Exam 18: Public Choice, taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models447 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System492 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply476 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes420 Questions

Exam 5: Externalities, environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply294 Questions

Exam 7: The Economics of Health Care338 Questions

Exam 8: Firms,the Stock Market,and Corporate Governance522 Questions

Exam 9: Comparative Advantage and the Gains From International Trade377 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology,production,and Costs327 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting272 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets258 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, taxes, and the Distribution of Income258 Questions

Exam 19: Gdp: Measuring Total Production and Income261 Questions

Exam 20: Unemployment and Inflation291 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles253 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies262 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run301 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis286 Questions

Exam 25: Money,banks,and the Federal Reserve System281 Questions

Exam 26: Monetary Policy275 Questions

Exam 27: Fiscal Policy306 Questions

Exam 28: Inflation, unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System258 Questions

Select questions type

Article Summary

Monthly marijuana sales in Colorado topped $100 million for the first time in August,2015,with $59.2 million in recreational sales and $41.4 million in medical sales.Colorado has levied three types of state taxes on recreational-use marijuana: a 2.9% standard sales tax,a 10% special marijuana sales tax,and a 15% excise tax on wholesale marijuana transfers.The 15% excise tax is earmarked for school construction projects.In August,recreational-use taxes and fees totaled $11.2 million and medical taxes and fees were $2 million,bringing total revenue-to-date for the year to over $86 million.

-Refer to the Article Summary.Colorado taxes marijuana with a 12.9% sales tax on buyers and a 15% wholesale excise tax on producers,or a total tax of 27.9% Suppose the actual burden of the tax falls 80 percent on consumers and 20 percent on producers.In this case,consumers will actually bear the tax burden of about ________ percent of the selling price and producers will actually bear the tax burden of ________ percent of the selling price.

(Multiple Choice)

4.9/5  (45)

(45)

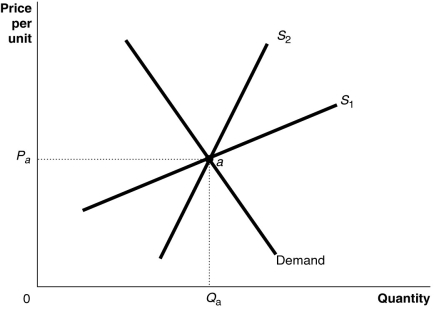

Figure 18-3  -Refer to Figure 18-3.The figure above shows a demand curve and two supply curves,one more elastic than the other.Use Figure 18-3 to answer the following questions.

a.Suppose the government imposes an excise tax of $1.00 on every unit sold.Use the graph to illustrate the impact of this tax.

b.If the government imposes an excise tax of $1.00 on every unit sold,will the consumer pay more of the tax if the supply curve is S1 or S2? Refer to the graphs in your answer.

c.If an excise tax of $1.00 on every unit sold is imposed,will the revenue collected by the government be greater if the supply curve is S1 or S2?

d.If the government imposes an excise tax of $1.00 on every unit sold,will the deadweight loss be greater if the supply curve is S1 or S2?

-Refer to Figure 18-3.The figure above shows a demand curve and two supply curves,one more elastic than the other.Use Figure 18-3 to answer the following questions.

a.Suppose the government imposes an excise tax of $1.00 on every unit sold.Use the graph to illustrate the impact of this tax.

b.If the government imposes an excise tax of $1.00 on every unit sold,will the consumer pay more of the tax if the supply curve is S1 or S2? Refer to the graphs in your answer.

c.If an excise tax of $1.00 on every unit sold is imposed,will the revenue collected by the government be greater if the supply curve is S1 or S2?

d.If the government imposes an excise tax of $1.00 on every unit sold,will the deadweight loss be greater if the supply curve is S1 or S2?

(Essay)

4.9/5  (31)

(31)

What are the two types of taxes that working individuals pay on their earnings?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following statements about rent seeking is false?

(Multiple Choice)

4.7/5  (33)

(33)

If the government wants to minimize the welfare loss of a tax,it should tax goods with more inelastic demands or supplies.

(True/False)

4.9/5  (39)

(39)

Rapid economic growth tends to increase the degree of income mobility.

(True/False)

4.8/5  (32)

(32)

Incame Tax Bracket Mar ginal Tax Rate \ 0-8,000 12\% 8,001-22,000 17\% 22,001-48,000 25\% 48,001 and over 38\% Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.Sasha is a single taxpayer with an income of $60,000.What is his marginal tax rate and what is his average tax rate?

(Multiple Choice)

4.9/5  (39)

(39)

The federal government and some state governments levy taxes on specific goods such as gasoline,cigarettes,and beer.These are known as

(Multiple Choice)

4.8/5  (36)

(36)

If the marginal tax rate is less than the average tax rate as taxable income increases,the tax structure is

(Multiple Choice)

4.9/5  (43)

(43)

Congressman Gallstone seeks support from his colleagues for a bill he sponsors that will establish a new national park in his district.He offers to support Congresswoman Disrail's proposal to build a new library in her district in exchange for her vote for his national park bill.This is an example of

(Multiple Choice)

4.8/5  (41)

(41)

When the demand for a product is less elastic than the supply

(Multiple Choice)

4.8/5  (41)

(41)

In reference to the federal income tax system,a tax bracket is

(Multiple Choice)

4.7/5  (39)

(39)

The decision to make the U.S.income tax system progressive was

(Multiple Choice)

4.9/5  (39)

(39)

Compare the distribution of income in the United States with the distribution of income in other high-income countries.

(Essay)

5.0/5  (36)

(36)

Which of the following is the source of revenue for Medicare and Social Security in the United States?

(Multiple Choice)

4.9/5  (32)

(32)

The government of Silverado raises revenue through a general income tax paid by all its residents to operate the city's marina.The marina is used by private boat owners.This method of raising revenue to operate the marina is

(Multiple Choice)

4.8/5  (30)

(30)

Showing 181 - 200 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)