Exam 2: Job Order Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

Minstrel Manufacturing uses a job order costing system. During one month, Minstrel purchased $198,000 of raw materials on credit; issued materials to production of $195,000 of which $30,000 were indirect. Minstrel incurred a factory payroll of $150,000, of which $40,000 was indirect labor. Minstrel uses a predetermined overhead rate of 150% of direct labor cost. The journal entry to record the purchase of materials is:

(Multiple Choice)

4.8/5  (45)

(45)

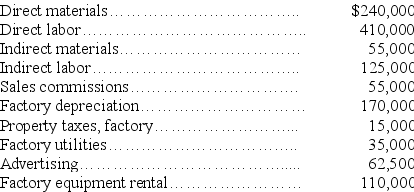

The predetermined overhead rate for Foster, Inc., is based on estimated direct labor costs of $400,000 and estimated factory overhead of $500,000. Actual costs incurred were:

(a) Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(b) Prepare the journal entry to eliminate the over- or underapplied overhead, assuming that it is not material in amount.

(a) Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(b) Prepare the journal entry to eliminate the over- or underapplied overhead, assuming that it is not material in amount.

(Essay)

4.7/5  (45)

(45)

Features of job order production include all of the following except:

(Multiple Choice)

4.9/5  (46)

(46)

If overhead is overapplied, it means that individual jobs have been charged too much overhead during the year and the cost of goods sold reported is too high.

(True/False)

4.8/5  (40)

(40)

Minstrel Manufacturing uses a job order costing system. During one month, Minstrel purchased $198,000 of raw materials on credit; issued materials to production of $195,000 of which $30,000 were indirect. Minstrel incurred a factory payroll of $150,000, of which $40,000 was indirect labor. Minstrel uses a predetermined overhead rate of 150% of direct labor cost. The journal entry to record the payment of the factory payroll is:

(Multiple Choice)

4.7/5  (38)

(38)

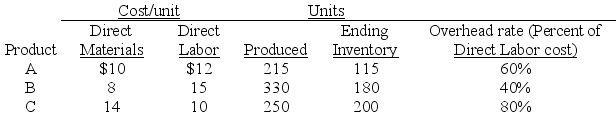

The following data relates to the Mass Company's first operating period. Calculate the total cost of goods sold for each product.

(Essay)

4.8/5  (32)

(32)

Southwick Company uses a job order costing system. On November 1, $15,000 of direct materials and $3,500 of indirect materials were requisitioned for production. Prepare the general journal entries to record this requisition.

(Essay)

4.8/5  (38)

(38)

Adams Manufacturing allocates overhead to production on the basis of direct labor costs. At the beginning of the year, Adams estimated total overhead of $396,000; materials of $410,000 and direct labor of $220,000. During the year Adams incurred $418,000 in materials costs, $413,200 in overhead costs and $224,000 in direct labor costs. Compute the predetermined overhead rate.

(Multiple Choice)

4.9/5  (32)

(32)

Andrew Industries purchased $165,000 of raw materials on account during the month of March. The beginning Raw Materials Inventory balance was $22,000, and the materials used to complete jobs during the month were $141,000 direct materials and $13,000 indirect materials. How should Andrews record the purchase of raw materials for March?

(Multiple Choice)

4.7/5  (33)

(33)

Requisitions of indirect materials are not recorded on job cost sheets.

(True/False)

4.9/5  (37)

(37)

Morris Company applies overhead based on direct labor costs. For the current year, Morris Company estimated total overhead costs to be $400,000, and direct labor costs to be $2,000,000. Actual overhead costs for the year totaled $380,000, and actual direct labor costs totaled $1,800,000. At year-end, Factory Overhead is:

(Multiple Choice)

4.8/5  (38)

(38)

If overhead is underapplied, it means that individual jobs have been charged too much during the year and the cost of goods sold reported is too high.

(True/False)

4.8/5  (43)

(43)

A company charged the following amounts of overhead to jobs during the current year: $12,000 to jobs still in process, $42,000 to jobs completed but not sold, and $66,000 to jobs finished and sold. At year-end, the company's Factory Overhead account has a credit balance of $9,000. What entry (if any) should the company make at year-end related to this overhead balance?

(Essay)

4.9/5  (35)

(35)

A time ticket is a source document used by an employee to record the number of hours worked on a particular job during the work day.

