Multiple Choice

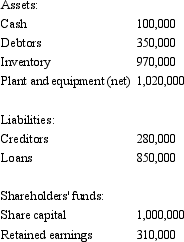

On 1 July 2002, City Ltd acquired 65 per cent of the issued capital of Town Ltd for $850,000 when the fair value of the net assets of Town Ltd was $1.2 million (share capital $1 million and retained earnings $0.2 million) . On 30 June 2005 City Ltd purchased a further 25 per cent of Town's issued capital for $300,000. The net assets of Town Ltd were not stated at fair value in the accounts, which are summarised as follows:

The fair value of the plant and equipment is $1,090,000 at year end. Goodwill has been deemed not to have been impaired. There were no inter-company transactions during the period.

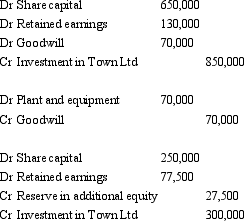

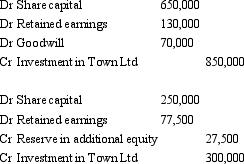

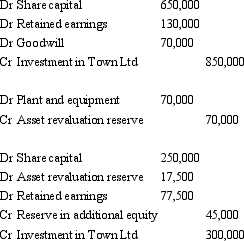

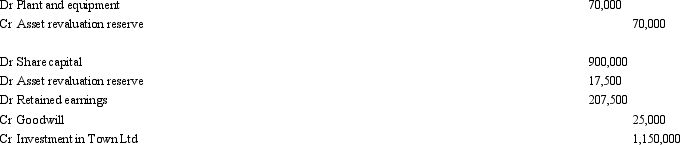

What are the consolidation journal entries required for the period ended 30 June 2005? (Ignore the tax effect of the revaluation)

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Fish Ltd acquired an 80 per cent

Q9: Fish Ltd acquired an 80 per cent

Q13: Which of the following statements is in

Q13: Hill Ltd acquired an 80 per cent

Q15: The following consolidation adjusting journal entries appeared

Q16: Fan Ltd acquired a 60 per cent

Q17: The following consolidation adjusting journal entries appeared

Q27: The required method (according to AASB 3)of

Q33: When shares in a subsidiary are sold

Q36: Which of the following is not a