Exam 8: Simple Interest Applications

Exam 1: Review of Arithmetic144 Questions

Exam 2: Review of Basic Algebra274 Questions

Exam 3: Ratio, Proportion, and Percent210 Questions

Exam 4: Linear Systems94 Questions

Exam 5: Cost-Volume-Profit Analysis and Break-Even47 Questions

Exam 6: Trade Discounts, Cash Discounts, Markup, and Markdown170 Questions

Exam 7: Simple Interest132 Questions

Exam 8: Simple Interest Applications87 Questions

Exam 9: Compound Interest - Future Value and Present Value172 Questions

Exam 10: Compound Interest - Further Topics77 Questions

Exam 11: Ordinary Simple Annuities104 Questions

Exam 12: Ordinary General Annuities104 Questions

Exam 13: Annuities Due, Deferred Annuities, and Perpetuities182 Questions

Exam 14: Amortization of Loans, Residential Mortgages, and Sinking Funds132 Questions

Exam 15: Bond Valuation87 Questions

Exam 16: Investment Decision Applications78 Questions

Select questions type

Determine the present value on January 17, 2014 of a non-interest-bearing promissory six-month note for $17 000.00 dated October 15, 2013 if money is worth 4.15%.

(Essay)

4.8/5  (26)

(26)

On July 12, 2013 a 140-day note promissory note for $9 175 with interest at 5.75% was issued. Find the proceeds of the note on September 30, 2013 if money is worth 7%.

(Essay)

4.7/5  (35)

(35)

Tracey bought a 182-day Government of Canada treasury bill at the price to yield an annual rate of return of 4.68%.

a) What was the price paid by Tracey if the T-bill has a face value of $100 000?

b) Later the same day, Tracey sold this T-bill to a large corporation to yield 4.48%. What was Tracey's profit on this transaction?

(Essay)

4.7/5  (33)

(33)

Find the maturity value of a six-month, $642 note dated November 1, 2013, earning interest at 7.5%.

(Essay)

4.8/5  (29)

(29)

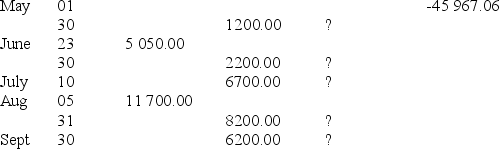

Determine the missing information for the following line of credit.

Harold has a line of credit secured by the equity in his home. The limit on his line of credit is $85 000. Transactions for the period May 1 to September 30 are shown below. Harold owed $45 967.06 on his line of credit on May 1.

-----------------------------------------------------------------

-----------------------------------------------------------------

Note: "-" indicates a negative balance.

Overdraft interest is 28.8% p.a. The line of credit interest is variable. It was 6.15% on May 1, 6.50% effective June 20, and 6.55% effective September 10.

a) Calculate the interest payments on May 31, June 30, July 31, August 31, and September 30.

b) What is the account balance on September 30?

Note: "-" indicates a negative balance.

Overdraft interest is 28.8% p.a. The line of credit interest is variable. It was 6.15% on May 1, 6.50% effective June 20, and 6.55% effective September 10.

a) Calculate the interest payments on May 31, June 30, July 31, August 31, and September 30.

b) What is the account balance on September 30?

(Essay)

4.8/5  (34)

(34)

Caprice buys a painting on his credit card for $14 990. She pays her credit card in full 3 days after the grace period of 11 days using her secured line of credit, which charges her prime (3%) plus 1%. She repays her loan in 168 days. If her credit card company charges her a rate of 28% after the grace period, what is the total amount of interest paid on the purchase of the painting?

(Essay)

4.9/5  (35)

(35)

Determine the maturity value of a 120-day note for $2260.00 dated May 9 and bearing interest at 5.66%.

(Essay)

4.9/5  (37)

(37)

Showing 81 - 87 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)