Exam 3: Accounting for Labor

Exam 1: Introduction to Cost Accounting77 Questions

Exam 2: Accounting for Materials75 Questions

Exam 3: Accounting for Labor52 Questions

Exam 4: Accounting for Factory Overhead86 Questions

Exam 5: Process Cost Accounting--General Procedures61 Questions

Exam 6: Process Cost Accounting--Additional Procedures58 Questions

Exam 7: Master Budget and Flexible Budgeting63 Questions

Exam 8: Standard Cost Accounting--Materials, labor, and Factory Overhead88 Questions

Exam 9: Cost Accounting for Service Businesses60 Questions

Exam 10: Cost Analysis for Management Decision Making78 Questions

Select questions type

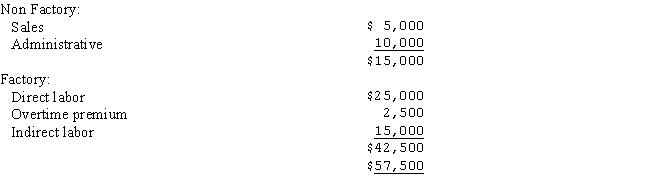

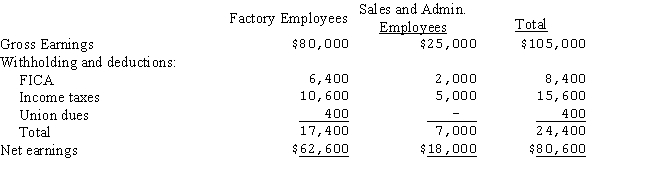

Western Industries pays employees on a weekly basis on Tuesday for the week ended the previous Friday.Employees' compensation is earned evenly each day over a 5-day work week.This year,April 30 fell on Thursday.Payroll costs for the week ended May 1 follow:  Excluding payroll taxes,how much of the accrued payroll at April 30 should be charged to Factory Overhead?

Excluding payroll taxes,how much of the accrued payroll at April 30 should be charged to Factory Overhead?

(Multiple Choice)

4.9/5  (41)

(41)

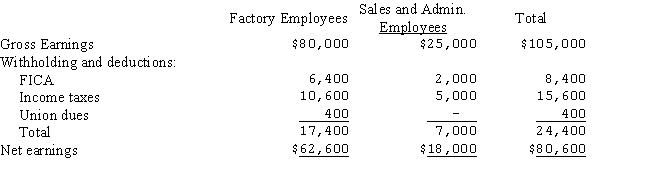

The payroll summary for EVB Inc.for the period August 3 - 10 is as follows:  These wages were paid on August 15.

The entry to record the payment of earnings to the employees would include:

These wages were paid on August 15.

The entry to record the payment of earnings to the employees would include:

(Multiple Choice)

4.8/5  (38)

(38)

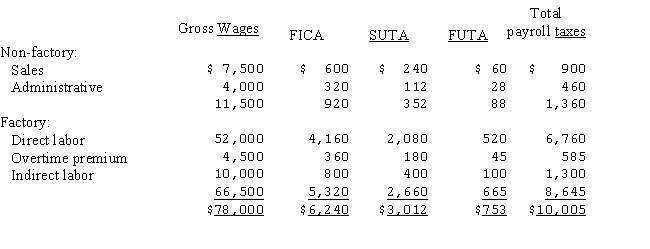

Tacy Company's Schedule of Earnings and Payroll taxes for the period ended March 28 - 31 to be paid April 5 follow:  Prepare the journal entries to:

(a)Accrue the payroll in the appropriate period

(b)Distribute the accrued payroll in the appropriate period

(c)Recognize related accrued employer's payroll taxes in the appropriate period assuming payroll taxes are spread over all jobs produced.

Prepare the journal entries to:

(a)Accrue the payroll in the appropriate period

(b)Distribute the accrued payroll in the appropriate period

(c)Recognize related accrued employer's payroll taxes in the appropriate period assuming payroll taxes are spread over all jobs produced.

(Essay)

4.7/5  (31)

(31)

All of the following are characteristics of hourly wage plans except:

(Multiple Choice)

4.8/5  (28)

(28)

For a factory worker,all of the following are charged to Factory Overhead except:

(Multiple Choice)

4.8/5  (32)

(32)

Joel Williams works at Allentown Company where he assembles components for small appliances and earns $16 per hour with "time-an-a-half" for overtime.During the week ended July 25,Joel worked 43 hours as follows:  The amount of Joel's wages that will be charged to the Work in Process account,assuming that the overtime worked was due to a rush order on the FASB job is:

The amount of Joel's wages that will be charged to the Work in Process account,assuming that the overtime worked was due to a rush order on the FASB job is:

(Multiple Choice)

4.7/5  (33)

(33)

The file that serves as a basis for reporting payroll information to governmental agencies and preparing Form W-2 is the:

(Multiple Choice)

4.8/5  (29)

(29)

Of the following taxes,the only one that the employer pays in entirety is:

(Multiple Choice)

4.8/5  (30)

(30)

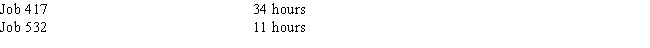

David Andrews works at the Neal Company where he makes $10 per hour with "time-and-a-half" for overtime.For the week ended January 8,David worked 45 hours as follows:  Assuming the overtime was due to priority scheduling for Job 532,how much will be charged to Job 532?

Assuming the overtime was due to priority scheduling for Job 532,how much will be charged to Job 532?

