Exam 3: National Income: Where It Comes From and Where It Goes

Exam 1: The Science of Macroeconomics66 Questions

Exam 2: The Data of Macroeconomics122 Questions

Exam 3: National Income: Where It Comes From and Where It Goes171 Questions

Exam 4: The Monetary System: What It Is and How It Works118 Questions

Exam 5: Inflation: Its Causes, Effects, and Social Costs118 Questions

Exam 6: The Open Economy139 Questions

Exam 7: Unemployment and the Labor Market118 Questions

Exam 8: Economic Growth I: Capital Accumulation and Population Growth121 Questions

Exam 9: Economic Growth II: Technology, Empirics, and Policy103 Questions

Exam 10: Introduction to Economic Fluctuations124 Questions

Exam 11: Aggregate Demand I: Building the Is-Lm Model126 Questions

Exam 12: Aggregate Demand Ii: Applying the Is-Lm Model145 Questions

Exam 13: The Open Economy Revisited: the Mundell-Fleming Model and the Exchange-Rate Regime135 Questions

Exam 14: Aggregate Supply and the Short-Run Tradeoff Between Inflation and Unemployment112 Questions

Exam 15: A Dynamic Model of Economic Fluctuations110 Questions

Exam 16: Understanding Consumer Behavior121 Questions

Exam 17: The Theory of Investment112 Questions

Exam 18: Alternative Perspectives on Stabilization Policy100 Questions

Exam 19: Government Debt and Budget Deficits100 Questions

Exam 20: The Financial System: Opportunities and Dangers120 Questions

Select questions type

The total output of the closed economy Moneyland is 10,000. Consumption is explained by the function C = 3,800 + 0.7T - 150r, where r is the real interest rate. Investment (I) is given by the equation, I = 1,500 + 50r. Taxes (T) are 1,000 and government spending (G) is 3,500. What are the values of consumption, investment, and real interest rate?

(Essay)

4.9/5  (32)

(32)

In the classical model with fixed income, if households want to save more than firms want to invest, then:

(Multiple Choice)

4.8/5  (33)

(33)

The economy of Miniland has an income of $400, consumption is $200, government expenditure is $200, and the tax earnings of government is $150.

a. Calculate private saving.

b. Calculate public saving.

c. Calculate national saving.

(Essay)

4.8/5  (25)

(25)

Use the following to answer questions :

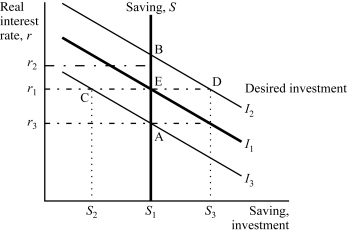

Exhibit: Saving, Investment, and the Interest Rate 2  -(Exhibit: Saving, Investment, and the Interest Rate 2) The economy begins in equilibrium at Point E, representing the real interest rate, r1, at which saving, S1, equals desired investment, I1. What will be the new equilibrium combination of real interest rate, saving, and investment if there is a tax law change that makes investment projects less profitable and decreases the demand for investment goods (but does not change the amount of taxes collected in the economy)?

-(Exhibit: Saving, Investment, and the Interest Rate 2) The economy begins in equilibrium at Point E, representing the real interest rate, r1, at which saving, S1, equals desired investment, I1. What will be the new equilibrium combination of real interest rate, saving, and investment if there is a tax law change that makes investment projects less profitable and decreases the demand for investment goods (but does not change the amount of taxes collected in the economy)?

(Multiple Choice)

4.9/5  (41)

(41)

A consumption function shows the relationship between consumption and:

(Multiple Choice)

4.8/5  (37)

(37)

In the classical model with fixed income, if the interest rate is too low, then investment is too ______ and the demand for output ______ the supply.

(Multiple Choice)

4.8/5  (34)

(34)

The production function feature called "constant returns to scale" means that if we:

(Multiple Choice)

4.8/5  (28)

(28)

In the circular flow diagram, firms receive revenue from the _____ market, which is used to purchase inputs in the _____ market.

(Multiple Choice)

4.8/5  (29)

(29)

Other things equal, an increase in the interest rate leads to:

(Multiple Choice)

4.9/5  (37)

(37)

a. Suppose there is a technological breakthrough that increases the productivity of all capital and, consequently, increases the demand for investment. Using the long-run model of the economy developed in Chapter 3, graphically illustrate the impact of the increased investment demand. Be sure to label:

i. the axes

ii. the curves

iii. the initial eqilibrium values

iv. the direction curves shift

v. the terminal equilibrium values

b. State in words what happens to

i. the real interest rate

ii. nafional saving

iii. investment

iv. consumption

v. output.

(Essay)

4.9/5  (40)

(40)

With a Cobb-Douglas production function, the share of output going to labor:

(Multiple Choice)

4.8/5  (44)

(44)

According to the model developed in Chapter 3, when taxes are increased but government spending is unchanged, interest rates:

(Multiple Choice)

4.8/5  (29)

(29)

An example of increasing returns to scale is when capital and labor inputs:

(Multiple Choice)

4.8/5  (39)

(39)

Assume that a competitive economy can be described by a constant returns to scale (Cobb-Douglas) production function and all factors of production are fully employed. Holding other factors constant, including the quantity of capital and technology, carefully explain how a one-time, 10-percent increase in the quantity of labor (perhaps the result of a special immigration policy) will change each of the following: a. the level of output produced;

b. the real wage of labor;

c. the real rental price of capital;

d. labor's share of total income.

(Essay)

4.8/5  (34)

(34)

The closed economy of Moneyland has total income of $5000, consumption function is C = 2000 - 30r, investment function I = 1500 - 20r, government spending is $2000, r is nominal interest rate. Inflation is 6 percent. Find the real rate of interest.

(Essay)

4.8/5  (40)

(40)

If an earthquake destroys some of the capital stock, the neoclassical theory of distribution predicts:

(Multiple Choice)

4.8/5  (31)

(31)

In the classical model with fixed income, an increase in the real interest rate could be the result of a(n):

(Multiple Choice)

4.7/5  (29)

(29)

Showing 41 - 60 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)