Multiple Choice

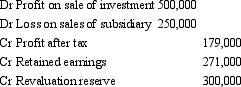

The following consolidation adjusting journal entries appeared at the end of a period in which the parent sold all of its shareholding in a subsidiary. It received $1,200,000 for the shares.

At the time of the sale of the shares, the parent was holding the investment in subsidiary at what amount, in its own books?

A) $450,000.

B) $700,000.

C) $950,000.

D) $1,450,000.

E) Cannot be determined from the information given.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: On 1 July 2002, City Ltd acquired

Q13: Hill Ltd acquired an 80 per cent

Q13: Which of the following statements is in

Q16: Fan Ltd acquired a 60 per cent

Q17: The following consolidation adjusting journal entries appeared

Q19: On 1 July 2004, Horse Ltd acquired

Q22: Under the step-by-step method,the aggregate costs of

Q27: The required method (according to AASB 3)of

Q33: When shares in a subsidiary are sold

Q34: When a parent sells its interest in