Exam 4: Activity-Based Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

The more activities tracked by activity-based costing, the more accurately overhead costs are assigned.

(True/False)

4.7/5  (33)

(33)

In activity-based costing, an activity can involve several related tasks.

(True/False)

4.8/5  (38)

(38)

Explain some of the disadvantages of the departmental overhead rate method.

(Essay)

4.7/5  (36)

(36)

By definition, costs classified as overhead are consumed in basically the same manner regardless of the process involved.

(True/False)

4.8/5  (37)

(37)

When products differ in batch size and complexity, they usually consume different amounts of ________.

(Short Answer)

4.9/5  (38)

(38)

Which types of overhead allocation methods result in the use of more than one overhead rate during the same time period?

(Multiple Choice)

4.8/5  (33)

(33)

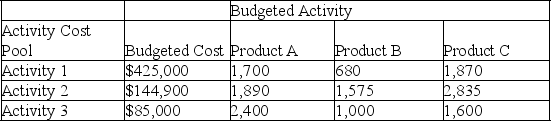

A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table:

Compute the company's activity rates under activity-based costing for each of the three activities.

Compute the company's activity rates under activity-based costing for each of the three activities.

(Essay)

4.9/5  (31)

(31)

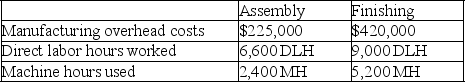

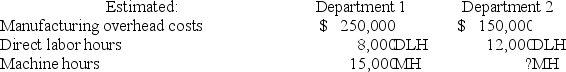

Superior Products Manufacturing identified the following data in its two production departments.

Make the following independent calculations (Round to two decimals).

a. Compute a plantwide overhead rate using machine hours as the allocation base.

b. Compute a plantwide overhead rate using direct labor hours as the allocation base.

Make the following independent calculations (Round to two decimals).

a. Compute a plantwide overhead rate using machine hours as the allocation base.

b. Compute a plantwide overhead rate using direct labor hours as the allocation base.

(Essay)

4.9/5  (30)

(30)

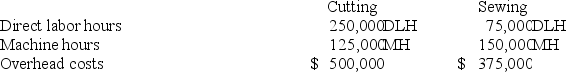

Turtle Company produces t-shirts that go through two operations, cutting and sewing, before they are complete. Expected costs and activities for the two departments are shown below. Given this information, the departmental overhead rate for the cutting department based on direct labor hours is $2.69 per direct labor hour (rounded to two decimals).

(True/False)

4.8/5  (37)

(37)

The major advantages of using a single plantwide overhead rate are ________ and ________.

(Essay)

4.7/5  (32)

(32)

West Company estimates that overhead costs for the next year will be $5,240,000 for indirect labor and $550,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 150,000 machine hours are planned for this next year, what is the company's plantwide overhead rate?

(Multiple Choice)

4.9/5  (29)

(29)

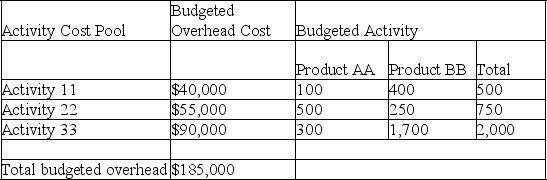

A company has two products: AA and BB. It uses a plantwide overhead allocation method based on activity 33 and has prepared the following analysis showing budgeted costs and activities. Use this information to compute the company's plantwide overhead rate.

(Essay)

4.8/5  (35)

(35)

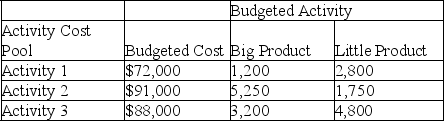

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

a. Compute the approximate overhead cost per unit of big product under activity-based costing.

b. Compute the approximate overhead cost per unit of little product under activity-based costing.

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

a. Compute the approximate overhead cost per unit of big product under activity-based costing.

b. Compute the approximate overhead cost per unit of little product under activity-based costing.

(Essay)

4.8/5  (45)

(45)

A company estimates that overhead costs for the next year will be $7,200,000 for indirect labor, $400,000 for factory utilities, and $43,000 for depreciation on factory machinery. The company uses direct labor hours as its overhead allocation base. If 955,375 direct labor hours are planned for this next year, what is the company's plantwide overhead rate?

(Essay)

4.8/5  (44)

(44)

A ________ is a collection of costs that are related to the same or similar activity.

(Short Answer)

4.8/5  (37)

(37)

Western Company allocates $10 overhead to products based on the number of machine hours used. The company uses a plantwide overhead rate with machine hours as the allocation base. Given the amounts below, how many machine hours does the company expect in department 2?

(Multiple Choice)

5.0/5  (38)

(38)

Direct labor, direct materials, and manufacturing overhead are all product costs. Why is overhead more difficult to account for than either direct labor or direct materials?

(Essay)

4.8/5  (31)

(31)

A company estimates that costs for the next year will be $500,000 for indirect labor, $50,000 for factory utilities, and $1,000,000 for the CEO's salary. The company uses machine hours as its overhead allocation base. If 25,000 machine hours are planned for this next year, then the plantwide overhead rate is $22 per machine hour.

(True/False)

4.8/5  (33)

(33)

Showing 201 - 220 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)