Multiple Choice

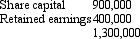

Hill Ltd acquired an 80 per cent interest in Dale Ltd on 1 July 2004 for a cash consideration of $1,200,000. At that date the shareholders' funds of Dale Ltd were:

The assets of Dale Ltd were recorded at fair value at the time of the purchase.

On 1 July 2005 Hill Ltd purchased the remaining 20 per cent of the issued capital of Dale Ltd for a cash consideration of $336,000. At this date the fair value of the net assets of Dale Ltd were represented by:

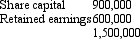

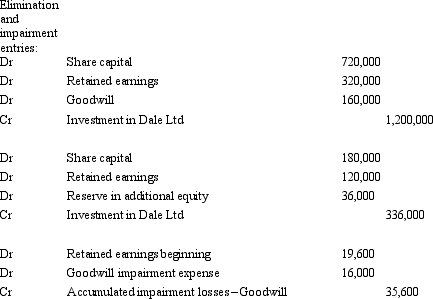

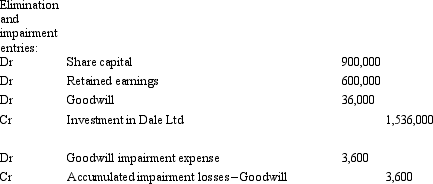

Impairment of goodwill amounted to $35,600; $16,000 of which related to the year ended 30 June 2006. There were no inter-company transactions. What are the consolidation entries to eliminate the investment in the subsidiary and account for goodwill for the period ended 30 June 2006?

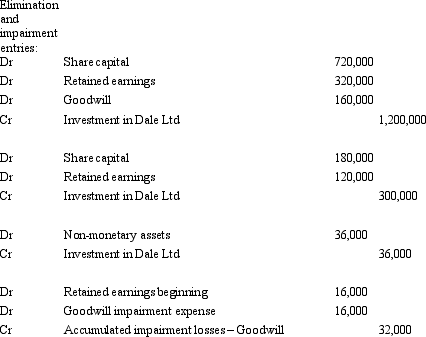

A)

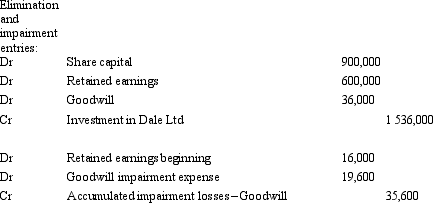

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Fish Ltd acquired an 80 per cent

Q12: On 1 July 2002, City Ltd acquired

Q13: Which of the following statements is in

Q15: The following consolidation adjusting journal entries appeared

Q16: Fan Ltd acquired a 60 per cent

Q17: The following consolidation adjusting journal entries appeared

Q27: The required method (according to AASB 3)of

Q33: When shares in a subsidiary are sold

Q34: When a parent sells its interest in

Q36: Which of the following is not a