Exam 14: Financial Statement Analysis

Exam 1: Investments: Background and Issues79 Questions

Exam 2: Asset Classes and Financial Instruments85 Questions

Exam 3: Securities Markets94 Questions

Exam 4: Mutual Funds and Other Investment Companies90 Questions

Exam 5: Risk, Return, and the Historical Record89 Questions

Exam 6: Efficient Diversification89 Questions

Exam 7: Capital Asset Pricing and Arbitrage Pricing Theory89 Questions

Exam 8: The Efficient Market Hypothesis92 Questions

Exam 9: Behavioral Finance and Technical Analysis89 Questions

Exam 10: Bond Prices and Yields96 Questions

Exam 11: Managing Bond Portfolios90 Questions

Exam 12: Macroeconomic and Industry Analysis93 Questions

Exam 13: Equity Valuation94 Questions

Exam 14: Financial Statement Analysis88 Questions

Exam 15: Options Markets91 Questions

Exam 16: Option Valuation90 Questions

Exam 17: Futures Markets and Risk Management92 Questions

Exam 18: Evaluating Investment Performance78 Questions

Exam 19: International Diversification50 Questions

Exam 20: Hedge Funds65 Questions

Exam 21: Taxes, Inflation, and Investment Strategy74 Questions

Exam 22: Investors and the Investment Process86 Questions

Select questions type

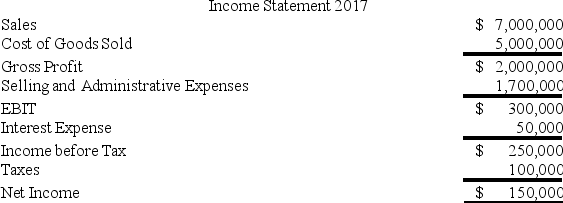

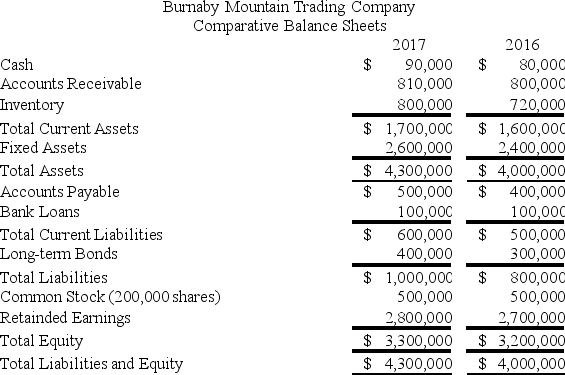

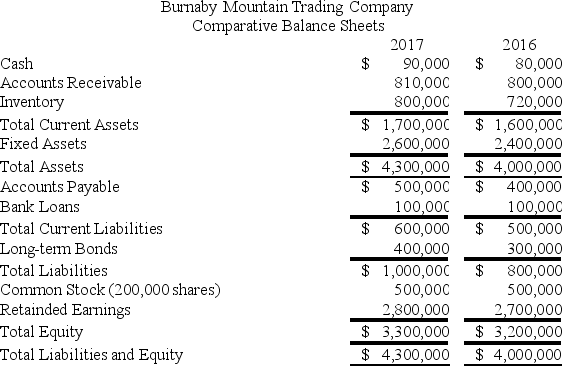

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's return-on-equity ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's return-on-equity ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

The term quality of earnings refers to ________.

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

B

The net income of the company is $120. Accounts payable increase by $20, depreciation is $15, and equipment is purchased for $40. If the firm issued $110 in new bonds, what is the total change in cash for the firm for all activities?

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

A

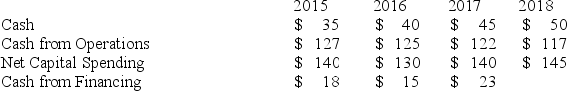

Cash Flow Data for Interceptors, Inc.

Based on the cash flow data in the table for Interceptors Inc., which of the following statements is (are) correct?

I. This firm appears to be a good investment because of its steady growth in cash.

II. This firm has been able to generate growing cash flows only by borrowing or selling equity to offset declining operating cash flows.

III. Financing activities have been increasingly important for this firm's operations, at least in the short run.

Based on the cash flow data in the table for Interceptors Inc., which of the following statements is (are) correct?

I. This firm appears to be a good investment because of its steady growth in cash.

II. This firm has been able to generate growing cash flows only by borrowing or selling equity to offset declining operating cash flows.

III. Financing activities have been increasingly important for this firm's operations, at least in the short run.

(Multiple Choice)

4.9/5  (43)

(43)

You find that a firm that uses debt has a compound leverage factor less than 1. This tells you that ________.