(True/False)

4.7/5  (35)

(35)

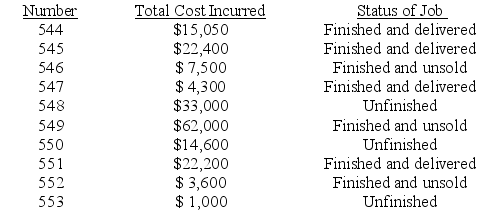

Merker Manufacturing Company has the following job cost sheets on file. They represent jobs that have been worked on during April of the current year. This table summarizes information provided on each sheet:

(a) What is the cost of goods sold for the month of April?

(b) What is the cost of the Work in Process inventory on April 30?

(c) What is the cost of the finished goods inventory on April 30?

(a) What is the cost of goods sold for the month of April?

(b) What is the cost of the Work in Process inventory on April 30?

(c) What is the cost of the finished goods inventory on April 30?

(Essay)

4.8/5  (40)

(40)

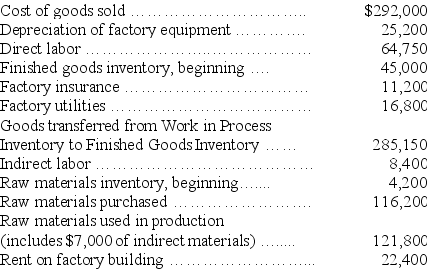

The following information is available for Annum Corporation for the current year:

Annum Company uses a predetermined overhead rate of 150% of direct labor cost. Prepare journal entries for the following transactions and events.

(a) Purchase of raw materials on account.

(b) Assignment of materials costs to Work in Process Inventory and Factory Overhead.

(c) Assignment of factory payroll to Work in Process Inventory and Factory Overhead.

(d) Recording of other factory overhead. Assume that all items other than depreciation are paid in cash.

(e) Apply factory overhead to Work in Process Inventory.

(f) Transfer of goods completed to Finished Goods Inventory.

(g) Recording cost of goods sold.

(h) Assignment of over- or underapplied overhead to Cost of Goods Sold.

Annum Company uses a predetermined overhead rate of 150% of direct labor cost. Prepare journal entries for the following transactions and events.

(a) Purchase of raw materials on account.

(b) Assignment of materials costs to Work in Process Inventory and Factory Overhead.

(c) Assignment of factory payroll to Work in Process Inventory and Factory Overhead.

(d) Recording of other factory overhead. Assume that all items other than depreciation are paid in cash.

(e) Apply factory overhead to Work in Process Inventory.

(f) Transfer of goods completed to Finished Goods Inventory.

(g) Recording cost of goods sold.

(h) Assignment of over- or underapplied overhead to Cost of Goods Sold.

(Essay)

4.9/5  (42)

(42)

A perpetual record of a raw materials item that records data on the quantity and cost of units purchased, units issued for use in production, and units that remain in the raw materials inventory, is called a(n):

(Multiple Choice)

4.8/5  (27)

(27)

The Work in Process Inventory account of a manufacturing company has a $4,400 debit balance. The company applies overhead using direct labor cost. The cost sheet of the only job still in process shows direct material cost of $2,000 and direct labor cost of $800. Therefore, the company's predetermined overhead rate is:

(Multiple Choice)

4.8/5  (37)

(37)

A ________ is calculated by dividing total estimated factory overhead by an activity base such as total estimated direct labor cost.

(Short Answer)

4.9/5  (46)

(46)

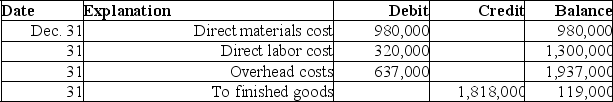

Booth Manufacturing uses a job order costing system that charges overhead to jobs on the basis of direct material cost. At year-end, the Work in Process Inventory account shows the following.

a. Determine the predetermined overhead rate used.

b. Only one job remained in process at December 31. Its direct materials cost is $60,000. How much direct labor cost and overhead cost are assigned to it?

a. Determine the predetermined overhead rate used.

b. Only one job remained in process at December 31. Its direct materials cost is $60,000. How much direct labor cost and overhead cost are assigned to it?

(Essay)

4.8/5  (32)

(32)

Showing 141 - 160 of 216

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)