Multiple Choice)

4.8/5  (44)

(44)

Showing 61 - 80 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)