Exam 7: Master Budgets and Performance Planning

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

Gardner Company expects sales for October of $248,000. Experience suggests that 45% of sales are for cash and 55% are on credit. The company collects 50% of its credit sales in the month of sale and 50% in the month following sale. Budgeted Accounts Receivable on September 30 is $67,000. What is the amount of Accounts Receivable on the October 31 budgeted balance sheet?

(Multiple Choice)

4.8/5  (41)

(41)

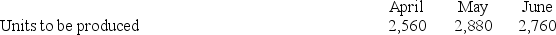

Charm Enterprises' production budget shows the following units to be produced for the coming three months:  A finished unit requires four ounces of a key direct material. The March 31 Raw Materials Inventory has 4,032 ounces (oz.) of the material. Each month's ending Raw Materials Inventory should be 35% of the following month's production needs. Materials purchases in May should be?

A finished unit requires four ounces of a key direct material. The March 31 Raw Materials Inventory has 4,032 ounces (oz.) of the material. Each month's ending Raw Materials Inventory should be 35% of the following month's production needs. Materials purchases in May should be?

(Multiple Choice)

4.9/5  (43)

(43)

________ is a budgeting guideline that recognizes employees affected by a budget should be involved in preparing it.

(Short Answer)

5.0/5  (42)

(42)

The master budget includes individual budgets for sales, production or merchandise purchases, various expenses, capital expenditures, and cash.

(True/False)

4.9/5  (32)

(32)

Coomb's Fashions forecasts sales of $125,000 for the quarter ended December 31. Its gross profit rate is 20% of sales, and its September 30 inventory is $32,500. If the December 31 inventory is targeted at $41,500, budgeted purchases for this quarter should be:

(Multiple Choice)

4.8/5  (38)

(38)

Masterson Company's budgeted production calls for 56,000 units in April and 52,000 units in May of a key raw material that costs $1.85 per unit. Each month's ending raw materials inventory should equal 30% of the following month's budgeted materials. The April 1 inventory for this material is 16,800 unit. What is the budgeted materials needed in units for April?

(Multiple Choice)

4.7/5  (32)

(32)

Traditional budgeting is generally better than activity-based budgeting when attempting to reduce costs by eliminating non-value-added activities.

(True/False)

4.9/5  (39)

(39)

The number and types of budgets included in a master budget depend on the company's size and complexity.

(True/False)

4.9/5  (38)

(38)

Which of the following would not be used in preparing a cash budget for October?

(Multiple Choice)

4.9/5  (40)

(40)

Alliance Company budgets production of 24,000 units in January and 28,000 units in the February. Each finished unit requires 4 pounds of raw material K that costs $2.50 per pound. Each month's ending raw materials inventory should equal 40% of the following month's budgeted materials. The January 1 inventory for this material is 38,400 pounds. What is the budgeted materials needed in pounds for January?

(Multiple Choice)

4.9/5  (42)

(42)

Glaston Company manufactures a single product using a JIT inventory system. The production budget indicates that the number of units expected to be produced are 193,000 in October, 201,500 in November, and 198,000 in December. Glaston assigns variable overhead at a rate of $0.75 per unit of production. Fixed overhead equals $150,000 per month. Compute the total budgeted overhead for October.

(Multiple Choice)

4.9/5  (39)

(39)

Presented below are terms or phrases preceded by letters (a) through (j) Match the correct definitions with the terms

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (38)

(38)

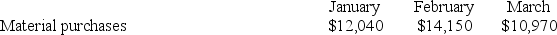

Fortune Company's direct materials budget shows the following cost of materials to be purchased for the coming three months:  Payments for purchases are expected to be made 50% in the month of purchase and 50% in the month following purchase. The December Accounts Payable balance is $6,500. The expected January 31 Accounts Payable balance is:

Payments for purchases are expected to be made 50% in the month of purchase and 50% in the month following purchase. The December Accounts Payable balance is $6,500. The expected January 31 Accounts Payable balance is:

(Multiple Choice)

4.9/5  (38)

(38)

Wichita Industries' sales are 10% cash and 90% on credit. Credit sales are collected as follows: 30% in the month of sale, 50% in the next month, and 20% in the second following month. On December 31, the accounts receivable balance includes $12,000 from November sales and $42,000 from December sales. Assume that total sales for January are budgeted to be $50,000. What are the expected cash receipts for January from the current and past sales?

(Multiple Choice)

4.9/5  (40)

(40)

Ewing Company budgeted sales for January, February, and March of $96,000, $88,000, and $72,000, respectively. Seventy percent of sales are on credit. The company collects 60% of its credit sales in the month following sale, and 40% in the second month following sale. What are Ewing's expected cash receipts for March related to its current and past sales?

(Essay)

4.8/5  (27)

(27)

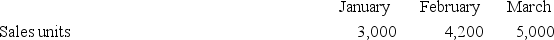

Ruiz Co. provides the following unit sales forecast for the next three months:  The company wants to end each month with ending finished goods inventory equal to 10% of the next month's sales. Finished goods inventory on December 31 is 300 units. The budgeted production units for February are:

The company wants to end each month with ending finished goods inventory equal to 10% of the next month's sales. Finished goods inventory on December 31 is 300 units. The budgeted production units for February are:

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is a benefit derived from budgeting?

(Multiple Choice)

4.8/5  (39)

(39)

The process of planning future business actions and expressing them as a formal plan is called:

(Multiple Choice)

4.7/5  (37)

(37)

Addams, Inc., is preparing its master budget for the second quarter. The following sales and production data have been forecasted:

Finished goods inventory on March 31: 120 units

Raw materials inventory on March 31: 450 pounds

Desired ending inventory each month:

Finished goods: 30% of next month's sales

Raw materials: 25% of next month's production needs

Number of pounds of raw material required per finished unit: 4 lbs.

How many pounds of raw materials should be purchased in April?

Finished goods inventory on March 31: 120 units

Raw materials inventory on March 31: 450 pounds

Desired ending inventory each month:

Finished goods: 30% of next month's sales

Raw materials: 25% of next month's production needs

Number of pounds of raw material required per finished unit: 4 lbs.

How many pounds of raw materials should be purchased in April?

(Essay)

4.9/5  (30)

(30)

Showing 41 - 60 of 215

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)