(Multiple Choice)

4.9/5  (36)

(36)

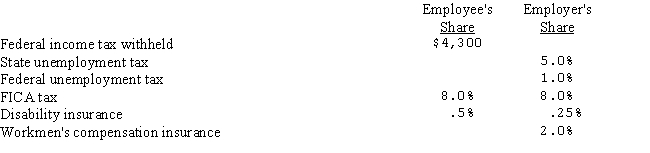

Patrick Poplin is a factory worker at Ingram Inc.earning $15.00 per hour.Patrick is eligible for ten paid holidays and three weeks vacation and is paid "time-and-a-half" for overtime.He is also eligible for a $700 bonus at the end of the year.Patrick's earnings so far this year are $7,000.

Tax rates are as follows:

Employee income tax 15% on all earnings

FICA 8% on first $100,000 of earnings

FUTA 1% on first $8,000 of earnings

SUTA 4% on first $8,000 of earnings

Assuming Patrick worked 48 hours this week,calculate the total expense to Ingram Inc.for this week's wages,payroll taxes and fringe benefits.

(Essay)

4.7/5  (36)

(36)

The Dehl Company payroll for the first week in January was $10,000.The amount of income tax withheld was 12 percent and the FICA,state unemployment,and federal unemployment tax rates were 8 percent,5 percent,and 1 percent,respectively.The amount of the employer's payroll taxes are:

(Multiple Choice)

4.8/5  (25)

(25)

The payroll summary for EVB Inc.for the period August 3 - 10 is as follows:  The entry to record payroll would be:

The entry to record payroll would be:

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following items relating to direct labor employees might be charged to specific jobs in work in process rather than factory overhead?

(Multiple Choice)

4.9/5  (32)

(32)

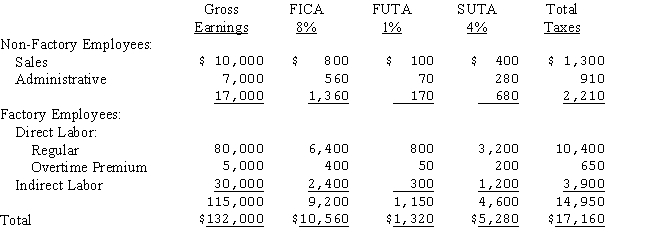

Daktari Enterprises' Schedule of Earnings and Payroll Taxes for April is as follows:  Assuming overhead is a result of the random scheduling of jobs,the entry to record and distribute the employer's payroll taxes would include:

Assuming overhead is a result of the random scheduling of jobs,the entry to record and distribute the employer's payroll taxes would include:

(Multiple Choice)

4.9/5  (44)

(44)

The following payroll summary is prepared for the Sothern Manufacturing Company for the week ending March 29:  Payroll taxes and insurance are to be computed as follows:

Payroll taxes and insurance are to be computed as follows:  Prepare the general journal entries to:

a.Record the payroll.

b.Pay the payroll.

c.Distribute the payroll to the appropriate accounts.

d.Record the employer's share of payroll tax expense.(All of the employees work in the factory. )

Prepare the general journal entries to:

a.Record the payroll.

b.Pay the payroll.

c.Distribute the payroll to the appropriate accounts.

d.Record the employer's share of payroll tax expense.(All of the employees work in the factory. )

(Essay)

4.9/5  (27)

(27)

An accrued expense such as Wages Payable can best be described as an amount:

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following would not be included on a payroll record?

(Multiple Choice)

4.9/5  (29)

(29)

Toshlin issues financial statements on June 30.If payroll was $30,000 through June 30th and wages were to be paid on July 5,what is the correct journal entry on June 30? Assume FIT = 15%,FICA = 8%,SUTA = 6%,FUTA = 1%,

(Multiple Choice)

4.8/5  (32)

(32)

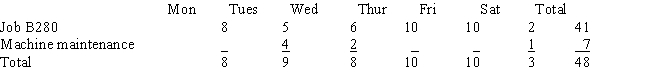

Tyler Jacob is paid $15 per hour for a 40-hour work week with time-and-a-half for overtime,which is not charged to specific jobs.For the week of March 4 - 10,Tyler's labor time record was as follows:  Other Information:

Tyler's year-to-date wages as of March 3 were $7,500.He contributes $20 weekly for his health insurance premiums.

Current tax rates in effect are: FIT withholding rate - 10%;FICA - 8% on the first $100,000 of wages;SUTA - 4% on the first $8,000 of wages;and FUTA - 1% on the first $8,000 of wages.

(a)Calculate Tyler's gross and net pay.

(b)Prepare the journal entries necessary to

(1)Record Tyler's payroll

(2)Pay Tyler's payroll

(3)Distribute Tyler's payroll to the appropriate accounts

(c)Calculate the employer's payroll taxes and prepare the journal entry to record them employer's portion of payroll taxes

Other Information:

Tyler's year-to-date wages as of March 3 were $7,500.He contributes $20 weekly for his health insurance premiums.

Current tax rates in effect are: FIT withholding rate - 10%;FICA - 8% on the first $100,000 of wages;SUTA - 4% on the first $8,000 of wages;and FUTA - 1% on the first $8,000 of wages.

(a)Calculate Tyler's gross and net pay.

(b)Prepare the journal entries necessary to

(1)Record Tyler's payroll

(2)Pay Tyler's payroll

(3)Distribute Tyler's payroll to the appropriate accounts

(c)Calculate the employer's payroll taxes and prepare the journal entry to record them employer's portion of payroll taxes

(Essay)

4.8/5  (42)

(42)

Showing 21 - 40 of 52

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)