Multiple Choice

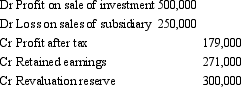

The following consolidation adjusting journal entries appeared at the end of a period in which the parent sold all of its shareholding in a subsidiary. It received $1,200,000 for the shares.

The 'Cr Profit after tax' entry above represents:

A) the profit made by the parent on the sale of the shares.

B) the profit made by the economic entity on the sale of the shares.

C) the amount accruing to the minority interest of the subsidiary.

D) the share of profits derived by the subsidiary for the entire current period.

E) the share of profits derived by the subsidiary in the current period, up to the time of divestment.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: On 1 July 2002, City Ltd acquired

Q13: Hill Ltd acquired an 80 per cent

Q15: The following consolidation adjusting journal entries appeared

Q16: Fan Ltd acquired a 60 per cent

Q19: On 1 July 2004, Horse Ltd acquired

Q20: In calculating the profit or loss on

Q22: Under the step-by-step method,the aggregate costs of

Q22: Dolly Ltd acquired a 60 per cent

Q33: When shares in a subsidiary are sold

Q34: When a parent sells its interest in