Exam 3: Process Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

In process costing, the classification of materials as direct or indirect depends on whether or not they are clearly linked with a specific process or department.

Free

(True/False)

4.9/5  (32)

(32)

Correct Answer:

True

Richards Corporation uses the weighted-average method of process costing. The following information is available for October in its Fabricating Department: Units:

Beginning Inventory: 80,000 units, 60% complete as to materials and 20% complete as to conversion.

Units started and completed: 250,000.

Units completed and transferred out: 330,000.

Ending Inventory: 30,000 units, 40% complete as to materials and 10% complete as to conversion.

Costs:

Costs in beginning Work in Process - Direct Materials: $37,200.

Costs in beginning Work in Process - Conversion: $79,700.

Costs incurred in October - Direct Materials: $646,800.

Costs incurred in October - Conversion: $919,300.

Calculate the cost per equivalent unit of conversion.

Free

(Multiple Choice)

4.9/5  (27)

(27)

Correct Answer:

E

The cost object in a process costing system is the specific job.

Free

(True/False)

4.9/5  (37)

(37)

Correct Answer:

False

In a process costing system, companies typically end each period with only Finished Goods Inventory.

(True/False)

4.8/5  (35)

(35)

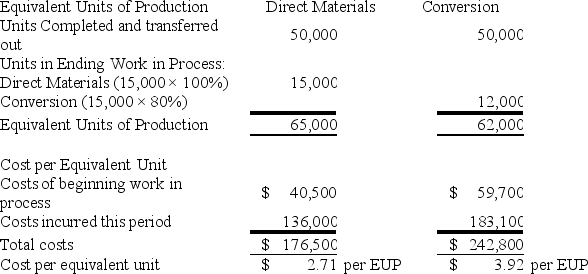

Following is a partial process cost summary for Mitchell Manufacturing's Canning Department.  The total materials costs transferred out of the Canning Department equals:

The total materials costs transferred out of the Canning Department equals:

(Multiple Choice)

4.9/5  (42)

(42)

During March, the production department of a process operations system completed and transferred to finished goods 25,000 units that were in process at the beginning of March and 110,000 that were started and completed in March. March's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to conversion. At the end of March, 30,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to conversion. Compute the number of equivalent units with respect to both materials and conversion respectively for March using the FIFO method.

(Multiple Choice)

4.8/5  (32)

(32)

One section of the process cost summary describes the equivalent units of production for the department during the reporting period and presents the calculations of the direct materials and conversion costs per equivalent unit.

(True/False)

4.9/5  (34)

(34)

The FIFO method of computing equivalent units excludes the beginning inventory costs in computing the cost per equivalent unit for the current period.

(True/False)

4.8/5  (38)

(38)

In a process costing system, direct material costs incurred are recorded:

(Multiple Choice)

4.8/5  (43)

(43)

Prepare the required general journal entries to record the following transactions for the Ringer Company.

a. Purchased $40,000 of raw materials on account.

b. Used $12,000 of direct materials in the production department.

c. Used $5,000 of indirect materials.

(Essay)

4.9/5  (37)

(37)

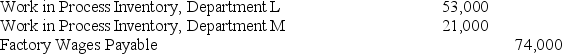

If Department L uses $53,000 of direct labor and Department M uses $21,000 of direct labor, the following journal entry would be recorded using a process costing system:

(True/False)

4.9/5  (40)

(40)

The process cost summary is an important managerial accounting report prepared for each process or production department.

(True/False)

4.9/5  (45)

(45)

In some circumstances, a process costing system can classify wages paid to maintenance workers as direct labor costs instead of factory overhead.

(True/False)

4.9/5  (38)

(38)

A company uses the weighted average method for inventory costing. At the start of a period the production department had 20,000 units in beginning Work in Process inventory which were 40% complete; the department completed and transferred 165,000 units. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 75% complete. The production department had conversion costs in the beginning goods is process inventory of $99,000 and total conversion costs added during the period are $726,825. Compute the conversion cost per equivalent unit.

(Multiple Choice)

4.8/5  (27)

(27)

A company uses the weighted-average method for inventory costing. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 100% complete for materials and 75% complete for conversion. The equivalent costs per unit are materials, $2.65 and conversion $5.35. Compute the cost that would be assigned to the ending Work in Process inventory for the period.

(Multiple Choice)

4.7/5  (30)

(30)

Yamada Company applies factory overhead to its production departments on the basis of 90% of direct labor costs. In the Assembly Department, Yamada had $125,000 of direct labor cost, and in the Finishing Department, Yamada had $35,000 of direct labor cost. The entry to apply overhead to these production departments is:

(Multiple Choice)

4.8/5  (40)

(40)

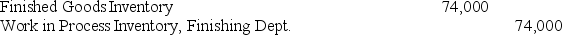

The Finishing Department transferred out completed units with a cost of $74,000. This transfer should be recorded with the following entry:

(True/False)

4.9/5  (42)

(42)

A production department's output for the most recent month consisted of 10,000 units completed and transferred to the next stage of production and 10,000 units in ending Work in Process inventory. The units in ending Work in Process inventory were 50% complete with respect to both direct materials and conversion costs. There were 1,000 units in beginning Work in Process inventory, and they were 70% complete with respect to both direct materials and conversion costs. Calculate the equivalent units of production for the month, assuming the company uses the weighted average method.

(Multiple Choice)

4.8/5  (42)

(42)

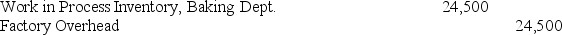

If the predetermined overhead allocation rate is 245% of direct labor cost, and the Baking Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

(True/False)

4.8/5  (39)

(39)

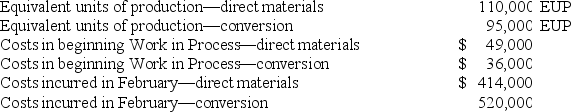

Andrews Corporation uses the weighted-average method of process costing. The following information is available for February in its Polishing Department:  The cost per equivalent unit of production for conversion is:

The cost per equivalent unit of production for conversion is:

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 231

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)