(Multiple Choice)

4.8/5  (30)

(30)

A firm has an ROE of 20% and a market-to-book ratio of 2.38. Its P/E ratio is ________.

(Multiple Choice)

4.8/5  (23)

(23)

If a firm has a positive tax rate and a positive operating ROA, and the interest rate on debt is the same as the operating ROA, then operating ROA will be ________.

(Multiple Choice)

4.8/5  (29)

(29)

The firm's leverage ratio is 1.2, interest-burden ratio is 0.81, and profit margin is 0.24, and its asset turnover is 1.25. What is the firm's ROA?

(Multiple Choice)

4.7/5  (41)

(41)

One of the biggest impediments to a global capital market has been ________.

(Multiple Choice)

4.9/5  (29)

(29)

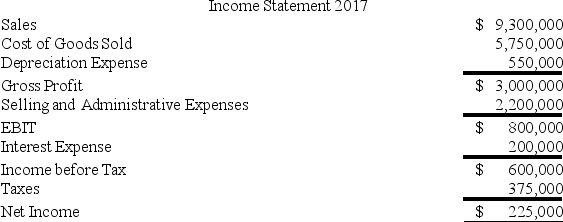

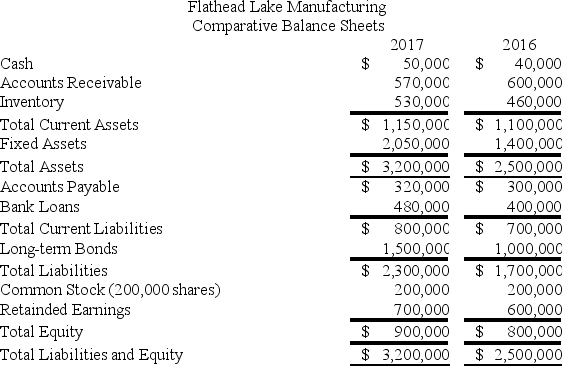

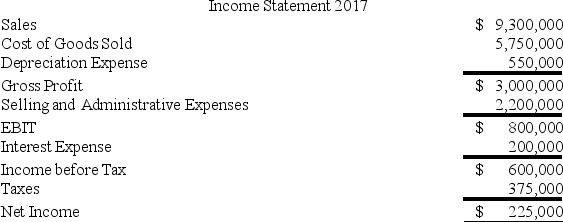

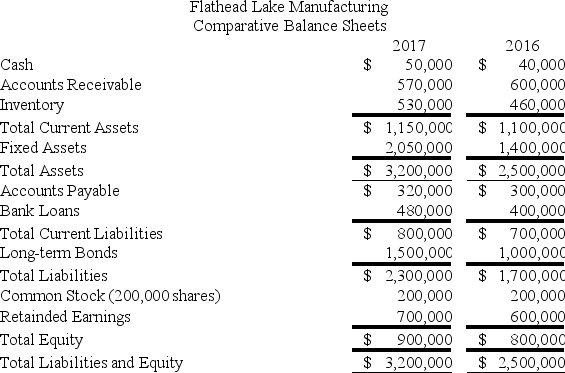

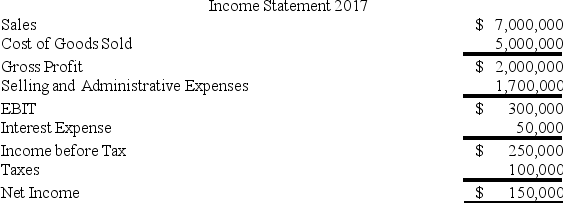

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's P/E ratio for 2017 is ________.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's P/E ratio for 2017 is ________.

(Multiple Choice)

4.7/5  (39)

(39)

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's debt-to-equity ratio for 2017 is ________.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's debt-to-equity ratio for 2017 is ________.

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following transactions will result in a decrease in cash flow from operations?

(Multiple Choice)

4.8/5  (36)

(36)

Depreciation expense is in what broad category of expenditures?

(Multiple Choice)

4.9/5  (32)

(32)

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's times-interest-earned ratio for 2017 is ________.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's times-interest-earned ratio for 2017 is ________.

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following is not a ratio used in the DuPont analysis?

(Multiple Choice)

4.8/5  (35)

(35)

Operating ROA is calculated as ________, while ROE is calculated as ________.

(Multiple Choice)

4.8/5  (30)

(30)

If a firm's ratio of stockholders' equity/total assets is lower than the industry average and its ratio of long-term debt/stockholders' equity is also lower than the industry average, this would suggest that the firm ________.

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 88

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)