Exam 18: Public Choice, taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models447 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System492 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply476 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes420 Questions

Exam 5: Externalities, environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply294 Questions

Exam 7: The Economics of Health Care338 Questions

Exam 8: Firms,the Stock Market,and Corporate Governance522 Questions

Exam 9: Comparative Advantage and the Gains From International Trade377 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology,production,and Costs327 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting272 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets258 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, taxes, and the Distribution of Income258 Questions

Exam 19: Gdp: Measuring Total Production and Income261 Questions

Exam 20: Unemployment and Inflation291 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles253 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies262 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run301 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis286 Questions

Exam 25: Money,banks,and the Federal Reserve System281 Questions

Exam 26: Monetary Policy275 Questions

Exam 27: Fiscal Policy306 Questions

Exam 28: Inflation, unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System258 Questions

Select questions type

Table 18-4

Foreign Aid Post-Secondary Education Roads and Bridges Tom 3rd 1st 2nd Dick 2nd 3rd 1st Harriet 1 st 2nd 3rd

-Refer to Table 18-4.The table above outlines the rankings of three members of the U.S.House of Representatives on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Tom,Dick,and Harriet,all members of the House of Representatives,participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Foreign Aid and Post-Secondary Education (2)Foreign Aid and Roads and Bridges and (3)Post-Secondary Education and Roads and Bridges.

Determine whether the voting paradox will occur as a result of these votes.

(Essay)

4.8/5  (39)

(39)

If the government is most interested in minimizing excess burden of an excise tax,should it impose the tax on goods that are elastic or on goods that are inelastic?

(Essay)

4.7/5  (35)

(35)

Taxable Income Tax Payments \ 10,000 \ 1,000 12,000 1,240 16,000 1,780 22,000 2,740 Table 18-7 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-7.The tax system is

(Multiple Choice)

4.8/5  (41)

(41)

Most economists agree that some of the burden of the corporate income tax

(Multiple Choice)

4.8/5  (38)

(38)

Taxable Incame Tax Payments \ 20,000 \ 2,000 25,000 2,250 32,000 2,560 42,000 2,940 Table 18-5 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-5.The tax system is

(Multiple Choice)

5.0/5  (36)

(36)

According to the benefits-received principle,those who receive the benefits from a government program should pay the taxes that support the program.

(True/False)

4.8/5  (35)

(35)

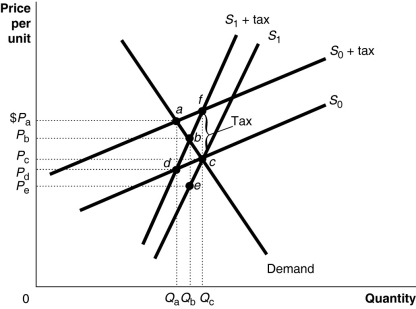

Figure 18-2 shows a demand curve and two sets of supply curves,one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,what is the size of the deadweight loss,if there is any?

Figure 18-2 shows a demand curve and two sets of supply curves,one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,what is the size of the deadweight loss,if there is any?

(Multiple Choice)

4.8/5  (36)

(36)

Economist Kenneth Arrow has shown mathematically that no system of voting will consistently represent the underlying preferences of voters.This finding is called

(Multiple Choice)

4.9/5  (36)

(36)

At the state and local levels in the United States,the largest source of tax revenue is

(Multiple Choice)

4.9/5  (34)

(34)

How would the elimination of a sales tax affect the market for a product that had been subject to the tax?

(Multiple Choice)

4.8/5  (34)

(34)

Income Tax Bracket Marginal Tax Rate \ 0-6,000 10\% 6,001-20,000 15\% 20,001-44,500 22\% 44,501 and over 30\% Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.Calculate the income tax paid by Sylvia,a single taxpayer with an income of $70,000.

(Multiple Choice)

4.8/5  (33)

(33)

Policymakers focus on marginal tax rate changes when making changes in the tax code because the marginal tax rate

(Multiple Choice)

4.9/5  (41)

(41)

Economists often analyze the interaction of individuals and firms in markets.Economists also examine the actions of individuals and firms as they attempt to use government to make themselves better off at the expense of others,a process that is referred to as

(Multiple Choice)

4.8/5  (38)

(38)

Holding all other factors constant,income earned from capital is more unequally distributed than income earned from labor.

(True/False)

4.7/5  (39)

(39)

Ivy Jasmnine Rose Subsidies for educationt 2nd 3rd 1st Research on Alzheimer's 3rd 1st 2nd Increased border security 1st 2nd 3rd Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1)Subsidies for education,2)Research on Alzheimer's or 3)Increased border security.Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1.Suppose a series of votes are taken in which each pair of alternatives is considered in turn.If the vote is between allocating funds to education subsidies and increased border security

(Multiple Choice)

4.8/5  (38)

(38)

Showing 141 - 160 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)