Exam 12: Managing and Reporting Performance

Exam 1: Management Accounting: Information for Creating Value and Managing Resources52 Questions

Exam 2: Management Accounting: Cost Terms and Concepts73 Questions

Exam 3: Cost Behaviour, Cost Drivers and Cost Estimation78 Questions

Exam 4: Product Costing Systems74 Questions

Exam 5: Process Costing and Operation Costing73 Questions

Exam 6: Service Costing78 Questions

Exam 7: A Closer Look at Overhead Costs85 Questions

Exam 8: Activity-Based Costing78 Questions

Exam 9: Budgeting Systems78 Questions

Exam 10: Standard Costs for Control: Direct Material and Direct Labour91 Questions

Exam 11: Standard Costs for Control: Flexible Budgets and Manufacturing Overhead97 Questions

Exam 12: Managing and Reporting Performance88 Questions

Exam 13: Financial Performance Measures and Incentive Schemes80 Questions

Exam 14: Strategic Performance Measurement Systems73 Questions

Exam 15: Managing Suppliers and Customers76 Questions

Exam 16: Managing Costs and Quality78 Questions

Exam 17: Sustainability and Management Accounting71 Questions

Exam 18: Cost Volume Profit Analysis97 Questions

Exam 19: Information for Decisions: Relevant Costs and Benefits95 Questions

Exam 20: Pricing and Product Mix Decisions95 Questions

Exam 21: Information for Capital Expenditure Decisions108 Questions

Select questions type

Which of the following is a problem with the use of cost-based transfer pricing?

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following are risks associated with self-managed work teams?

i.Deterioration in job satisfaction of team members

ii.Less opportunity to improve the quality of service

iii.Slower response time to customer needs

(Multiple Choice)

4.9/5  (32)

(32)

Transfer prices should not be based on actual costs because:

(Multiple Choice)

4.8/5  (36)

(36)

Barrister Company has two divisions: A and Z.The A Division produces a single product that can be sold to outside customers or to the Z Division.Sales forecasts,production statistics and costs for both divisions for 2008 are shown below:

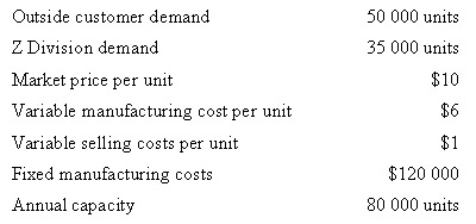

A Division:

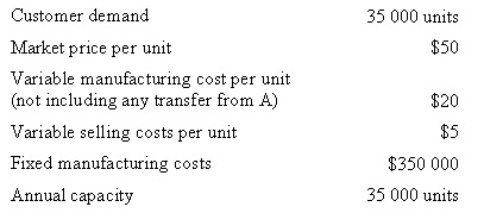

Z Division:

* When A Division sells to Z Division,no variable selling costs are incurred by A Division.Calculate the minimum per unit transfer price that A Division should charge Z Division in 2008,using the general transfer-pricing formula.

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following statements is/are true?

When a multinational company transfers goods or services between business units located in different countries:

i.the tax rates of the different countries will have no effect on overall company profits

ii.the result is a moving of profits from one country to another.

iii.the company will consider the tax rates of the different countries when determining the transfer price.

(Multiple Choice)

4.9/5  (38)

(38)

When management is using performance reports to evaluate the economic performance of a business unit,which of the following costs should be considered:

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following statements best completes this sentence? 'A cost is deemed to be controllable by the manager …'

(Multiple Choice)

5.0/5  (44)

(44)

Which of the following statements best completes this sentence? 'The biggest challenge(s)facing all decentralised firms is …'

(Multiple Choice)

5.0/5  (29)

(29)

Which of the following is usually achieved when the general transfer-pricing rule is implemented?

(Multiple Choice)

5.0/5  (41)

(41)

Fruities Ltd has two divisions,Durian Division and Juice Division.Durian Division has an annual capacity of 10 000 units of durian juice concentrate.Juice Division's annual requirement of durian juice concentrate is 8000 units.There is no external market for durian juice concentrate;however,the Durian Division can use its facilities to manufacturer prune paste,which is a very popular product with unlimited external demand,at $13 per unit.The variable production cost of one unit of durian juice concentrate at Durian Division is $6,and the variable production cost of one unit of prune paste is $8.Durian division also incurs $1 additional shipping cost per unit when selling prune paste to external suppliers.Using the transfer pricing formula,what is the per unit opportunity cost of selling one unit of durian juice concentrate to Juice Division?

(Multiple Choice)

4.7/5  (37)

(37)

Which of the following managers is held accountable for the subunit's profit and invested capital?

(Multiple Choice)

4.9/5  (41)

(41)

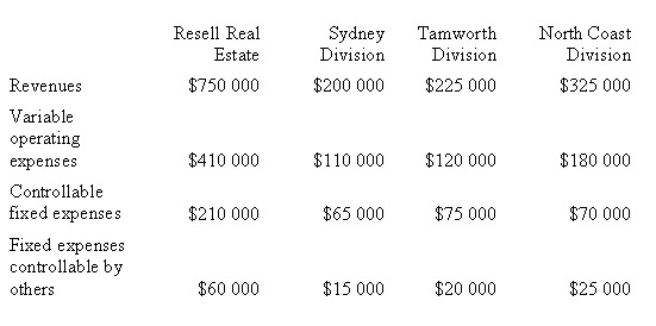

The following information was taken from the business united profit and loss statement of Resell Real Estate Agents for 2008:

In addition,the company incurred common fixed costs of $18 000.What was the business unit margin of the Tamworth Division during 2008?

(Multiple Choice)

4.8/5  (37)

(37)

Fruities Ltd has two divisions,Durian Division and Juice Division.Durian Division has an annual capacity of 10 000 units of either juice concentrate or fruit paste.Usually,Durian Division produces durian juice concentrate for the Juice Division.Juice Division's annual requirement of durian juice concentrate is 8000 units.There is no external market for durian juice concentrate;however,the Durian Division can use its facilities to manufacturer prune paste,which is a very popular product with unlimited external demand.The market price for prune paste is $13 per unit.The variable production cost of one unit of durian juice concentrate at Durian Division is $6,and the variable production cost of one unit of prune paste is $8.Durian division also incurs $1 additional shipping cost per unit when selling prune paste to external suppliers.Using the transfer pricing formula,what is the per unit transfer price selling one unit of durian juice concentrate to Juice Division?

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following is not a benefit of decentralisation?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following might you expect to see being used as a performance measure for a cost centre?

(Multiple Choice)

4.8/5  (34)

(34)

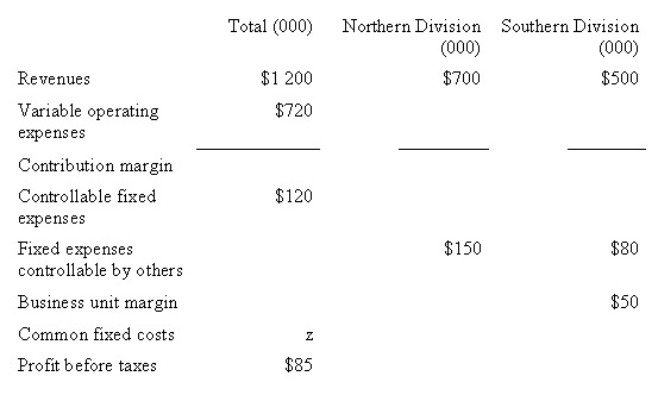

Callahan Company consists of two divisions,Northern and Southern.During 2008,many of the accounting records were destroyed in a fire.The managing director has asked the accountant for information relating to 2008.The following information is available to the accountant.In addition,the contribution margin ratio for both divisions was the same.What were the common fixed costs (z)during 2008?

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following statements about transfer prices is/are true?

i.When the producing division has excess capacity and the external market is imperfectly competitive,the general transfer-pricing rule and the external market price will be the same

ii.If the transfer price is set at the market price,the supplying division will be indifferent to selling internally or externally.

iii.If the transfer price is set at the market price,the buying division will usually purchase goods from inside its organisation,if product specifications are met.

(Multiple Choice)

4.7/5  (46)

(46)

Hamilton has excess capacity.If the company wishes to implement the general transfer-pricing rule,the opportunity cost would be equal to:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 41 - 60 of 88

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)